Expert Philadelphia, PA Car Insurance Advice (Compare Costs & Companies)

Pennsylvania car insurance laws require all drivers to have at least 15/30/5 in bodily injury and property damage. The average car insurance cost in Philadelphia for females is $627 per month, while Philadelphia car insurance rates for males are $624 per month. Interestingly, Philadelphia auto insurance rates are higher for females than males.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Dec 24, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Dec 24, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Philadelphia, PA minimum car insurance requirements are 15/30/5 for bodily injury and property damage

- Car insurance quotes in Philadelphia, PA average $627/mo for females and $624/mo for males

- The cheapest auto insurance companies in Philadelphia, PA are USAA and Geico

| Philadelphia City Statistics | Details |

|---|---|

| Population | 1,580,863 |

| Density | 11,702 people per square mile |

| Average Cost of Insurance in Philadelphia | $9,302.74 |

| Cheapest Car Insurance Company | USAA and Geico |

| Road Conditions | Poor: 43% Mediocre: 28% Fair: 11% Good: 17% Vehicle Operating Cost: $732 |

Philadelphia is one of the largest-populated cities, with its historic streets overflowing with pedestrians and drivers. If you are planning on becoming one of Philadelphia’s residents or if you already live in Philadelphia and need a new insurer, this guide is for you. Moving to a new city or looking for a car insurance provider can be stressful, but we are here to help.

Our Philadelphia guide covers everything you need to know about living and driving in Philadelphia, so you are prepared beforehand for whatever challenges you may face.

So keep reading to learn about everything from Philadelphia, PA car insurance rates to unique city laws. If you want to start comparing car insurance providers’ rates, enter your zip code in our free online tool above.

The Cost of Car Insurance in Philadelphia

Car insurance is expensive. The average rate in Philadelphia is high and may take you by surprise if you are new to Philadelphia.

Luckily, there are ways to bring this high rate down. There are multiple factors that affect your rates, and we are going to go through each one to show you how you can reduce your costs. We’ve partnered with Quadrant to bring you the best data on rates.

So let’s jump right into car insurance rates.

Male vs. Female vs. Age

It’s true. Insurers look at a driver’s gender when factoring rates. However, this won’t be the case in Pennsylvania.

The state law in Pennsylvania prohibits insurers from basing rates on a driver’s gender. Let’s take a look at the rates for male versus female drivers in Philadephia.

- Male Driver: $7,482

- Female Driver: $7,524

Yes, the average rates are different. But this isn’t because insurers automatically lower and raise rates when they see the M or F circled on an application. The rate difference is due to a variety of other factors, such as accident and claim history.

Interestingly, females tend to pay more than males in Philadelphia. Usually, males pay more.

Now that we know what different genders pay, let’s look at age and rates. Age is important to providers, as there is a huge difference between the experience of a teen driver and a middle-aged driver. Data USA found that the median age in Philadelphia is 34.4 years.

This means most drivers will be paying the average rate for a 35-year-old driver.

| Age | 17 | 25 | 35 | 60 | Cheapest Age |

|---|---|---|---|---|---|

| Philadelphia Average Premium | $17,201.53 | $4,779.13 | $4,092.17 | $3,856.53 | 60 |

Yikes. Teens pay over $17,000 for insurance in Philadelphia. Because of these high costs, teen drivers need to shop around at insurance providers and consider going on a parent’s policy to reduce costs.

Now that we know which age has the highest rates (no surprise there), let’s combine gender and age demographics.

| Demographic | Rate (Cheapest) |

|---|---|

| Married 60-year old male | $3,825.49 |

| Married 60-year old female | $3,887.56 |

| Married 35-year old male | $4,060.58 |

| Married 35-year old female | $4,123.77 |

| Single 25-year old male | $4,748.21 |

| Single 25-year old female | $4,810.06 |

| Single 17-year old male | $17,126.38 |

| Single 17-year old female | $17,276.69 |

Being married also has the advantage of lowering car insurance rates (see the video below). Why? Because two people are now responsible for car insurance payments. If you recently got married, let your provider know.

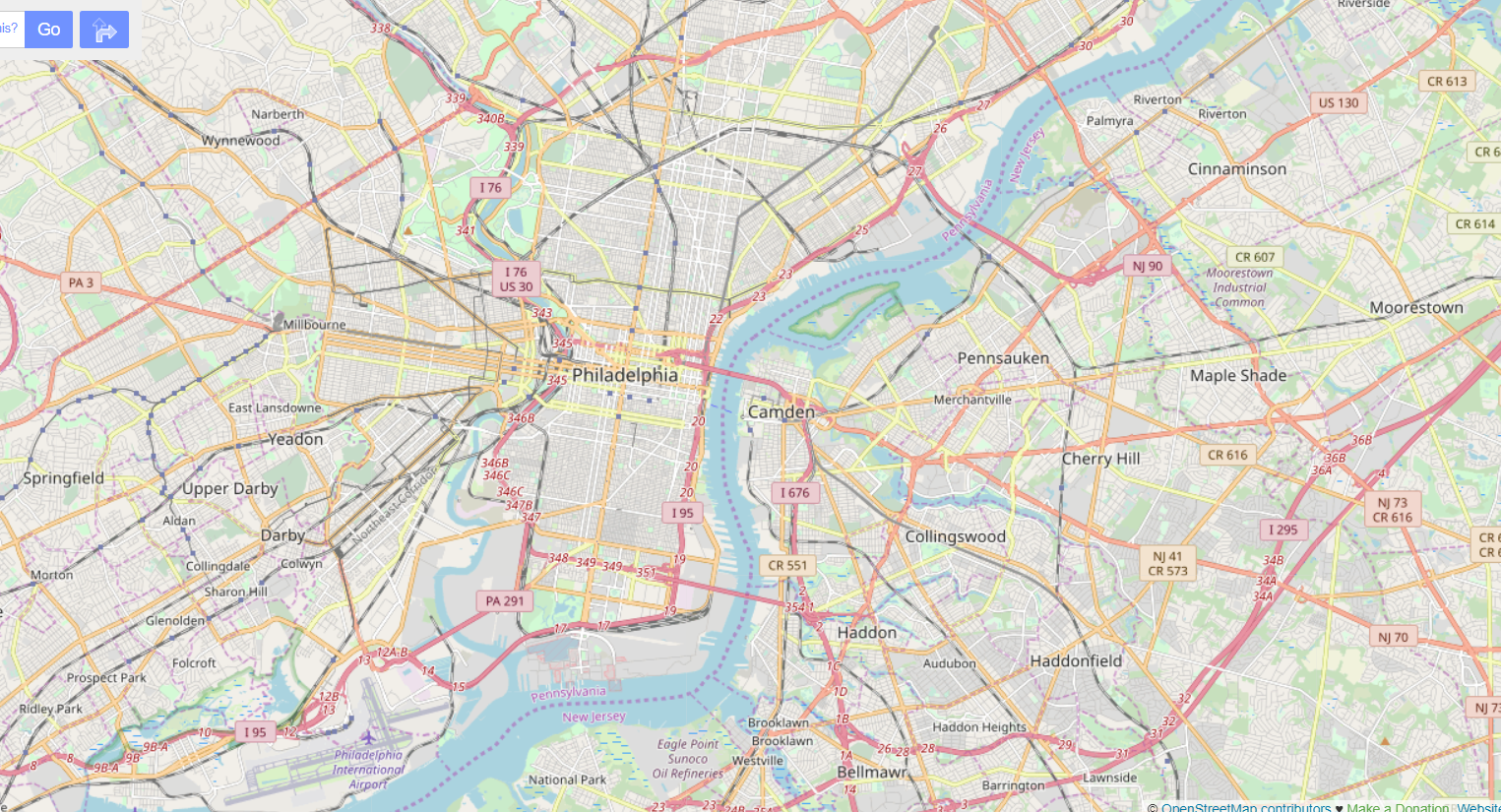

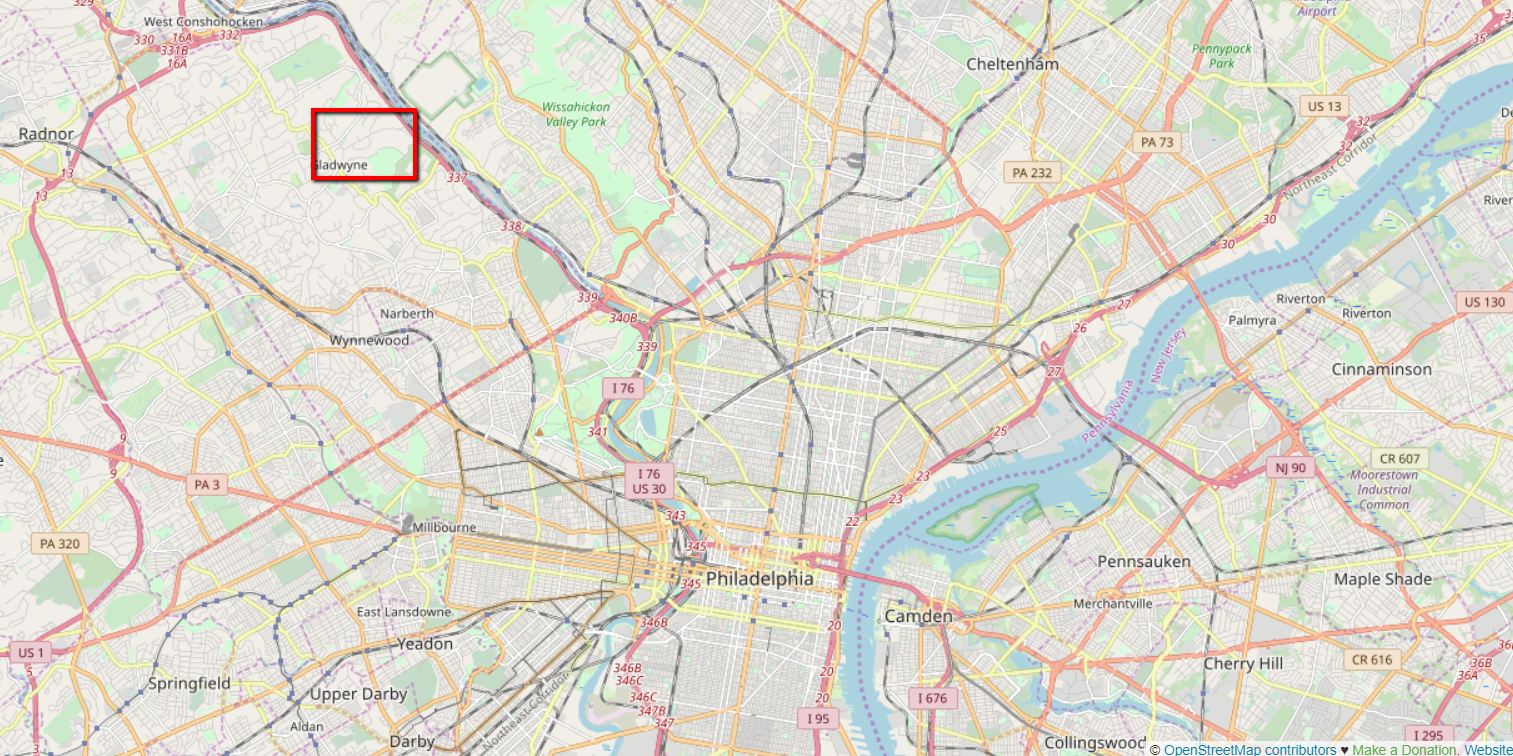

Cheapest Zip Codes in Philadelphia

Where you live in a city can have a significant impact on your rates. The reason for this is simple. Some neighborhoods have more poverty and crime, making insuring a car in those areas more expensive.

After all, your insurer will have to pay if your car is stolen and vandalized, so insurers charge more to take on that risk.

Now that we know why insurers charge more based on zip codes, let’s see what the average rates are in Philadelphia.

| Zip code | Average Annual Rate |

|---|---|

| 19113 | $7,230.41 |

| 19128 | $7,971.25 |

| 19118 | $8,015.18 |

| 19127 | $8,067.84 |

| 19154 | $8,305.29 |

| 19114 | $8,418.71 |

| 19129 | $8,567.87 |

| 19116 | $8,681.96 |

| 19119 | $8,717.53 |

| 19137 | $8,731.85 |

| 19152 | $8,761.68 |

| 19102 | $8,771.34 |

| 19136 | $8,797.21 |

| 19115 | $8,865.96 |

| 19111 | $8,957.91 |

| 19106 | $9,023.19 |

| 19149 | $9,043.03 |

| 19130 | $9,125.87 |

| 19103 | $9,148.09 |

| 19150 | $9,169.50 |

| 19151 | $9,178.22 |

| 19135 | $9,194.67 |

| 19107 | $9,241.41 |

| 19110 | $9,248.59 |

| 19123 | $9,298.94 |

| 19146 | $9,337.55 |

| 19144 | $9,362.74 |

| 19109 | $9,392.81 |

| 19147 | $9,428.07 |

| 19148 | $9,508.89 |

| 19131 | $9,539.80 |

| 19190 | $9,564.29 |

| 19104 | $9,581.50 |

| 19138 | $9,631.63 |

| 19134 | $9,650.55 |

| 19124 | $9,672.32 |

| 19126 | $9,681.59 |

| 19153 | $9,685.55 |

| 19125 | $9,719.20 |

| 19145 | $9,771.21 |

| 19120 | $9,780.21 |

| 19141 | $9,793.33 |

| 19112 | $10,086.22 |

| 19122 | $10,186.97 |

| 19143 | $10,219.59 |

| 19121 | $10,283.48 |

| 19139 | $10,358.57 |

| 19140 | $10,370.26 |

| 19142 | $10,372.77 |

| 19132 | $10,446.90 |

| 19133 | $10,480.35 |

The cheapest zip code costs $3,250 less than the most expensive zip code. This is a significant price difference. In other places, $3,250 is the cost of a full coverage policy. So, if you move around Philadelphia, you may end up having to pay a high price for insurance.

What’s the best car insurance company in Philadelphia?

Now that you’re aware of how expensive rates are in Philadelphia, we want to go over companies’ rates. This way, you can pick a company that better fits your budget and find out what increases insurers’ rates.

So stick with us as we go through major companies’ rate changes in Philadelphia.

Cheapest Car Insurance Rates by Company

Getting reasonable rates is important. Let’s look at which companies have the cheapest rates in Philadelphia.

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| USAA | $5,737.15 | $5,737.15 | $2,509.52 | $2,509.52 | $1,873.20 | $1,873.20 | $1,696.36 | $1,696.36 | $2,954.06 |

| Geico | $8,992.37 | $7,789.85 | $3,584.35 | $3,089.58 | $3,659.99 | $3,154.47 | $3,597.48 | $3,100.88 | $4,621.12 |

| State Farm | $10,223.02 | $10,223.02 | $3,322.46 | $3,322.46 | $2,999.54 | $2,999.54 | $2,671.30 | $2,671.30 | $4,804.08 |

| Nationwide | $9,294.93 | $9,294.93 | $3,880.78 | $3,880.78 | $3,487.69 | $3,487.69 | $3,321.34 | $3,321.34 | $4,996.19 |

| Allstate | $15,830.38 | $15,830.38 | $4,920.02 | $4,920.02 | $4,534.62 | $4,534.62 | $4,251.22 | $4,251.22 | $7,384.06 |

| Progressive | $14,597.00 | $14,597.00 | $5,880.20 | $5,880.20 | $4,869.14 | $4,869.14 | $4,389.55 | $4,389.55 | $7,433.97 |

| Liberty Mutual | $23,772.74 | $23,772.74 | $10,467.69 | $10,467.69 | $8,295.78 | $8,295.78 | $7,619.34 | $7,619.34 | $12,538.89 |

| Travelers | $49,765.94 | $49,765.94 | $3,915.43 | $3,915.43 | $3,270.16 | $3,270.16 | $3,553.91 | $3,553.91 | $15,126.36 |

USAA has the cheapest average rate, followed by Geico. However, USAA is only for military members and their families, so if you aren’t military, Geico will be the best option.

Also, we want to point out how important it is to look at rates for your demographic. At Travelers, the average rate for teenagers is $50,000. That’s a downpayment on a house, and there’s no way an average teenager can afford that. However, USAA, Geico, and Nationwide have more reasonable prices for teenagers. The prices are still high, but at least they don’t amount to $50,000.

Make sure to check what insurers are charging by demographics and not just their average rate overall.

Best Car Insurance for Commute Rates

Did you know insurers look at your daily commute when determining rates? While not all insurers change their rates because of commute distance, others do.

| Company | 10 miles commute / 6,000 annual mileage | 25 miles commute / 12,000 annual mileage |

|---|---|---|

| USAA | $2,867.82 | $3,040.30 |

| Geico | $4,547.62 | $4,694.62 |

| State Farm | $4,648.40 | $4,959.76 |

| Nationwide | $4,996.18 | $4,996.18 |

| Allstate | $7,221.19 | $7,546.93 |

| Progressive | $7,433.97 | $7,433.97 |

| Liberty Mutual | $12,223.66 | $12,854.12 |

| Travelers | $15,126.36 | $15,126.36 |

In Pennsylvania, the average driver travels 11,203 miles a year, so most Philadelphia drivers will pay for a long commute distance.

We want to point out that just because an insurer charges for a longer commute doesn’t mean you should switch to a provider who doesn’t change its rates. For the most part, insurers who don’t charge for long commutes already have more expensive rates, such as Travelers and Progressive. On the other hand, insurers like USAA and Geico charge for a longer commute, but their resulting rates are still cheaper than other companies.

Best Car Insurance for Coverage Level Rates

Because car insurance is expensive in Philadelphia, you may be tempted to buy a low coverage policy. However, shopping around can help you buy a high coverage policy for an economical price. Below, you can see the average rate changes for coverage levels at Philadelphia companies.

| Group | Low | Medium | High |

|---|---|---|---|

| USAA | $2,686.69 | $2,987.59 | $3,187.90 |

| Geico | $3,945.98 | $4,670.50 | $5,246.88 |

| State Farm | $4,417.09 | $4,881.11 | $5,114.04 |

| Nationwide | $4,876.19 | $5,060.43 | $5,051.93 |

| Allstate | $6,663.27 | $7,468.23 | $8,020.68 |

| Progressive | $6,400.45 | $7,453.60 | $8,447.87 |

| Liberty Mutual | $11,792.43 | $12,648.26 | $13,175.96 |

| Travelers | $14,699.01 | $15,177.09 | $15,502.99 |

Some of the insurers on this list have economical price increases. For example, Nationwide charges an average of $175 to upgrade from low to high coverage. This is an amazing upgrade price, and Nationwide customers should definitely take advantage of it.

However, while other providers charge about $1,000 to upgrade, compare the prices for high coverages rather than looking at how much it costs to upgrade. For example, while Nationwide has a low upgrade price, it is still more expensive than a handful of other companies’ prices for high coverage.

Best Car Insurance for Credit History Rates

Credit has a direct impact on what you pay for car insurance. Since the average credit score in the U.S. is 675, you can expect to pay more for car insurance if your credit score is below this number.

| Company | Good | Fair | Poor |

|---|---|---|---|

| USAA | $2,393.33 | $2,724.60 | $3,744.26 |

| Geico | $2,986.78 | $3,893.08 | $6,983.51 |

| State Farm | $3,356.18 | $4,239.43 | $6,816.64 |

| Nationwide | $4,279.62 | $4,814.49 | $5,894.45 |

| Allstate | $5,638.55 | $7,048.60 | $9,465.03 |

| Progressive | $5,513.16 | $6,909.76 | $9,879.00 |

| Liberty Mutual | $10,176.47 | $11,494.99 | $15,945.20 |

| Travelers | $13,999.55 | $14,869.14 | $16,510.40 |

The numbers above show how important good credit is. At companies like Liberty Mutual, drivers with poor credit will end paying $5,700 more than drivers with good credit. So shop around if you have poor credit and try to find an insurer whose rate increase is less than $2,000 (like USAA or Nationwide).

Best Car Insurance for Driving Record Rates

Equally as important as your credit score is your driving history.

| Company | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| USAA | $2,362.27 | $2,646.58 | $3,288.44 | $3,518.96 |

| Geico | $3,356.70 | $4,667.79 | $5,913.58 | $4,546.42 |

| State Farm | $4,373.72 | $4,804.08 | $5,234.44 | $4,804.08 |

| Nationwide | $3,654.90 | $4,822.52 | $4,841.23 | $6,666.09 |

| Allstate | $7,045.78 | $7,045.78 | $8,398.88 | $7,045.78 |

| Progressive | $6,727.17 | $6,778.57 | $9,240.42 | $6,989.74 |

| Liberty Mutual | $11,444.01 | $12,800.78 | $13,109.97 | $12,800.78 |

| Travelers | $10,688.46 | $15,238.90 | $15,238.90 | $19,339.18 |

DUIs, accidents, and speeding violations cost much more than just the price of a traffic ticket or a lawyer. They will also raise your rates significantly.

For example, a DUI at Travelers will cost drivers over $8,000. This is one of the more extreme price raises, but you can expect a poor driving record to raise rates anywhere from a few hundred to a few thousand dollars.

Car Insurance Factors in Philadelphia

Insurers’ rates are influenced by more than just a driver’s history. The economy of a city also influences rates, as it contributes to issues like poverty and crime.

Stick with us as we go through Philadelphia’s economy, from prosperity to common employment occupations. Let’s begin.

Metro Report – Growth & Prosperity

Brookings has an extensive metro report on the top 100 largest metropolitan areas in the U.S. The report rates the cities by growth and prosperity levels. Let’s start by looking at 2019 prosperity in Philadelphia, which measures the “average wealth and income produced by an economy.”

Philadelphia’s overall prosperity earned it a ranking of 44th out of 100.

- Productivity: +1.0 percent (47th out of 100)

- Standard of Living: +2.1 percent (24th out of 100)

- Average Annual Wage: +0.6 (70th out of 100)

The standard of living has increased in Philadelphia, though productivity and average annual wage only had slight changes. Let’s look at 2019 growth in Philadelphia, as increased economic activity helps the prosperity of a metropolitan area.

Philadelphia’s growth placed it as 28th out of 100. Below, you can see what percent changes happened in the growth categories.

- Jobs: +1.4 percent (51st out of 100)

- Gross Metropolitan Product (GMP): +2.4 percent (44th out of 100)

- Jobs at Young Firms: +7.1 percent (18th out of 100)

Philadelphia has ranked high in producing more jobs at young firms. However, it has also increased in all areas of growth, which is good.

Median Household Income

We now know that the average annual wage in Philadelphia has increased 0.6 percent in one year. This means nothing, though, if we don’t know what the average household income is. Data USA lists the median household income in Philadelphia as $39,759.

This income is lower than both the U.S. average income ($60,336) and the Pennsylvania average income ($59,195). This low income, combined with higher than normal insurance rates, means the average Philadelphia household spends about 23.3 percent of their income on car insurance.

This is an extremely high percentage of income going to car insurance. Want to know what percentage of your income goes to car insurance? Try out our free calculator below.

CalculatorPro

Homeownership in Philadelphia

With car insurance consuming so much of Philadelphia residents’ budgets, we want to look at Data USA’s information on the percentage of homeownership. Owning a home can help lower insurance costs, as homeowners offer auto and home bundling discounts.

In 2017, 49 percent of Philadelphia residents owned their homes. This is a drop from 2016 when there was 52.1 percent homeownership.

Philadelphia’s rate of homeownership is lower than both the U.S. average (63.8 percent) and the Pennsylvania average (69 percent). The lower incomes and higher insurance costs in Philadelphia could have something to do with this.

The median value of a home in Philadelphia is $166,200 (2017). This is only about $11,000 below the U.S. median value of a home. So even though Philadelphia residents tend to earn less, the cost of homes in Philadelphia is only slightly below the U.S. average.

Education in Philadelphia

There are plenty of higher education opportunities in Philadelphia. Below is a complete 2016 list from Data USA of Philadelphia colleges and universities.

| Sector | University | 2016 Degrees Completed |

|---|---|---|

| Private not-for-profit, 4-year or above | University of Pennsylvania | 9,053 |

| Public, 4-year or above | Temple University | 9,017 |

| Private not-for-profit, 4-year or above | Drexel University | 7,549 |

| Private not-for-profit, 4-year or above | Saint Joseph's University | 2,712 |

| Public, 2-year | Community College of Philadelphia | 2,343 |

| Private not-for-profit, 4-year or above | La Salle University | 1,762 |

| Private not-for-profit, 4-year or above | Philadelphia University | 1,027 |

| Private not-for-profit, 4-year or above | Thomas Jefferson University | 1,201 |

| Private not-for-profit, 4-year or above | Philadelphia College of Osteopathic Medicine | 742 |

| Private not-for-profit, 4-year or above | University of the Sciences | 848 |

| Private not-for-profit, 4-year or above | Holy Family University | 739 |

| Private not-for-profit, 4-year or above | Chestnut Hill College | 650 |

| Private for-profit, less-than 2-year | Star Career Academy-Philadelphia | 470 |

| Private for-profit, 2-year | Brightwood Career Institute-Philadelphia Mills | 426 |

| Private not-for-profit, 4-year or above | The University of the Arts | 412 |

| Private for-profit, 4-year or above | The Art Institute of Philadelphia | 370 |

| Private for-profit, 2-year | Brightwood Career Institute-Philadelphia | 327 |

| Private not-for-profit, 4-year or above | Peirce College | 309 |

| Private for-profit, 2-year | Lincoln Technical Institute-Center City Philadelphia | 264 |

| Private not-for-profit, 2-year | Orleans Technical College | 263 |

| Private for-profit, less-than 2-year | Jean Madeline Aveda Institute | 236 |

| Private for-profit, less-than 2-year | Prism Career Institute-Philadelphia | 172 |

| Private for-profit, 2-year | Lincoln Technical Institute-Northeast Philadelphia | 168 |

| Private for-profit, less-than 2-year | Empire Beauty School-Center City Philadelphia | 157 |

| Private not-for-profit, less-than 2-year | Philadelphia Technician Training | 150 |

| Private for-profit, 4-year or above | The Restaurant School at Walnut Hill College | 144 |

| Private for-profit, 2-year | Lincoln Technical Institute-Philadelphia | 136 |

| Private for-profit, 2-year | Aviation Institute of Maintenance-Philadelphia | 134 |

| Private for-profit, 4-year or above | University of Phoenix-Pennsylvania | 118 |

| Private not-for-profit, 4-year or above | Moore College of Art and Design | 115 |

| Private for-profit, less-than 2-year | Empire Beauty School-NE Philadelphia | 95 |

| Private not-for-profit, 4-year or above | Pennsylvania Academy of the Fine Arts | 94 |

| Private for-profit, 2-year | Roxborough Memorial Hospital School of Nursing | 67 |

| Private not-for-profit, 4-year or above | Lutheran Theological Seminary at Philadelphia | 41 |

| Private not-for-profit, 4-year or above | Curtis Institute of Music | 41 |

| Private for-profit, 2-year | Jna Institute of Culinary Arts | 29 |

| Private for-profit, 4-year or above | Hussian College School of Art | 24 |

| Private for-profit, less-than 2-year | L T International Beauty School | 23 |

| Private not-for-profit, 2-year | The Workforce Institute's City College | 19 |

| Private not-for-profit, 4-year or above | Talmudical Yeshiva of Philadelphia | 16 |

| Private not-for-profit, 2-year | Studio Incamminati | 6 |

| Private not-for-profit, 4-year or above | Academy of Vocal Arts | 5 |

The University of Pennsylvania completed the most degrees in 2016, followed by Temple University.

As well, if you want to save money by attending community college, the Community College of Philadelphia is a great option, offering multiple one- to two-year accreditation programs, as well as transfer programs. There are also convenient online classes if the campus is too far away or you work.

Wage by Race & Ethnicity in Common Jobs

While we’ve looked at the average wage, we want to dig deeper into Philadelphia’s economics by looking at wages by race and ethnicity. Below is Data USA’s information on miscellaneous managers’ wages in Pennsylvania, as well as the percentage of income going to car insurance.

| Ethnicity | Miscellaneous Managers | Premiums as Percentage of Income |

|---|---|---|

| Asian | $114,226 | 8.14% |

| White | $96,999 | 9.59% |

| Two or More Races | $73,230 | 12.70% |

| Black | $70,316 | 13.23% |

| Other | $69,194 | 13.44% |

Even the highest paid race/ethnicity (Asians) spends over 8 percent of their income on car insurance. As we’ve said many times before, car insurance in Philadelphia is expensive.

Wage by Gender in Common Jobs

The gender wage gap also makes for significant differences in the percentage of income spent on car insurance. According to Data USA, the average Philadelphia wages for males and females are the following:

- Male Average Salary: $68,603

- Female Average Salary: $51,375

This $17,000 difference between the two salaries means that while males spend 13.5 percent of their income on car insurance, females spend 18.1 percent.

Let’s dig deeper into these salary differences by looking at salaries for males versus females in common jobs.

| Occupation | Male Salary | Female Salary |

|---|---|---|

| Miscellaneous Managers | $109,260 | $81,888 |

| Registered Nurses | $80,388 | $67,214 |

| Elementary and Middle School Teachers | $65,851 | $57,795 |

| Secretaries and Administrative Assistants | $51,278 | $39,478 |

| Driver/Sales Workers and Truck Drivers | $46,920 | $32,379 |

In every job occupation, male employees make more than female employees. Next, we will look at how this gender wage gap is part of the factor in poverty rates by gender and age.

Poverty by Age & Gender

Let’s take a look at gender and age poverty statistics from Data USA.

| Philadelphia Percentage of Males and Females Living in Poverty by Age | Male | Female |

|---|---|---|

| >5 years | 4.95% | 4.88% |

| 5 years | 0.876% | 0.869% |

| 6 - 11 years | 4.99% | 5.12% |

| 12 - 14 years | 2.56% | 2.19% |

| 15 years | 0.75% | 0.915% |

| 16 - 17 years | 1.53% | 1.43% |

| 18 - 24 years | 6.4% | 7.24% |

| 25 - 34 years | 6.24% | 9.06% |

| 35 - 44 years | 4.09% | 6.08% |

| 45 - 54 years | 4.96% | 6.01% |

| 55 - 64 years | 4.41% | 5.68% |

| 65-74 years | 1.84% | 2.97% |

| 75+ years | 1.07% | 2.89% |

Before the age of 18, there are more males than females living in poverty in Philadelphia. After age 18 — the age when the wage gap begins to have an impact because teens are moving out — more females than males are living in poverty.

Did you know that 25.8 percent of the population living in poverty in Philadelphia are living below the poverty line?

This is a high percentage, as the national average of those living below the poverty line is only 13.4 percent. Based on these numbers, you can expect a higher-than-average amount of poverty in the city.

Poverty by Race & Ethnicity

We’ve looked at the salary differences between races and ethnicities in Philadelphia, and now we want to look at the poverty differences.

| Race or Ethnicity | Number of People Living in Poverty |

|---|---|

| Black | 196,990 |

| White | 118,649 |

| Hispanic | 86,690 |

| Other | 35,556 |

| Asian | 28,698 |

| Two or More | 11,940 |

| Native American | 1,759 |

Blacks have the highest number of people living in poverty, followed by whites.

Employment by Occupations

We’ve covered a lot of salary and poverty information, and now we want to look at what the most common occupations are in Philadelphia. According to Data USA, the three most common occupations are:

- Office and Administrative Support Occupations (83,030 people)

- Sales and Related Occupations (57,331 people)

- Management Occupations (56,671 people)

Unfortunately, employment in Philadelphia dropped from 2016 to 2017 at a rate of -0.741 percent. The result was that the number of employees dropped from 679,000 to 674,000.

Driving in Philadelphia

Are you ready to drive around one of the most populated cities in the U.S.? City driving has a host of challenges that are different from rural road and suburban driving. If you don’t quite feel up to the challenge yet, this section is for you. We cover every challenge you might face when driving around Philadelphia, from major highways to how safe Philadelphia’s roads are.

So keep reading to learn about Philadelphia’s street conditions.

Roads in Philadelphia

Roads in a large city can be confusing. Until you learn your way around like a native, you’re bound to make a few wrong turns. To help speed the process along, we are going to cover information about Philadelphia’s roads, from major highways to road conditions.

Let’s jump right in, so you can be prepared to drive across the city.

Major Highways

The state of Pennsylvania has 23 active routes, making up 1,862 miles in the state. A number of these major routes cut right through or by Philadelphia: I-76, I-95, I-476, I-295, and I-676.

Being so close to major routes means you can easily take a highway to another part of Pennsylvania.

The price of traveling on these highways, though, is paying tolls. If you don’t want to get stuck waiting in line while scrambling for change, consider an E-ZPass device.

The device costs $35 to buy, and then there is a $3 annual fee to keep your account open. Of course, there will also be the price of tolls when you go through the E-ZPass lanes. If you go through tolls frequently, though, the pass will save you time on the highway.

– Popular Road Trips & Sites

There is plenty to do in Philadelphia. If you don’t know where to start, though, check out the list below of some popular attractions in Philadelphia.

- Philadelphia Zoo: If you’re an animal lover, then the Philadelphia Zoo is a must-see.

- Nature Spots: Need to escape the city for a bit? Check out this list of the best nature spots in Philadelphia.

- Hidden Local Attractions: If you want to see some hidden spots in Philadelphia, such as breakfast nooks and gardens, check out this list.

Once you’ve explored what Philadelphia has to offer, you may want to plan a road trip across Pennsylvania.

- Abandoned Places Road Trip: One of the attractions on this eerie road trip is right in Philadelphia, the Eastern State Penitentiary.

- Christmas Lights Road Trip: Full of Christmas cheer? One of the attractions on this list is right in Philadelphia (the Longwood Gardens).

- Fall Foliage Trip: Pennsylvania is beautiful in the fall, with the trees slowly turning shades of gold and rust. If you want to get your fill of the fall season, take this road trip to see Pennsylvania’s beautiful scenery.

- Haunted Road Trip: If you like spooky places, this road trip is for you. The Eastern State Penitentiary in Philadelphia is also on this list, so if you like creepy, abandoned places you should pay it a visit.

These are just a few ideas to get you started. The longer you live in Philadelphia, the more you will find to do.

Road Conditions

Sometimes, cities let the roads fall into disrepair because they spent the budget on other things. However, road maintenance is important. If cities let their roads crack open with potholes, drivers will end up spending more on vehicle maintenance and repairs.

So let’s take a look at TRIP’s report on Philadelphia’s road conditions (TRIP is a nonprofit research group).

| Road Condition | Poor | Mediocre | Fair | Good |

|---|---|---|---|---|

| Philadelphia | 43% | 28% | 11% | 17% |

The average cost to operate a vehicle on these roads is $732. This isn’t surprising, seeing as only 11 percent of Philadelphia’s roads are in good condition, and 43 percent are in poor condition. Hopefully, Philadelphia will add road repairs to its list of city improvements.

Does Philadelphia use speeding or red-light cameras?

The Insurance Institute for Highway Safety (IIHS) says that the state of Pennsylvania has both red-light and speed cameras. There have been active red-light cameras in Philadelphia for over a decade.

The city also installed speed cameras in 2019.

So even if you don’t see a cop hiding around a corner, you can still be caught if you speed or run a red light.

Vehicles in Philadelphia

Your insurance rate in Philadelphia also depends on vehicle factors, such as what type of vehicle you drive. There are also outside factors that can raise your rates, like the amount of crime and vehicle theft in your area.

So keep reading to learn what to expect and what to watch out for in Philadelphia.

Most Popular Vehicles Owned

YourMechanic has recorded data on what the most popular types of cars are in major cities. Below is YourMechanic’s data on popular car types in Philadelphia.

| Car Type | Percentage Serviced by YourMechanic in Philadelphia |

|---|---|

| American Made | 44% |

| Hybrids | 0.6% |

| Muscle Cars with V8 Engines | 10.8% |

| Subaru | 1.7% |

The most unusually popular car in Philadelphia is the Nissan Maxima. The National Highway Traffic Safety Administration (NHTSA) gave the Nissan Maxima a five-star safety rating, and the car gets 20 to 30 miles per gallon of gas.

Having a car with a good safety rating can help lower your car insurance costs, as insurers look at the safety ratings of cars when determining a driver’s rates.

Cars Per Household

Now that we know what types of cars Philadelphia residents own, we want to see how many cars residents own. Below is Data USA’s information on car ownership in Philadelphia.

| Number of Cars | Household Percentage |

|---|---|

| 0 | 17.1% |

| 1 | 40.3% |

| 2 | 28% |

| 3 | 9.93% |

| 4 | 3.46% |

| 5+ | 1.12% |

Most Philadelphia residents own one car. This is less than usual, as the U.S. average of car ownership is two cars. As well, 17 percent of Philadelphia residents own zero cars, depending on alternate transportation to get to work and run errands.

Households Without a Car

We know that a high percentage of Philadelphia residents don’t own cars, and we want to see if this number has changed at all over the years.

| 2015 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Households Without Vehicles | 2016 Vehicles Per Household |

|---|---|---|---|

| 31.10% | 1.03 | 29.50% | 1.05 |

The percentage of households without vehicles did drop slightly in 2016, which means more households bought a car. However, Philadelphia still has a high rate of households without vehicles.

In a city, though, residents can get by without cars due to public transportation.

Speed Traps in Philadelphia

Speedtrap.org listed Philadelphia as one of the top 10 worst cities in Pennsylvania for speed traps. If you drive safe and follow the posted speed limits, there is no cause for alarm. However, if you tend to drive faster than you should, you’ll have to contend with speed traps and speed cameras around the city.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Vehicle Theft in Philadelphia

The FBI’s crime report found that 5,483 vehicles were stolen in 2017 in the city of Philadelphia. This is the highest number out of all Pennsylvania cities.

To put this amount in perspective, the second-highest number of stolen vehicles in 2017 was 680 stolen vehicles in Pittsburgh. This high number of vehicle thefts is probably part of the reason Philadelphia’s insurance rates are so high.

So how can you keep your car safe?

According to Neighborhood Scout, the safest neighborhood in Philadephia is Roseglen.

Not the area you wanted to live in? Neighborhood Scout lists the other safest neighborhoods as:

- Rhawn St / Rowland Ave

- Stevens Rd / Byberry Rd

- Byberry Rd / Depue Ave

- Ridge Ave / Flamingo St

- Germantown Ave / W Willow Grove Ave

- Chestnut Hill / Chestnut Hill College

- Cherokee St / W Hartwell Ln

- Old Line Rd / Ridge Ave

- Mount Airy

Living in one of these neighborhoods will help lower your chance of being the victim of a crime. In Philadelphia, you have a one in 106 chance of being the victim of a violent crime. In Pennsylvania, you have a one in 319 chance.

Philadelphia’s chance is much worse than Pennsylvania’s chance. Let’s see how many violent crimes occurred in Philadelphia in 2017.

| Philadelphia Violent Crimes | Murder | Rape | Robbery | Assault |

|---|---|---|---|---|

| Report Total | 316 | 1,182 | 6,028 | 7,417 |

| Rate Per 1,000 | 0.2 | 0.75 | 3.81 | 4.69 |

Philadelphia has a high number of violent crimes, In fact, the city has a crime index rating of 10, meaning it is only safer than 10 percent of all U.S. cities.

Below, you can see the number of total crimes that occur in Philadelphia.

| Philadelphia 2017 Annual Crimes | Violent | Property | Total |

|---|---|---|---|

| Number of Crimes | 14,943 | 48,276 | 63,219 |

| Crime Rate (per 1,000 Residents) | 9.45 | 30.54 | 39.99 |

With over 63,000 crimes occurring in 2017, it’s prudent to move into one of Philadelphia’s safest neighborhoods.

Traffic

Traffic is a natural fixture of cities. If you hate sitting in traffic, keep reading to learn about Philadelphia’s traffic. We will go through everything from traffic congestion to the best repair shops in case someone runs into you during heavy traffic.

Let’s begin.

Traffic Congestion in Philadelphia

In such a heavily populated city, you can expect heavy traffic congestion. Let’s take a look at Inrix’s data on traffic in Philadelphia.

| 2018 Impact Rank (2017) | Hours Lost in Congestion | Year Over Year Change | Cost of Congestion (Per Driver) | Inner City Travel Time (Minutes) | Inner City Last Mile Speed (mph) |

|---|---|---|---|---|---|

| 69 (67) | 112 | 0% | $1,568 | 6 | 10 |

The good news is that Philadelphia’s traffic congestion hasn’t changed. However, traffic congestion does cost drivers an average of $1,568 a year. That’s a lot of money to spend on just crawling forward in a long line of cars. So if you live in Philadelphia, be prepared for traffic congestion.

Transportation

According to Data USA, the average commute time in Philadelphia is 31.7 minutes (or 63.4 minutes a day). This is higher than the average U.S. commute time of 25.5 minutes a day. This isn’t surprising, considering Philadelphia has a lot of traffic congestion.

So what transportation modes do Philadelphia residents use for their hour-long commute each day?

- Driving Alone: 51.1 percent

- Using Public Transit: 23.8 percent

- Walking: 8.44 percent

A high percentage of Philadelphians use public transit. The remaining percentage (besides the first three methods) is made up of alternate transportation methods like working at home, bicycling, or carpooling.

Busiest Highways

Two sections of highway in Philadelphia are among the busiest highways in Pennsylvania.

- I-76 (length “between City Avenue and Roosevelt Boulevard”)

- I-676 (length between “Schulkill Expressway and North 24th Street”)

These stretches of highway cost drivers time in delays, making the commute time longer.

How safe are Philadelphia’s streets & roads?

We aren’t talking about crime, but rather the accidents that happen every year. For example, some cities are prone to more drunk driving or speeding deaths, depending on the law and the level of enforcement.

To see how safe Philadelphia’s roads are, we are going to jump into fatality data from the NHTSA. Let’s start by looking at how many fatalities have happened in Philadelphia over the years.

| Philadelphia County Fatalities (All Crashes) | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Fatalities | 97 | 94 | 101 | 94 | 103 |

Philadelphia County has the highest number of fatalities out of all counties in Pennsylvania. The good news is that the number of fatalities each year hasn’t increased significantly, though the bad news is that the numbers haven’t decreased, either.

Now that we know the total number of crashes, let’s break those numbers down into the crash causes.

| Philadelphia Fatalities by Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Crashes Involving an Alcohol-Impaired Driver | 26 | 31 | 23 | 22 | 27 |

| Single Vehicle Crash | 65 | 66 | 57 | 55 | 65 |

| Fatalities in Crashes Involving Speeding | 34 | 32 | 22 | 29 | 24 |

| Involving a Roadway Departure | 38 | 40 | 23 | 29 | 34 |

| Involving an Intersection | 41 | 35 | 50 | 37 | 39 |

In 2018, single-vehicle crashes, intersection crashes, and roadway departure crashes were the major contributors to Philadelphia’s fatalities. Next, let’s take a look at what type of people die in these crashes, from pedestrians to vehicle occupants.

| Philadelphia County Fatalities by Person Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Passenger Car Occupant | 31 | 28 | 29 | 24 | 35 |

| Pedestrian | 38 | 26 | 43 | 37 | 41 |

| Pedalcyclist | 3 | 7 | 3 | 2 | 4 |

In 2018, there were 41 pedestrian deaths, a slight increase from 2014. However, there hasn’t been a dramatic rise in any of the person type fatalities, which is good.

So what are the most dangerous roads to walk by or drive on in Pennsylvania?

| Pennsylvania Road Type | 2017 Fatal Crashes |

|---|---|

| Rural Interstate | 80 |

| Urban Interstate | 46 |

| Freeway and Expressway | 43 |

| Other | 322 |

| Minor Arterial | 229 |

| Collector Arterial | 204 |

| Local | 211 |

| Unknown | 2 |

| Total Fatal Crashes | 1,137 |

Arterial road types are the most dangerous in Pennsylvania. An arterial road is a high traffic road. Minor arterial roads have less traffic volume than arterial roads, and collector arterial roads take local traffic to arterial roads.

So highways and merging ramps are among the most dangerous in Pennsylvania, although this is true across the U.S. Whenever there are high volumes of traffic traveling at high speeds, crashes are deadly.

Below, you can see the U.S. Department of Transportation’s (US DOT) data on which roads in Philadelphia have the most crashes.

| Calendar Year | County | City | Highway | Highway User Type | Highway User Speed | Rail Equipment Type | Non-Suicide Fatality | Non-Suicide Injury |

|---|---|---|---|---|---|---|---|---|

| 2012 | PHILADELPHIA | PHILADELPHIA | DELAWARE AVENUE | Automobile | 0 | Yard/Switch | 0 | 0 |

| 2013 | PHILADELPHIA | PHILADELPHIA | DELAWARE AVE EAST | Automobile | 50 | Freight Train | 0 | 0 |

| 2013 | PHILADELPHIA | PHILADELPHIA | PRIVATE | Automobile | 3 | Freight Train | 0 | 0 |

| 2013 | PHILADELPHIA | PHILADELPHIA | MILNOR & BLEIGH | Automobile | 25 | Yard/Switch | 0 | 1 |

| 2015 | PHILADELPHIA | PHILADELPHIA | GREENWICH YARD | Truck-trailer | 5 | Light Loco(s) | 0 | 0 |

| 2015 | PHILADELPHIA | PHILADELPHIA | MAIN STREET | Pedestrian | Freight Train | 0 | 1 | |

| 2016 | PHILADELPHIA | PHILADELPHIA | 58TH ST | Truck-trailer | 5 | Freight Train | 0 | 0 |

Be careful when driving around any of the areas above, as there have been a number of fatal crashes on those roads.

Allstate America’s Best Drivers Report

Allstate records accident and hard-braking incidents in the top 200 largest cities in the U.S. Let’s see how Philadelphia ranked on Allstates’ 2019 report.

| 2019 Best Drivers Report Ranking | Average Years Between Collisions | 2018 Best Drivers Report Ranking | Change in Ranking From 2018 to 2019 | Relative Claim Likelihood (Compared to National Average) | Drivewise® HardBraking Events per 1,000 Miles |

|---|---|---|---|---|---|

| 190 | 6.33 | 191 | 1 | 0.67 | 43.88 |

Philadelphia scored poorly, only ranking 190 out of the 200 cities. Only an average of six years pass between claims, and there is a high number of hard-braking events per 1,000 miles.

The only good bit of the data to point out is that in 2018, Philadelphia ranked 191, so it did move up one slot. Hopefully, it will continue to rank better each year.

Ridesharing

Nervous about driving in a city with a poor driver rating? Below are the rideshare options that are available in the city.

- Taxi: Surprisingly, a traditional taxi tends to be the cheapest option in Philadelphia.

- Curb: A taxi system, Curb costs a bit less than Lyft and Uber.

- Lyft: This rideshare system is affordable, as long as you don’t get Lyft Premier or Lyft Lux.

- Uber: Uber is similar in price to Lyft, though its Uber X and Uber Black options are expensive.

- Carmel: This is the most expensive option in Philadelphia.

To save money, use a rate comparer like RideGuru to compare rates before calling a rideshare service.

E-star Repair Shops

Need a reputable repair shop? Esurance has a list of reputable shops through its E-star rating system. Let’s see what E-star repair shops Philadelphia has to offer.

| Shop Name | Address | Contact Info |

|---|---|---|

| ROCCO'S COLLISION CENTER, INC. | 806 REED ST PHILADELPHIA PA 19147 | email: [email protected] P: (215) 334-3244 F: (215) 271-3151 |

| ROCCO'S COLLISION CENTER, INC. - SNYDER | 1021 SNYDER AVE. PHILADELPHIA PA 19148 | email: [email protected] P: (215) 334-3244 F: (215) 271-3151 |

| FAULKNER COLLISION OF SOUTH PHILADELPHIA | 6615 Essington Ave. PHILADELPHIA PA 19153 | email: [email protected] P: (215) 863-4100 |

| SERVICE KING PHILADELPHIA SOUTH | 7791 Essington Avenue PHILADELPHIA PA 19153 | email: [email protected] P: (215) 365-3513 F: (215) 365-1664 |

| CALIBER - CLIFTON HEIGHTS | 557-C E BALTIMORE PIKE CLIFTON HEIGHTS PA 19018 | email: [email protected] P: (610) 626-7726 F: (610) 626-7890 |

| CALIBER - CYNWYD | 332 IONA AVENUE NARBERTH PA 19072 | email: [email protected] P: (610) 664-2578 F: (610) 664-8846 |

| CALIBER - LANSDOWNE | 714 EAST BALTIMORE AVE. CLIFTON HEIGHTS PA 19018 | email: [email protected] P: (610) 622-0555 F: (610) 622-0189 |

| ELMER'S AUTO BODY, INC. | 201-209 route 130 WEST COLLINGSWOOD HEIGHTS NJ 08059 | email: [email protected] P: (856) 456-7018 F: (856) 456-9228 |

| CALIBER - PENNSAUKEN | 6900 WESTFIELD AVENUE PENNSAUKEN NJ 08110 | email: [email protected] P: (856) 792-0130 F: (856) 792-1039 |

| CALIBER - WESTMONT | 6 WEST CUTHBERT BLVD HADDON TOWNSHIP NJ 08108 | email: [email protected] P: (856) 854-4888 F: (856) 854-7108 |

It’s important to have a good repair shop noted down before you need repairs. Otherwise, you may scramble to find a shop and pick one that overcharges or has slow work If you want to look up more repair shops, use the E-star shop finder tool.

Weather

Curious about what type of weather you’ll experience in Philadelphia? Below is the U.S. Climate Data’s information on average temperatures in the city.

| Philadelphia Average Weather | Details |

|---|---|

| Annual high temperature | 64.7°F |

| Annual low temperature | 47°F |

| Average temperature | 55.85°F |

| Average annual precipitation (rainfall) | 41.45 inches |

| Average annual snowfall | 23 inches |

The weather in Philadelphia is cold. There is an average of 23 inches of snowfall each year, so make sure to buy a warm winter coat. In fact, a number of the natural disasters that have happened in Philadelphia were caused by winter conditions.

The 21 natural disasters that happened in Philadelphia were made up of hurricanes, winter storms, floods, snowstorms, tropical storms, storms, blizzards, snowfalls, tropical depressions, and water shortages.

Philadelphia’s number of natural disasters is higher than the U.S. average (13). Because Philadelphia has had a number of winter disasters, consider purchasing comprehensive coverage for your vehicle.

Comprehensive coverage protects vehicles in cases of natural disasters, animal collisions, and theft/vandalism. Because Philadelphia also has a high crime rate, this coverage will do double duty to protect your vehicle.

Public Transit

The city of Philadelphia is served by the Southeastern Pennsylvania Transportation Authority (SEPTA). This service has buses, rails, and trolleys across Pennsylvania.

Below are the basic fares for using the SEPTA buses and rails.

- Transit Quick Trip: $2.50

- One-Day Pass: $9

- Weekly TransPass: $25.50

- Monthly TransPass: $96

There are also reduced fares for senior citizens and people with disabilities. SEPTA also has a paratransit system for people with disabilities, provided through the Customized Community Transportation (CCT).

Alternate Transportation

While you can ride a bike down the streets of Philadelphia, electric scooters are currently illegal. However, Philadelphia may pass a law that allows electric scooters onto its streets.

If so, popular scooter companies like Lime can expand into Philadelphia.

Parking in Metro Areas

There is plenty of street parking in Philadelphia, but you will have to pay to park on the street. According to the Philadelphia Parking Authority, there are coin-operated meters throughout the city.

There are also kiosks in the busiest parts of the city, where bills and credit cards can be used instead of change. However, all of these slots have time limits, so make sure to be back at your car before your meter runs out. Philadelphia introduced a payment app a few years ago, so you can prepay from your phone to avoid a trip to a kiosk.

Philadelphia also has multiple parking garages if you need more parking time than street parking provides. If you are flying out of Philadelphia, you can also use the local airport’s satellite parking. The longer you are gone, the higher your parking charges will be. If you will be gone for a while, it may be more cost-effective to take a rideshare vehicle to the airport.

Finally, if you need to park and charge your electric vehicle, Philadelphia has 191 public charging stations in the city. Fifty-eight of these charging stations are free to use.

Air Quality in Philadelphia

Heavily populated cities often have issues with air pollution, as there are thousands of cars on the streets belching out toxic fumes. The fumes produced by cars and other pollutant sources have a negative effect on people’s health, which is why we want to check Philadelphia’s air quality.

Below is data from the Environmental Protection Agency (EPA).

| Philadelphia Air Quality Index | Number of Days with AQUI | Good Days | Moderate Days | Unhealthy for Sensitive Groups Days | Unhealthy Days | Very Unhealthy Days |

|---|---|---|---|---|---|---|

| 2016 | 366 | 192 | 165 | 9 | - | - |

| 2017 | 365 | 190 | 163 | 10 | 2 | - |

| 2018 | 365 | 217 | 138 | 9 | 1 | - |

Philadelphia’s air quality isn’t that bad for a city. It’s good days increased in 2018, and it’s only had three unhealthy days over three years. This could be because Philadelphia has a lower than average rate of car ownership, as a lot of residents depend on public transit or only own one car.

Still, Philadelphia’s air quality could be much better. Hopefully, the city will work on cleaning up its air in the future.

Military & Veterans

If you are serving in the military or have served, most insurers offer discounts. However, it can be hard to pick through insurers to find discounts and see which one has the best rates.

To give you a picture of Philadelphia’s military and company discounts, we are going to go through everything from Philadelphia veterans to USAA availability.

Let’s begin.

– Veterans by Service Period

According to Data USA, the most common service period in Philadelphia is Vietnam, with 16,527 Vietnam veterans living in the city. Other common service periods are as follows:

- Gulf War (2001-): 6,722 veterans

- Gulf War (1990s): 5,506 veterans

- Korea: 4,319 veterans

- World War II: 1,749 veterans

Philadelphia has a significant number of World War II veterans still in the city. There is also a small number of Korea veterans and Gulf War veterans (both wars).

Military Bases Within an Hour

There is only one military base within an hour of Philadelphia, the McGuire-Dix-Lakehurst Base Guide. The base is just under an hour away from the heart of Philadelphia, and its “mission is to support the transportation of troops, passengers, equipment, cargo, mail; to provide aerial refueling.”

Depending on where you live in Philadelphia, the base could be within a commutable distance.

Military Discounts by Providers

The following providers offer military discounts. We’ve also included the percentage saved (when known).

- Allstate

- Farmers

- Geico: 15 percent

- Liberty Mutual: four percent

- Metlife: 15 percent

- Safe Auto: 25 percent

- Safeco

- StateFarm

- The General

- USAA (also offers military garaging discount)

At the majority of providers, you’ll have to ask what percentage you’ll save. Sometimes, it depends on the years/type of service.

USAA

You’ve probably heard of USAA before. It is a major provider of insurance for military members and boasts economical rates. Let’s see how USAA’s rates compare to other Pennsylvania companies.

| Company | Company's Average Annual Premium | Compared to State Average Premium (+/-) | Compared to State Average Premium (%) |

|---|---|---|---|

| Travelers | $7,842.47 | $3,807.98 | 94.39% |

| Liberty Mutual | $6,055.20 | $2,020.70 | 50.09% |

| Progressive | $4,451.00 | $416.51 | 10.32% |

| Allstate | $3,984.12 | -$50.38 | -1.25% |

| Nationwide | $2,800.37 | -$1,234.13 | -30.59% |

| State Farm | $2,744.23 | -$1,290.27 | -31.98% |

| Geico | $2,605.22 | -$1,429.28 | -35.43% |

| USAA | $1,793.37 | -$2,241.13 | -55.55% |

USAA has the cheapest rates, followed by Geico and State Farm. If you aren’t military, these two companies may be worth looking into.

Unique Philadelphia City Laws

Even if you’ve lived in Philadelphia for a while, cities are always coming out with new laws. It can be hard to keep track of them all and avoid a ticket. And if you are new to Philadelphia, your risk of getting a ticket is high unless you familiarize yourself with the local laws.

So keep reading to discover Philadelphia’s unique city laws, from cellphone laws to parking laws.

Hands-Free Laws

According to the Insurance Institute for Highway Safety (IIHS), the state of Pennsylvania doesn’t have a handheld ban for drivers. However, there is a ban on texting.

The state prohibits all drivers from texting while driving, and the enforcement of this is primary. So while you can hold your phone in your hand briefly to change a song, you can’t read or send large bodies of text.

If an officer sees you doing this, that officer will pull you over and ticket you. So put that phone down in Philadelphia and drive distraction-free.

Food Trucks

Thinking of selling Philly cheesesteaks out of a food truck? To operate a food truck in Philadelphia, you’ll need need to obtain multiple licenses from the city.

- Business License and Tax ID

- Commercial Activity License

- Food Preparing and Serving License

- Plan Review for Mobile Food Business

- Vendor License

In addition to the required licenses above, you may need some of the following licenses.

- Center City Vendor License

- Neighborhood Vending District License

- Pushcart Vendor License

- Sidewalk Sales License

If you aren’t sure what you need, contact the city and a representative can help guide you through the process and required licenses.

Tiny Home Laws

Ready to downsize your life? Philadelphia allows the use of tiny homes in the city. In fact, the city is hoping that introducing tiny homes will help create affordable housing in the city.

However, make sure you have the home properly inspected and registered so that you don’t face any fines or tickets.

Parking Laws

Wrong direction parking is illegal. The right passenger side of your vehicle must be facing the curb when you park on a street. If not, you’ll be pulling into oncoming traffic to get in and out of the spot.

So why do people do it? Often, it’s because they want to snag a street parking spot before someone else gets it. If you don’t want a ticket, though, don’t park in the wrong direction.

Want to make sure you’ll get a spot? Reserve a parking space in a parking garage.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Philadelphia Car Insurance FAQs

We’ve covered a lot of information in this guide, but you may still have questions. See what other people are asking about Philadelphia in our list of frequently asked questions below.

What happens if I get into a car accident in Philadelphia?

Pennsylvania is technically a no-fault state, which means that insurers cover their clients regardless of who caused the accident. However, Pennsylvania also allows drivers to skip out on the no-fault insurance option when they purchase car insurance.

Instead of a no-fault policy, drivers can buy an at-fault policy. Talk to your insurer to see what coverage option is right for you.

What is there to do in Philadelphia?

We’ve covered a number of sites and road trips to take around Philadelphia. With some creativity and searching, there should always be something to do, from annual festivals to local attractions.

What cities are near Philadelphia?

If you want to get out Philadelphia for a day, the following cities are near Philadelphia: Camden, New Jersey; Gloucester City, New Jersey; Yeadon, Pennsylvania; Collingswood, New Jersey; Darby, Pennsylvania.

As you can see, Philadelphia is close to New Jersey, which means you can quickly drive over to another state.

What airports are near Philadelphia?

The Philadelphia International Airport is right in the city, making it easy to fly out of the city for the holidays or business trips.

What school district is Philadelphia in?

The School District of Philadelphia covers all schools in the area. If you don’t have kids, this is where part of your taxes will go to support local children’s education.

You’ve now made it to the end of our guide. Did we answer all your questions? We hope you are now ready to live and drive in the city of Philadelphia and experience the Philadelphia freedom that Elton John sings about.

If you want to start comparing companies’ rates today, enter your zip code in our free rate tool below.

Frequently Asked Questions

What is the minimum car insurance requirement in Philadelphia, PA?

The minimum car insurance requirement in Philadelphia, PA is liability insurance with at least $15,000 per person and $30,000 per accident for bodily injury, and $5,000 per accident for property damage. However, it’s recommended to have higher liability limits and additional coverage, such as collision and comprehensive insurance, to protect yourself in case of accidents or theft.

What factors affect my car insurance rates in Philadelphia, PA?

Several factors affect your car insurance rates in Philadelphia, PA, including your age, gender, marital status, driving history, credit score, vehicle make and model, annual mileage, and coverage options. Additionally, some insurers may also consider factors such as your occupation, education level, and location.

How can I lower my car insurance rates in Philadelphia, PA?

You can lower your car insurance rates in Philadelphia, PA by maintaining a good driving record, improving your credit score, choosing a higher deductible, bundling your insurance policies, and taking advantage of discounts offered by insurers, such as safe driver, good student, and multi-car discounts.

What should I do if I’m involved in a car accident in Philadelphia, PA?

If you’re involved in a car accident in Philadelphia, PA, you should call the police and seek medical attention if necessary. You should also exchange contact and insurance information with the other driver(s), take photos of the accident scene and damage, and contact your insurance company to report the accident and file a claim. It’s important to cooperate with the authorities and your insurer and avoid admitting fault or making statements that could be used against you later.

What additional car insurance coverage should I consider in Philadelphia, PA?

In addition to the minimum liability insurance, you should consider additional coverage such as collision insurance to cover damages to your vehicle in case of an accident, and comprehensive insurance to cover damages from non-collision incidents such as theft, vandalism, or natural disasters. You may also want to consider uninsured/underinsured motorist coverage to protect you in case of an accident with a driver who doesn’t have enough insurance to cover your damages.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.