State Farm Car Insurance Review for 2025

On average, State Farm minimum coverage costs $33 per month while State Farm full coverage rates average $86 per month. In terms of customer satisfaction, State Farm insurance has a five J.D. Power circle rating. Although State Farm is available in most states, it doesn't actively sell new policies in Massachusetts and Rhode Island.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Dec 24, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Dec 24, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- State Farm’s A.M. Best rating is A

- State Farm monthly car insurance costs range from $33-$86

- State Farm’s types of insurance include: aircraft, auto, commercial auto, earthquake, flood, homeowners

State Farm is a major insurance giant that promises customers it will be there after accidents “like a good neighbor.” But you shouldn’t pick them as an insurer just because State Farm is one of the biggest companies and has a catchy jingle.

You need to make sure a company actually has good rates and excellent customer service, as well as good coverages. If the research to find out this information seems overwhelming, don’t worry.

We’ve done all the hard work researching State Farm in order to bring you an in-depth review of the company. Our comprehensive review and guide looks at everything from important ratings to the ease of filing a claim.

| State Farm Overview | Stats |

|---|---|

| Year Founded | 1922 |

| Current Executives | Michael L. Tipsord Chairman, President, and CEO |

| Numbers of Employees | Nearly 58,000 employees & 19,000 independent contractor agents |

| Total Revenue and Total Assets | Total Revenue $81.7 billion Total Assets $159.9 billion |

| Headquarters Address | State Farm Insurance One State Farm Plaza Bloomington, IL 61710 |

| Phone Number | 800-STATE-FARM (800-782-8332) |

| Company Website | www.statefarm.com |

| Premiums Written | 65,868,839 |

| Loss Ratio | 0.62 |

| Best For | Drivers with clean records |

So if you are thinking of purchasing a State Farm policy, wait until you’re done reading this review. Let’s get started.

If you want to start comparing rates at companies today, you can enter your zip code in our free online tool above.

State Farm Insurance Average Monthly Rates vs U.S. Average

| Coverage Type | State Farm | U.S. Average |

|---|---|---|

| Full Coverage | $86 | $119 |

| Minimum Coverage | $33 | $45 |

Factors Influencing State Farm Car Insurance Costs

In this section, we’ll explore the factors that influence the cost of State Farm auto insurance, allowing you to better understand what you might pay for coverage. Keep in mind that car insurance rates vary based on individual factors, and the figures provided are approximate estimates.

Several factors can influence the cost of your car insurance through State Farm:

- Location: Your geographic location plays a significant role in determining your car insurance rates. If you reside in an area with a high rate of accidents, theft, or severe weather, your premiums may be higher.

- Driving History: Your personal driving history is a critical factor in calculating your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums.

- Vehicle Type: The make and model of your vehicle affect your insurance costs. High-performance or luxury vehicles may have higher premiums due to their repair and replacement costs.

- Coverage Selection: The types and amounts of coverage you choose will directly impact your premiums. More extensive coverage, such as comprehensive and collision, will generally lead to higher costs.

- Deductible Amount: Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it means you’ll pay more if you need to make a claim.

- Discounts: State Farm offers various discounts that can help reduce your car insurance costs. These discounts may be based on factors like safe driving, bundling policies, or vehicle safety features.

- Age and Gender: Young and inexperienced drivers, as well as male drivers under 25, may face higher insurance rates due to a higher perceived risk of accidents.

- Credit Score: In some states, your credit score can influence your car insurance rates. A higher credit score may lead to lower premiums.

State Farm car insurance costs are influenced by numerous factors, and the final premium you pay will be unique to your circumstances. It’s essential to consider these factors when seeking a car insurance quote and to explore available discounts to potentially reduce your rates.

To get an accurate estimate of what State Farm car insurance will cost you, it’s advisable to request a personalized quote based on your specific details and coverage needs.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Rating Agency

When you purchase a new car, you probably spend hours researching various brands and models. Buying insurance should be no different. Reviews give us important insight into a product or company, but we understand you probably don’t want to spend hours combing through review sites.

So in this section, we’ve done the work already. We’ve collected reviews and ratings from major reviewers, ranging from financial reviews to customer satisfaction reviews.

Let’s get to work.

A.M. Best

When it comes to ratings of companies’ financial strength and creditworthiness, A.M. Best is a great independent reviewer to look at. It rates companies on a letter scale, from A++ to D.

A.M. Best gave State Farm an A++ rating.

This rating is excellent, as it is the highest possible rating A.M. Best gives to companies. As one of the largest insurers in the U.S., State Farm’s excellent financial management has clearly helped it grow.

https://youtu.be/P5nClTxqZ1w

Better Business Bureau

The Better Business Bureau (BBB) factors its ratings on multiple different categories, and most of the categories tend to relate to ethical business practices.

Below is a complete list of BBB’s rating factors.

- Complaint history with BBB

- Business type

- Time company has been in business

- Transparency of business practices

- Failure/success in honoring commitments with BBB

- Licensing and government actions

- Advertising issues

All of these categories together equal up to 100 points. So what did State Farm earn from the BBB?

In Wisconsin, State Farm has an A+ rating, meaning it earned over 97 points.

Wondering why we only included the rating for State Farm in Wisconsin? BBB rates companies within a state or local level. This means that there isn’t an overall score for State Farm in the U.S.

However, State Farm has good ratings from the BBB in the majority of states. If you want to look up State Farm’s rating in your state, you can visit the BBB website and use its search tool.

Moody’s Rating

Moody’s is another financial strength rater. Its ratings are on a scale from Aaa to C.

Moody’s gave State Farm an Aa1 ratings, which means State Farm has very low credit risk.

Like A.M. Best, Moody’s believes State Farm to be in good financial standing.

Standard & Poor Rating

Standard & Poor (S&P) also looks at financial strength by evaluating credit ratings. The ratings are on a letter scale, with AAA being the highest possible rating.

S&P gave State Farm an AA rating, which is the second-highest score.

An AA rating is great, as it tells us State Farm is financially strong and is able to meet financial commitments, such as paying claims.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) has collected years worth of data on customer complaints. To determine a company’s complaint index, the NAIC compares the number of total complaints to the number of total customers.

Before we get into State Farm’s complaint indexes, we want to point out that how a company deals with complaints is also important, which is why we will be looking at customer satisfaction ratings next.

First, though, let’s see how many customers are complaining about State Farm.

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 9,206 | 1,481 | 1,402 |

| Complaint Index (better or worse than National Index) | 2.16 (worse) | 0.52 (better) | 0.57 (better) |

| National Complaint Index | 0.78 | 1.2 | 1.16 |

The number of total complaints at State Farm has increased over the years. However, State Farm’s complaint index in 2017 and 2018 was lower than the national average, which is good.

So even though State Farm’s complaints went up, its total number of customers must have also increased. This means that the 1,400 complaints in 2018 were only a small percentage of customers, meaning the majority of customers are happy with State Farm.

JD Power

Now that we’ve looked at financial ratings and complaints in-depth, let’s see how happy customers are with State Farm’s services. In 2019, JD Power surveyed over 42,000 customers to gauge customer satisfaction at major insurance companies.

The companies are then rated on a 1,000 point scale and assigned a JD Power circle rating.

- Five JD Power Circles: company is “among the best”

- Four JD Power Circles: company is “better than most”

- Three JD Power Circles: company is “about average”

- Two JD Power Circles: company is “the rest”

Let’s take a look at State Farm’s ratings.

| U.S. Region | Customer Satisfaction (out of 1,000) | J.D. Power Circle Ranking |

|---|---|---|

| California | 824 | Better than most |

| Central | 828 | About average |

| Florida | 834 | About average |

| Mid-Atlantic | 834 | About average |

| New England | 844 | Better than most |

| New York | 845 | Better than most |

| North Central | 841 | Better than most |

| Northwest | 820 | About average |

| Southeast | 853 | Better than most |

| Southwest | 831 | Among the best |

| Texas | 835 | About average |

State Farm has decent ratings. It has “better than most” and “about average” ratings in the majority of regions. However, State Farm only earned one “among the best” rating in the Southwest region of the U.S.

So while none of State Farm’s ratings are bad, they could be better.

Consumer Reports

Another customer satisfaction rater, Consumer Reports grades on a 100 point scale.

State Farm has a total score of 89 from Consumer Reports.

Consumer Reports based this score off of the following category ratings for State Farm.

| Claims Handling | Score/Rating |

|---|---|

| Reader Score | 89 out of 100 |

| Ease of reaching an agent | Excellent |

| Simplicity of the process | Very good |

| Promptness of response - very good | Very good |

| Damage amount | Very good |

| Agent courtesy | Excellent |

| Timely payment | Very good |

| Freedom to select repair shop | Very good |

| Being kept informed of claim status | Excellent |

Excellent is the highest possible rating, while very good is the second-highest. State Farm earned one of these ratings in every category, which is great.

Consumer Affairs

The final customer satisfaction rating site we want to look at is Consumer Affairs.

On Consumer Affairs, State Farm has four out five stars (based on over 2,600 reviews in 2019).

Since Consumer Affairs tends to be a platform where people go to submit poor reviews and complaints, State Farm’s rating is excellent. All in all, State Farm seems to have fantastic financial strength and decent customer satisfaction levels.

State Farm Market Share

State Farm has dominated the marketplace for decades. However, it can be hard to compete with other growing insurance providers, and major insurers may start to backslide.

So let’s see how State Farm has maintained its market shares. Below is the NAIC’s data on State Farms’ share in the market over a four-year period.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm Market Share | 18.68% | 18.26% | 18.07% | 17.01% |

State Farm’s market share has decreased almost two percent since 2015. This is a significant dip. However, State Farm still has one of the largest market shares in the insurance market.

As long as it works on staying competitive and attracting customers, it should retain its current market share.

State Farm’s Position for the Future

State Farm is positioned well for the future. While its market share has dropped, it still remains one of the largest shares in the insurance market.

The company also has great ratings from financial rating sites, meaning it is more than capable of handling claims without going bankrupt. State Farm also has decent ratings form customer satisfaction sites, showing the majority of customers are happy with State Farm.

This will make it easier for State Farm to continue to attract customers and help regrow its market share.

Overall, State Farm has a good future ahead of it. If it keeps working on its finances and customer satisfaction, it should continue to grow and dominate the insurance market.

State Farm’s Online Presence

Companies need to have a strong online presence in order to provide information and help current customers.

State Farm has three main ways to get information and help with a State Farm policy.

- Go online to State Farm’s website

- Call/visit a local agent in your area

- Call State Farm (there are multiple phone numbers for everything from filing a claim to general comments)

Calling or visiting a local agent is a great way to get detailed information about State Farm’s rates and coverages. You can also look online at State Farm’s website to find coverage information and submit questions (if you have an account).

State Farm’s Commercials

Jingles can be annoying, especially when you find yourself humming a children’s cereal jingle in the car. However, these jingles or catchphrases are an important part of a company’s marketing technique.

If you can finish phrases after seeing a logo, then you understand that companies’ advertising is how they make themselves stand out from the pack.

So let’s take a look at one of State Farm’s commercials to see how strong its advertising is.

If “like a good neighbor, State Farm is there” runs through your head when you think of State Farm’s commercials, then State Farm has done a good job of sticking in viewers’ minds.

In addition to advertising how it can help after an accident or mishap, State Farm also frequently advertises its discounts.

https://youtu.be/yMsmubcvY_k

State Farm generally picks themes and runs a series of commercials on them, such as the “don’t mess with my discount” commercials.

This is effective, as its the same message but remodeled in new, humorous ways. So all in all, State Farm has a great advertising team on staff to make sure State Farm comes to mind when thinking of insurers.

State Farm in the Community

Today, consumers have become more conscientious of products, such as buying responsibly sourced products. So if consumers are presented with two profiles of a company, one who works to improve a community and one who doesn’t, they will probably tend to pick the community-involved company.

State Farm is a large corporation and has the resources to help the community. So what State Farm do for volunteer work and donations?

- Good Neighbor Citizenship® grants

- State Farm Companies Foundation

- Science Technology Engineering and Math (STEM) Initiative

- Auto and Home Safety Programs

- Community Reinvestment Act

- National Community Relationships

- Neighborhood of Good®

This is an impressive list. It shows that State Farm has taken its jingle to heart and actively works to be a good neighbor in the community.

State Farm’s Employees

Employees are a great source of information on how a company operates. If employees aren’t happy, then a company is doing something wrong.

Payscale, a review site, is a great indicator of employee satisfaction. Currently, State Farm has 3.3 stars out of five on Payscale.

The category scores that resulted in this average of 3.3. stars are below.

| Category | Rating (out of 5) |

|---|---|

| Appreciation | 3.2 |

| Company Outlook | 3.5 |

| Fair Pay | 2.7 |

| Learning and Development | 3.6 |

| Manager Communication | 3.8 |

| Manager Relationship | 4.0 |

| Pay Policy | 2.6 |

| Pay Transparency | 2.8 |

State Farm has good ratings for manager relationship and manager communication. However, ratings were poor for fair pay, pay policy, and pay transparency.

Based on this, employees clearly have issues with State Farm’s salaries. Although State Farm does have good ratings for manager relationships/communication, so the work environment itself seems to be decent.

To round out our information on State Farm’s work environment, we want to look at reviews on Glassdoor.

State Farm has an average of 3.1 stars out of five, a rating that Glassdoor calculated from over 8,000 employee reviews.

Three out five stars is just an average rating, so let’s see what employees have to say.

- Positive Comments: State Farm has great work benefits and a great work/life balance.

- Negative Comments: State Farm doesn’t have medical/dental benefits and the pay is not great.

These comments popped up multiple times on reviews, so once again, State Farm employees have issues with the company’s compensation.

However, State Farm did win the following awards from Glassdoor, showing its workplace environment isn’t as bad as the pay.

- Glassdoor’s Best Places to Work Award: 2011 (#38)

- Glassdoor’s Top CEOs Award: 2014 (#34) and 2013 (#37)

State Farm hasn’t won another Best Places to Work award since 2011, but the award is a good indicator that State Farm’s work environment is good.

If State Farm increases its benefits and pay, it will probably earn higher ratings on employee websites.

State Farm’s Awards and Accolades

Being around for almost a century means a long list of awards. You probably aren’t interested in awards won a decade ago, though, so we’ve only listed out State Farm’s last 10 awards in three different categories: employer recognition, community involvement, and environmental awards.

| Last 10 Employer Recognition Awards | Last 10 Community Recognition Awards | Last 10 Environmental Recognition Awards |

|---|---|---|

| 2019 Top 100 Most Military Friendly® Employer | 2017 Corporate Social Responsibility Leadership Award | 2012 Charlottesville, Virginia, Operations Center won award for energy efficiency |

| 2019 Most Admired Company | 2016 Corporate Social Responsibility Leadership Award | 2009 41st in the U.S. Environmental Protection Agency's ranking |

| 2019 National Recognition for Equality | 2014-2015 Junior Achievement Volunteer Service Award | 2009 Illinois Recycling Association's Excellence in Recycling Award |

| 2019 Top Companies for Executive Women | 2015 Corporate Social Responsibility Leadership Award | 2009 Outstanding Corporate Recycling Program |

| 2018 AnitaB.org Top Company for Women Technologists | 2013-2014 Junior Achievement Volunteer Service Award | 2008 California Integrated Waste Management Board's Waste Reduction Award |

| 2018 LATINA Style's 50 Best Companies for Latinas to Work | 2011 Corporate Social Responsibility Index | 2009 & 2008 Environmental Stewardship Award from the City of Greeley |

| 2018 Best Companies for Multicultural Women | 2010 Top 100 Employers | 2008 Best Practices Award from the Business Environmental Alliance of Sonoma County, California |

| 2018 Best Companies for Diversity | 2010 Top Diversity Business Advocate in U.S. Asian Markets | 2010 Top 50 greenest employers in Canada's Greenest Employers competition |

| 2018 Hispanic Association on Corporate Responsibility (HACR) - Corporate Inclusion Index (CII) | 2010 Hispanic Federation | 2009 Uptime Institute's 2009 Global Green 100 for Corporate Leadership in IT Energy Efficiency |

| 2017 CEO Cancer Gold Standard Accreditation™ | 2009 50 Best Companies for Latinas to Work | 2008 Automotive Fleet Magazine's third largest non-governmental eco-friendly fleet in the United States |

State Farm has an impressive list of awards. Its awards go beyond just the workplace environment and CEOs. The company also has awards for its efforts in the community and environmental efforts.

Cheap Car Insurance Rates

Car insurance is expensive, which is why states have to make it the law to have car insurance. Otherwise, many people would be opting out of coverage.

Car insurance doesn’t have to ruin a budget, though. Finding an insurer with economical rates is the first step to reducing costs.

While State Farm is a well-known, large corporation, this doesn’t mean its rates are affordable. That’s why we are going to go in-depth into State Farm’s rates with information from Quadrant.

Keep reading to learn about State Farm’s basic rates, as well as what can make prices go up and down.

State Farm Availability and Rates by State

As we’d expect of a large insurer, State Farm is available in all 50 U.S. states.

This does not mean rates will stay the same. Rates change by location, so moving to a new state may result in your costs going up.

So even though you can keep State Farm as a provider when moving to a new state, this doesn’t necessarily mean you should. Let’s take a look at State Farm’s rates by state.

| State | State Farm Annual Premium | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Alaska | $2,228.12 | -$1,193.39 | -34.88% |

| Alabama | $4,798.15 | $1,231.19 | 34.52% |

| Arkansas | $2,789.03 | -$1,335.95 | -32.39% |

| Arizona | $4,756.25 | $985.28 | 26.13% |

| California | $4,202.28 | $513.35 | 13.92% |

| Colorado | $3,270.77 | -$605.63 | -15.62% |

| Connecticut | $2,976.24 | -$1,642.68 | -35.56% |

| District of Columbia | $4,074.05 | -$365.20 | -8.23% |

| Delaware | $4,466.85 | -$1,519.48 | -25.38% |

| Florida | $3,397.67 | -$1,282.79 | -27.41% |

| Georgia | $3,384.88 | -$1,581.95 | -31.85% |

| Hawaii | $1,040.28 | -$1,515.36 | -59.29% |

| Iowa | $2,224.51 | -$756.77 | -25.38% |

| Idaho | $1,867.96 | -$1,111.13 | -37.30% |

| Illinois | $2,344.88 | -$960.60 | -29.06% |

| Indiana | $2,408.94 | -$1,006.03 | -29.46% |

| Kansas | $2,720.00 | -$559.62 | -17.06% |

| Kentucky | $3,354.32 | -$1,841.09 | -35.44% |

| Louisiana | $4,579.12 | -$1,132.22 | -19.82% |

| Maine | $2,198.68 | -$754.60 | -25.55% |

| Maryland | $3,960.87 | -$621.83 | -13.57% |

| Massachusetts | $1,361.86 | -$1,316.99 | -49.16% |

| Michigan | $12,565.52 | $2,066.88 | 19.69% |

| Minnesota | $2,066.99 | -$2,336.27 | -53.06% |

| Missouri | $2,692.91 | -$636.03 | -19.11% |

| Mississippi | $2,980.48 | -$684.09 | -18.67% |

| Montana | $2,417.74 | -$803.11 | -24.93% |

| North Carolina | $3,078.65 | -$314.46 | -9.27% |

| North Dakota | $2,560.53 | -$1,605.32 | -38.54% |

| Nebraska | $2,438.71 | -$844.97 | -25.73% |

| New Hampshire | $2,185.46 | -$966.32 | -30.66% |

| New Jersey | $7,527.16 | $2,011.94 | 36.48% |

| New Mexico | $2,340.66 | -$1,122.98 | -32.42% |

| Nevada | $5,796.34 | $934.64 | 19.22% |

| New York | $4,484.58 | $194.70 | 4.54% |

| Ohio | $2,507.88 | -$201.84 | -7.45% |

| Oklahoma | $2,816.80 | -$1,325.53 | -32.00% |

| Oregon | $2,731.48 | -$736.29 | -21.23% |

| Pennsylvania | $2,744.23 | -$1,290.27 | -31.98% |

| Rhode Island | $2,406.51 | -$2,596.85 | -51.90% |

| South Carolina | $3,071.34 | -$709.80 | -18.77% |

| South Dakota | $2,306.23 | -$1,676.05 | -42.09% |

| Tennessee | $2,639.30 | -$1,021.59 | -27.91% |

| Texas | $2,879.94 | -$1,163.34 | -28.77% |

| Utah | $4,645.83 | $1,033.94 | 28.63% |

| Virginia | $2,268.95 | -$88.92 | -3.77% |

| Vermont | $4,382.84 | $1,148.71 | 35.52% |

| Washington | $2,499.78 | -$559.55 | -18.29% |

| West Virginia | $2,126.32 | -$469.04 | -18.07% |

| Wisconsin | $2,387.53 | -$1,218.53 | -33.79% |

| Wyoming | $2,303.55 | -$896.53 | -28.02% |

| Median | $2,731.48 | -$929.41 | -25.39% |

The good news is that State Farm’s prices are lower than average in most states. The bad news is that this isn’t always the case.

For instance, in states like New Jersey, State Farm is well over the state average. So always check State Farm’s rates when you move, as you may be moving to one of the few states where State Farm raises premiums over the average.

Of course, you should still compare State Farm’s rates to other providers. Even if State Farm’s rates go up, its rates could still be cheaper than other companies’ rates.

Comparing the Top 10 Companies by Average Premiums

As we just mentioned, looking at other companies’ rates is important. Below are State Farm’s rates compared to other providers’ rates.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

Generally, State Farm is one of the cheapest companies.

There are few exceptions, such as in New Jersey, where State Farm is one of the most expensive providers.

Usually, though, State Farm is on the cheaper side, competing with companies like USAA and Geico for the cheapest rates. This is great, as it means State Farm’s rates should be economical in the majority of states.

Average State Farm Male vs Female Car Insurance Rates

Did you know that when you select male or female on a car insurance application this factors into your rates? State Farm changes rates based on drivers’ gender.

This is normal among insurers, except for in states where insurers can’t use gender to change rates.

California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan all have laws outlawing insurers from basing rates on customers’ gender.

So why do insurers charge based on gender? Well, it’s similar to how insurers base rates on drivers’ ages. Insurers use accident data collected over the years to determine which demographics are the riskiest to insure.

The result is that gender is just as much a rate factor as age. Let’s take a look at which demographic groups pay the most at State Farm.

| Marital Status, Gender, and Age | State Farm Average Premium |

|---|---|

| Married 60-year old female | $1,873.89 |

| Married 60-year old male | $1,873.89 |

| Married 35-year old female | $2,081.72 |

| Married 35-year old male | $2,081.72 |

| Single 25-year old female | $2,335.96 |

| Single 25-year old male | $2,554.56 |

| Single 17-year old female | $5,953.88 |

| Single 17-year old male | $7,324.34 |

The prices for 60-year-old drivers and 35-year-old drivers don’t change based on gender. However, State Farm does charge males more in the other age categories.

This is common, as most insurers tend to charge male drivers more.

Average State Farm Rates by Make and Model Last 5 Year Average

Parents usually give teens the safest possible car, which means you’ll see more teens driving the family minivan than the summer sports car.

Insurers also care about car safety.

The Insurance Information Institute (III) says that insurers use car crash safety ratings and expense of future repairs to determine rates. So if your car tests poorly in crash research or needs specially made parts, your insurance rates will be higher.

Curious which cars cost the most at State Farm? Below is a list of State Farm’s rates by make and model.

| Make and Model | State Farm |

|---|---|

| 2018 Ford F-150 | $3,497.17 |

| 2018 Toyota RAV4: XLE | $3,418.33 |

| 2015 Toyota RAV4 XLE | $3,226.02 |

| 2015 Ford F-150 | $3,204.23 |

| 2018 Honda Civic Sedan | $3,189.99 |

| 2015 Honda Civic Sedan | $3,024.24 |

| Average | $3,260.00 |

A 2018 Ford F-150 costs the most on the list, but it is only $200 more to insure than the cheapest car. This is a low rate increase, which is good.

Of course, State Farm will charge more if you come home with a sports car, but the rates above should give you an idea of State Farm’s price increases.

Average State Farm Commute Rates

A longer commute involves more than just budgeting for gas money. State Farm will also increase rates if drivers travel more than 12,000 miles a year.

| Commute | Average Premium |

|---|---|

| 10 miles/ 6,000 annual mileage | $3,175.98 |

| 25 miles/ 12,000 annual mileage | $3,344.01 |

State Farm charges drivers with a longer commute an average of $169. This is a little on the higher end, as the average amount for a longer commute is around $100.

Of course, State Farm’s rate could still be lower than companies who only charge $100.

Average State Farm Coverage Level Rates

We want to see if State Farm’s upgrade options for coverage are reasonable. If they aren’t, it means most drivers will be stuck with subpar low or medium car insurance.

| Coverage Type | State Farm Average Premium |

|---|---|

| High | $3,454.80 |

| Medium | $3,269.80 |

| Low | $3,055.40 |

State Farm’s average rate increase from low to high coverage is fantastic. It will cost drivers with low coverage about $400 to upgrade to high coverage.

This means drivers will pay just over $30 dollars a month for high coverage.

Once again, this is great, as most insurers charge about $1,000 to upgrade from low to high coverage. Make sure to take advantage of these low rates, as high coverage protects you the best in an accident.

Average State Farm Credit History Rates

When you sign up for a policy, insurers look at your credit history and change rates accordingly.

The U.S. average credit score is 675, which is a good credit score.

If your credit score is lower than the U.S. average, you may be placed in the poor or fair credit categories. This isn’t good, as it will raise your rates at State Farm significantly.

| Credit History | State Farm Average Premium |

|---|---|

| Poor | $4,951.20 |

| Fair | $2,853.00 |

| Good | $2,174.26 |

State Farm does have a high rate increase. If drivers’ credit drops from good to poor, State Farm charges an average of $2,777 more.

This is on the higher end, as most insurers’ rates for a drop in good credit are around $1,000.

Remember, though, to look at the final rate after increases, rather than just the increase amount. State Farm may still be cheaper than other companies for bad credit.

If it’s not, it may be worth looking into companies. Lowering insurance costs can help drivers work on improving their credit.

Average State Farm Driving Record Rates

All insurers penalize drivers for poor driving records. Below, you can see how much State Farm charges for DUIs, accidents, and speeding tickets.

| Driving Record | State Farm Average Premium |

|---|---|

| Clean Record | $2,821.18 |

| With One Speeding Violation | $3,186.01 |

| With One Accident | $3,396.01 |

| With One DUI | $3,636.80 |

State Farm’s rate increases for driving record offenses aren’t bad. Even a DUI at State Farm cost drivers under $1,000.

However, we want to point out that these rates are for first offenses. Drivers with more than one offense will have higher costs. In some cases, drivers may even have to purchase high-risk insurance.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Coverages Offered

Now that you know what rates you’ll be paying, you probably want to know what you’re paying for. Sometimes, a company will skimp out on coverages in order to offer lower prices.

We want to make sure this isn’t the case with State Farm, as it does have lower than the average rates. While State Farm will have the basic coverages that the law requires, we want to see what add-on coverages and perks it offers.

So let’s jump right into State Farm’s coverages, in order to see if the rates you pay earn you a decent amount of coverage.

Types of Coverages Offered

The first thing we want to look at is State Farm’s basic coverages.

- Classic Car Insurance Coverage — Classic car insurance insures vintage cars at a fraction of the price of a regular car.

- Collision Coverage — Covers accidents with another vehicle.

- Comprehensive Coverage — This coverage is great for a wide range of mishaps that aren’t covered by collision coverage. Comprehensive coverage protects in cases of animal collisions, damage from natural disasters or vandalism, and theft.

- Liability Coverage — States’ laws require all drivers to have liability coverage. It protects drivers if they cause an accident that injures another person or damages property.

- Uninsured Motorist Coverage — Protects you if you are in an accident with an uninsured driver who can’t pay your medical/property damage bills (if they caused the accident).

- Underinsured Motorist Coverage — Like uninsured coverage, underinsured coverage protects you if the driver who caused the accident can’t cover your medical/property damage bills.

- Medical Payments Coverage — This coverage assists with your medical bills after an accident.

- Rideshare Driver Coverage — Rideshare insurance is in addition to your personal insurance and covers you when you are driving customers for companies like Uber.

- Umbrella Coverage — This is extra liability coverage, which is useful in case you are sued after an accident.

State Farm offers a decent array of coverages. However, it is lacking a few basics like Personal Injury Protection (PIP). PIP is similar to Medical Payments, but it also covers lost wages after an accident if the driver is recuperating from an injury.

Factors That Affect Rates

There are a number of ways you can bring down your rates. Some of them we’ve already covered in our rate section, such as keeping a clean driving record and having good credit.

At State Farm, you can also bundle your auto insurance policy with another policy at State Farm to earn a discount. State Farm has the following types of insurance for bundling.

- Disability

- Health

- Home and Property

- Identity Restoration

- Liability

- Life

- Small Busines

If you would like to have all your insurance policies at one provider, then bundling is a great way to save a little money.

Getting the Best Rate with State Farm

One of the best ways to reduce rates is to take advantage of discounts. Below, we’ve listed out the discounts State Farm offers, as well as the percentage saved (when known).

| Discount | Amount |

|---|---|

| Anti-lock Brakes | 5% |

| Anti-Theft | 15% |

| Claim Free | 15% |

| Defensive Driver | 5% |

| Distant Student | speak with your agent to learn more |

| Driver's Ed | 15% |

| Driving Device/App | 50% |

| Good Credit | speak with your agent to learn more |

| Good Student | 25% |

| Homeowner | 3% |

| Low Mileage | 30% |

| Married | speak with your agent to learn more |

| Military | speak with your agent to learn more |

| Multiple Policies | 17% |

| Multiple Vehicles | 20% |

| Newer Vehicle | 40% |

| Paperless/Auto Billing | $2 |

| Passive Restraint | 40% |

| Safe Driver | 15% |

| Vehicle Recovery | 5% |

| Total Discounts | 20 |

State Farm doesn’t offer many discounts. Other competitors do offer more, as the highest number of discounts offered is 38. So State Farm is on the lower end with its amount of offered discounts.

However, State Farm’s rates are lower than average. If State Farm offered a high number of discounts, its rates would become too low to sustain.

State Farm’s Programs

Now that we’ve gone over coverages and discounts, let’s see what useful programs State Farm offers.

- Accident Forgiveness — You have to be accident-free for three years at State Farm to qualify for accident-forgiveness. It is a great program to qualify for, though, as your rates won’t increase after your first at-fault accident.

- Car Rental and Travel Expense — If your car is in the shop after a claimable accident, State Farm will pay for a rental car. If the accident occurs more than 50 miles from your home, State will also cover expenses for lodging, meals, and alternate transportation.

- Emergency Road Coverage — This coverage is useful for a variety of common troubles. State Farm will assist you if you lock yourself out of the car, run out of gas, have a dead battery, or need towed.

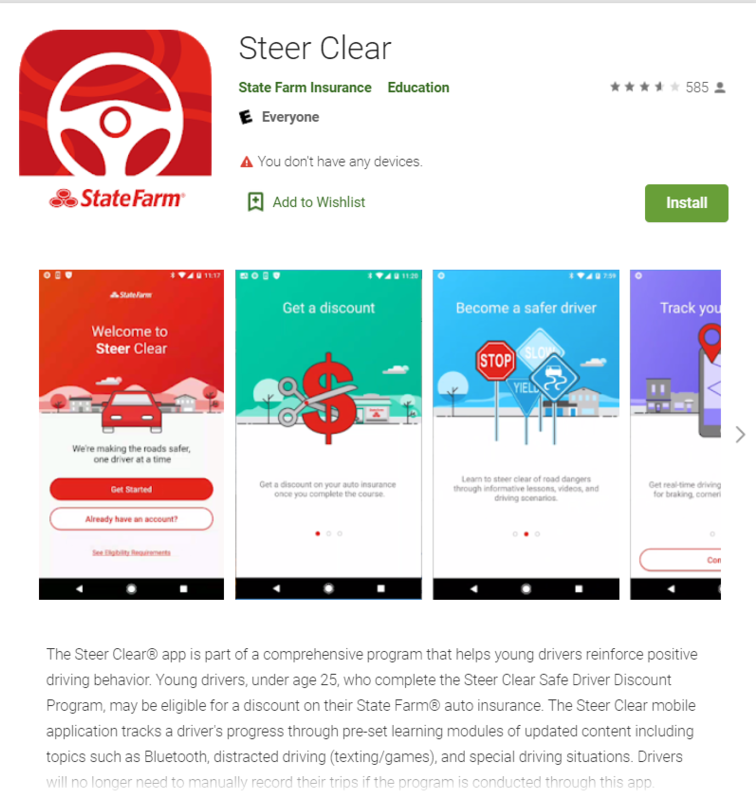

- Usage-Based App — State Farm’s Drive Safe & Save™ app offers discounts if drivers have consistent save driving habits. State Farm also has a Steer Clear® app that rewards young drivers for learning safe driving habits.

This is a great array of programs, and they are all designed to provide useful assistance or save customers money.

What Stands Out and What’s Missing

We’ve covered a lot already, so let’s take a moment to consider State Farm’s benefits and disadvantages.

- What’s Missing — State Farm doesn’t have a high number of discounts and lacks PIP coverage.

- What Stands Out — State Farm does have a good selection of coverages and low rates in the majority of states. It also has some great programs that can save money.

For the price, State Farm offers decent coverages. Its programs can also be combined with discounts to lower prices even more.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Canceling Your Policy

Eventually, there comes a time when you need to quit your provider — whether its because you are switching providers or are no longer driving.

Canceling isn’t always as straightforward as it seems, though, The process can become complicated and frustrating if you aren’t prepared beforehand.

So keep reading to learn about the process and what you need to cancel a State Farm policy.

– Cancellation Fee

State Farm doesn’t have information on cancellation fees, but generally, insurers don’t charge fees unless you cancel before the end of a renewal cycle.

If you cancel in the middle of a renewal cycle, an insurer may charge a small fee. If this is a concern, call and talk to your State Farm agent to ask about renewal cycles and fees.

Is There a Refund?

There should always be a refund if you cancel before the end of a renewal cycle.

This means that if you prepay for a year of coverage but cancel your policy in the eighth month, State Farm needs to refund you for the remaining four months.

How to Cancel

This is an important topic to cover. If you don’t cancel correctly, you could be stuck with a provider or face a lapse in coverage. So stick with us as we go through how to cancel step-by-step.

Sign Up With a New Provider Before Canceling

This is an incredibly important first step. You need to have a new insurer before you cancel at State Farm.

In fact, State Farm will ask for your new insurer’s name and policy number when you cancel. Likewise, your new insurer will ask for your old policy number and cancellation date.

This is because insurers want to make sure you don’t have a lapse in coverage. Not having insurance is illegal, so even a small gap period between insurance providers will result in increased rates.

So make sure to line up your dates correctly, so that your new insurance covers you before your old insurance ends.

However, if you are canceling your State Farm policy because you no longer need insurance, you will need to provide proof of that when canceling.

For example, if you are canceling because you sold your car and are no longer driving, then you need a bill of sale.

Regardless of your reason for cancellation, make sure to have the necessary information or documentation ready beforehand to make the process go as smoothly as possible.

Canceling by Phone

There are multiple ways to cancel a State Farm policy, but the first one we want to cover is canceling by phone. It is one of the easiest methods, as you don’t need to make an in-person visit.

However, State Farm doesn’t have a cancellation hotline. This means that you will need to call a local State Farm agent to cancel your policy.

When you call, you will need the following information.

- Name, address, and phone number

- Social Security Number (SSN)

- State Farm Policy Number

- Name and Policy Number of New Insurer (or Bill of Sale)

You will need this information for all methods of cancelation, not just calling.

Canceling by Mail

This is the slowest method of cancelation, so make sure to send in your cancellation letter well before the date you want to end your policy.

When addressing your letter, send it to the following corporate address:

Corporate Headquarters

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

You will need to date and sign your letter, and it needs to contain all of the information we covered in canceling by phone.

- Name, address, and phone number

- Social Security Number (SSN)

- State Farm Policy Number

- Name and Policy Number of New Insurer (or Bill of Sale)

Remember, this method takes the longest. If you want to cancel quickly, call State Farm or visit an agent in-person.

Canceling In-Person With an Agent

If there is a State Farm agent nearby, you may want to make an in-person visit to cancel. You will need to bring all the pertinent information that you’d use to cancel by phone or mail.

When Can I Cancel?

At State Farm, you can cancel your policy at any time. Remember, though, that you may have to pay a small fee if you cancel before the end of a renewal cycle.

Once you cancel, the cancellation will into effect immediately. If you list a later date for the desired cancellation, the cancellation will go into effect on that date.

If you want to double-check that State Farm correctly canceled your policy, you can call again to check. You can also check your online State Farm account to make sure the policy ended and you aren’t being billed.

Customer Reviews for State Farm Car Insurance

State Farm car insurance has garnered a strong reputation among its policyholders, with many customers expressing satisfaction with the company’s services. The insurer’s focus on personalized and attentive customer service through its network of local agents receives high praise.

State Farm’s efficient claims process and timely resolution of claims are frequently highlighted as significant advantages by its customers. Additionally, the company’s user-friendly mobile apps have been appreciated for their convenience and ease of use. State Farm’s commitment to offering discounts, especially to safe drivers and students, is another aspect that customers find appealing.

While customer reviews often point to the company’s competitive rates and coverage options, it’s important to remember that individual experiences may vary, and the best way to determine if State Farm is the right fit for your car insurance needs is to request a personalized quote based on your unique circumstances.

State Farm Company History

State Farm has been around for almost a century. Founded in 1922, the company sold its first auto insurance policy for a mere $11.17.

While we wish auto insurance still cost only $11 a year, State Farm managed to grow as a company despite rising auto insurance rates.

In the last century, State Farm has solidified its position as an insurance giant in the U.S. Today, it offers much more than just auto insurance.

State Farm now has insurance, banking, and investment services, making it a one-stop provider for customers’ policy needs.

While State Farm has a great past track record, we want to look into State Farm’s future. To do this, we are going to cover State Farm’s market shares, employee satisfaction ratings, and more.

So stick with us to see if State Farm will be around for another century.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Make a Claim

Unfortunately, the majority of drivers will have to make a claim at some point. Accidents are stressful, but knowing what to do before making a claim can make the claim process go smoothly.

So keep reading to learn how to make a claim at State Farm, as well as State Farm’s claim record.

Ease of Making a Claim

State Farm, like most providers, has multiple ways to file a claim.

- Online — After an accident, you can file a claim online at State Farm’s website.

- Mobile App — If you have State Farm’s mobile app on your smartphone, you can file through the app.

- Phone — You can call 800-SF-CLAIM (800-732-5246) to file a claim.

- In-Person — If you have an agent near you, another option is to visit in-person to file a claim.

Except for visiting an agent, all of the claim methods are available 24/7. This means that if you get into an accident at 3 a.m., you can immediately take a picture of the damages and submit a claim.

When you submit a claim, make sure you collect the following information.

- Date, time, and location of the incident

- Names of involved parties

- Vehicles involved

- Description of damages and injuries

- Description of accident

If you have a smartphone or camera on you, take pictures of the damages on the vehicle. This way, State Farm can immediately begin accessing the damages and your claim.

Premiums Written

Premiums written may seem like an odd thing to include in our claims section, but it is related to claims.

Basically, the more premiums that are written, the less strain claims place on a company. If a company has a small amount of written premiums (meaning it only has a few customers), multiple claims may force a company to raise its premiums to pay claims.

So the more written premiums there are, the easier it is for a company to lower its rates. Below is the NAIC’s data on premiums written at State Farm.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm Written Premiums | $35,588,209,000 | $39,194,660,000 | $41,817,416,000 | $41,963,578,000 |

State Farm had a large increase in its written premiums from the period of 2015 to 2017. This is great, as State Farm is increasing its customer base, which means it can continue to keep rates low.

Loss Ratio

Building upon the concept of written premiums and rates is loss ratio. A loss ratio is the comparison of written premiums to claims paid.

So if a company has a loss ratio of 70 percent, it is spending $70 on claims for every $100 earned in premiums.

As a result, companies with high loss ratios over 100 percent are risking bankruptcy. On the other hand, companies with loss ratios are clearly not paying out claims to customers.

So let’s take a look at the NAIC’s data on State Farm’s loss ratios.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm Loss Ratios | 66.1% | 77.02% | 68.79% | 63% |

State Farm’s loss ratio rose to over 70 percent in 2016, before dropping back to 63 percent in 2018. These rise and falls aren’t too noteworthy, as there could have been more accidents and claims one year.

As well, the rise and fall in State Farm’s loss ratio didn’t become dangerously high or low but stayed at a good level. Overall, State Farm’s loss ratios look good.

How to Get a Quote Online

If you found yourself scratching numbers on a piece of paper earlier to try to calculate your rate at State Farm, we have an easier way to find out what you’ll be paying.

State Farm offers free quotes, so you can get an estimate of your future premium. It’s also a great way to compare prices of competitors to make sure you’re getting the best deal possible.

Let’s get started.

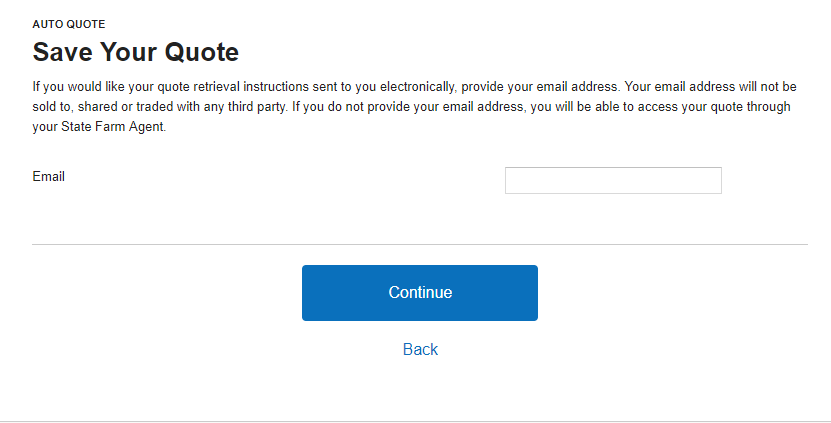

Step One: Visit State Farm’s Website

The first step is to go to State Farm’s website. On the home page, you will immediately see State Farm’s advertisement to get a free quote.

You may have noticed that there is also an option to call 1-800-STATEFARM to get a quote. If you want to get your quote online, though, click auto and you will be taken to the next step.

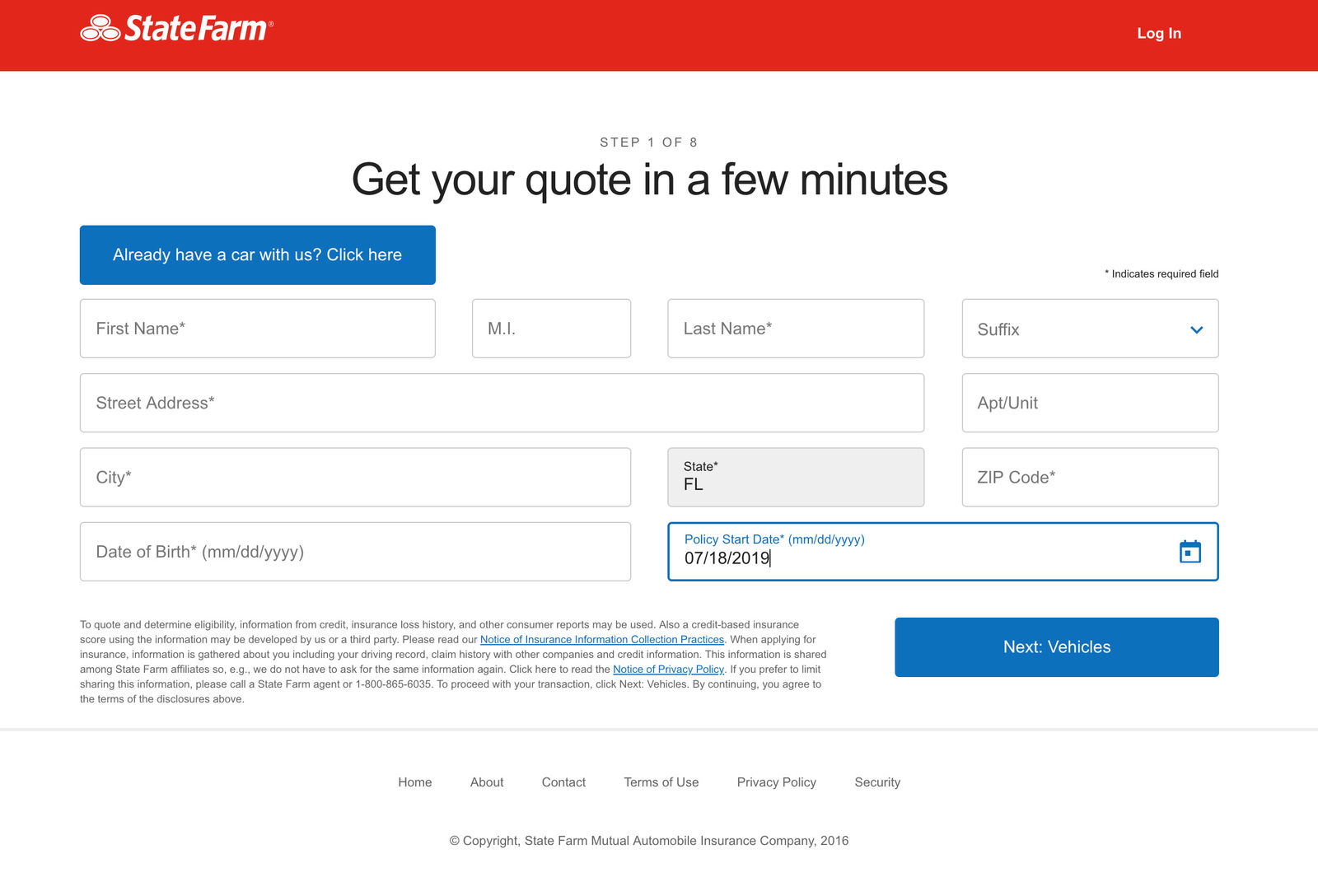

Step Two: Fill Out Personal Information

State Farm’s quote form will ask for personal information first.

The form will ask for your name, address, date of birth, and your intended policy start date.

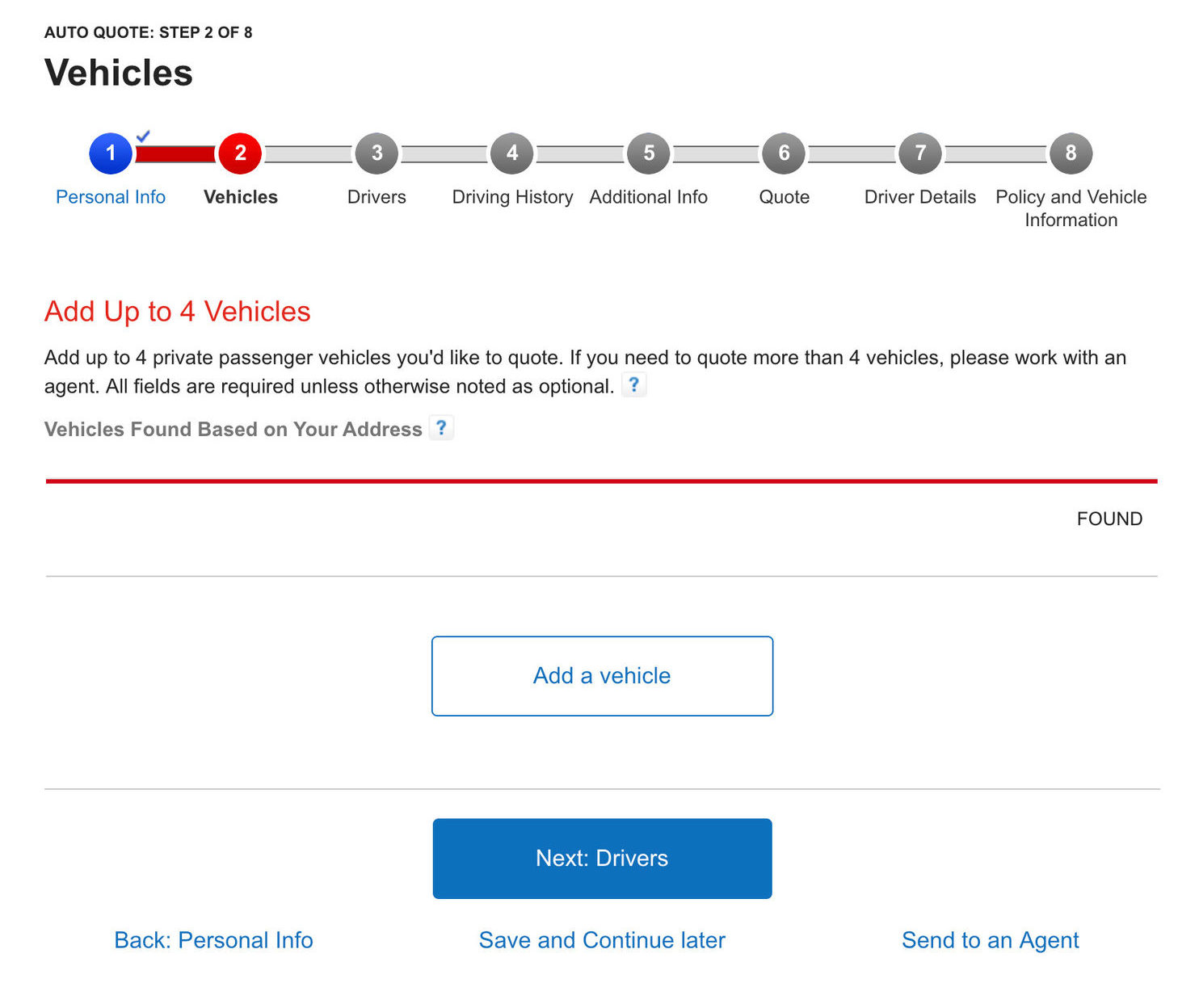

Step Three: Fill Out Vehicle Information

The next set of information State Farm will ask for is vehicle information.

State Farm allows you to enter up to four vehicles, but if you have more than four vehicles, you’ll need to call for a quote.

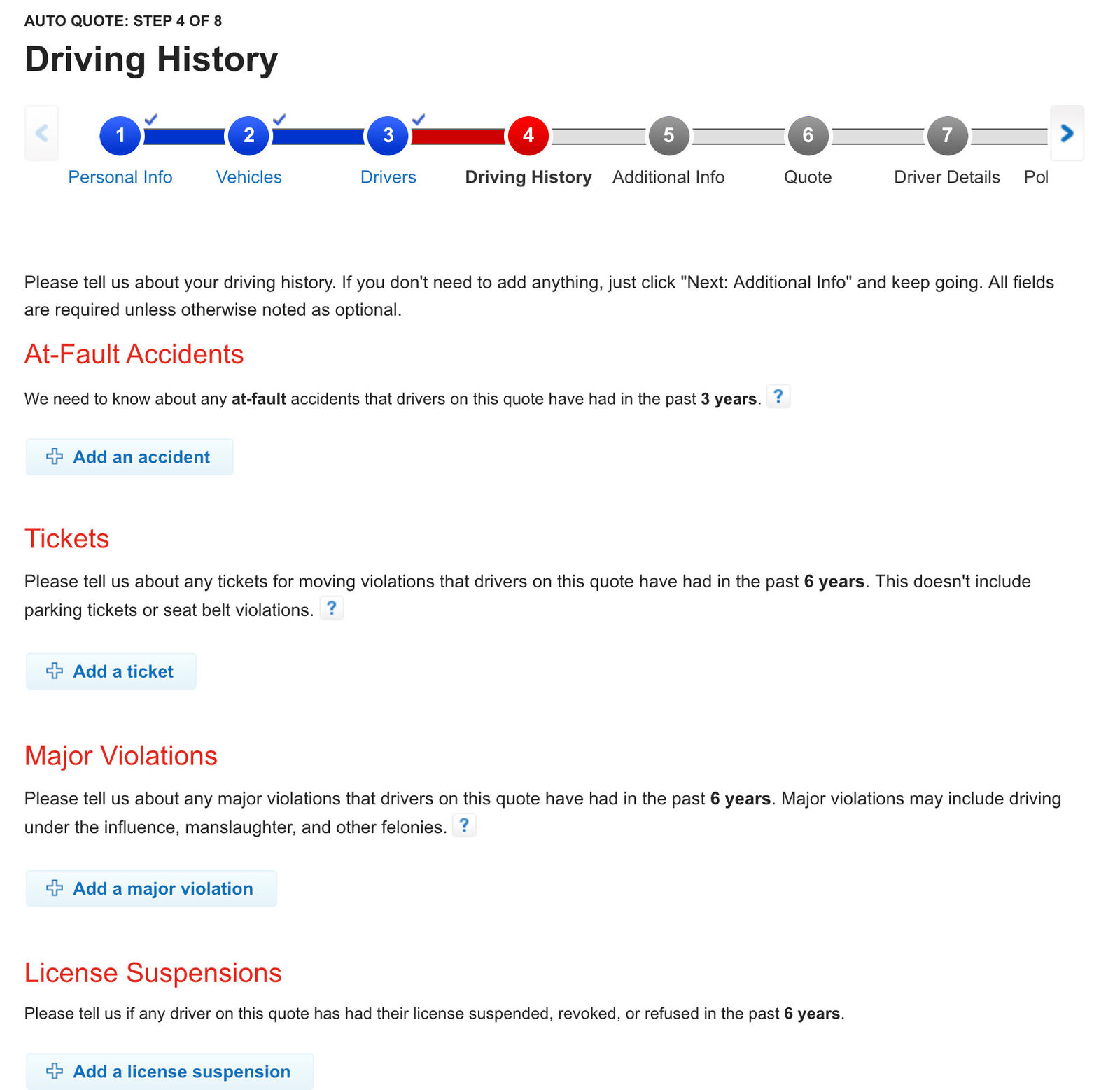

Step Four: Fill Out Driver Information

Next, State Farm will ask for information about your driving record.

Step Five: Fill Out Additional Information

State Farm will also ask how long you’ve been at your current provider and what coverage options you want.

Step Six: Get Your Quote

The final step is entering your email address. This way, State Farm can send you your quote. It also ensures you have a record of your quote in your mailbox.

If you don’t give State Farm your email address, you’ll have to call a State Farm agent to see your quote.

That’s it. It’s easy to get a quote from State Farm. Just remember you need the following to apply for a quote.

| Information Required | Document Types |

|---|---|

| Vehicle Information | Year, Make, Model, Body style (or VIN) Vehicle mileage Ownership Garaged address Name of registered owner Prior insurance carrier and expiration date Purchase date |

| Driver Information | Driver name and date of birth Driver's license number and state issued |

| Driving History | Ticket and accident history License suspension information |

Make sure to have your driver’s license on hand when filling out the section on driver information.

Design of Website and Apps

If you can’t seem to put down your smartphone or laptop, then you are aware of the importance of good apps and websites. Nobody wants to spend time waiting for a webpage to load, even if the title promises life-changing advice.

Nor do people want to deal with glitchy apps. If companies don’t have good websites and apps, customers may throw in the towel.

So let’s take a look at State Farm’s website and app designs.

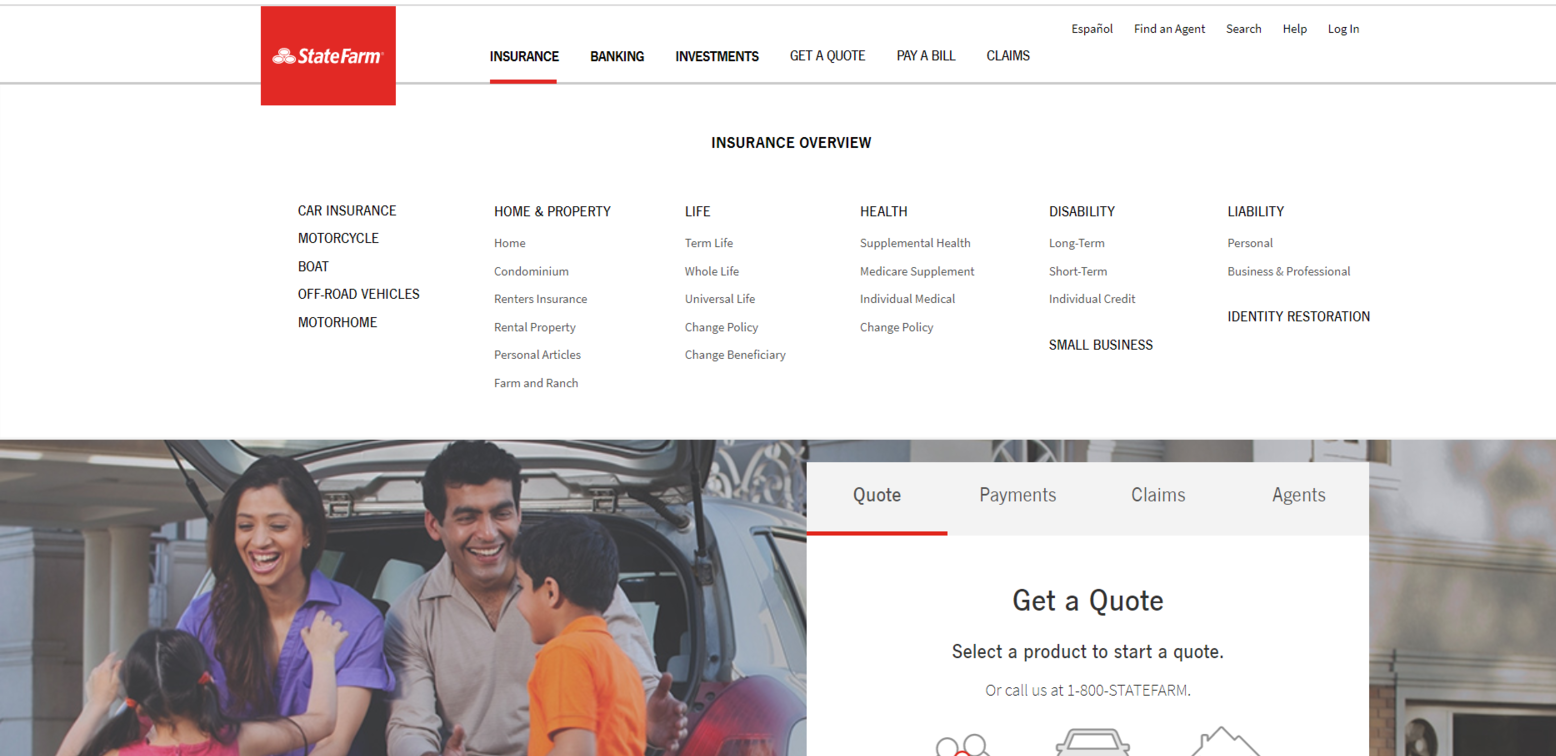

Website Design

State Farm has a well-designed website. The color scheme is simple, making sure visitors aren’t visually overwhelmed when looking for information.

Right away, visitors to the website will have menu options clearly laid out for them.

The dropdown menus on the upper left side provide subtopics for perusal. Clicking on one of the subtopics will take viewers to additional information. Below, you can see what appears when you select the insurance menu.

State Farm’s dropdown menus are well organized, making it easy to find the topic you are looking for. If users are having trouble finding the information they want, though, they can also click help or search on the upper right side.

There are also options on the upper right side to switch the language to Spanish, search for an agent, and log in.

Overall, State Farm has a well-designed website. The pages are also fast-loading, meaning you won’t have to wait for more than a second or two for a page to pop-up (as long as you aren’t on a computer or phone made ages ago).

Design of Apps

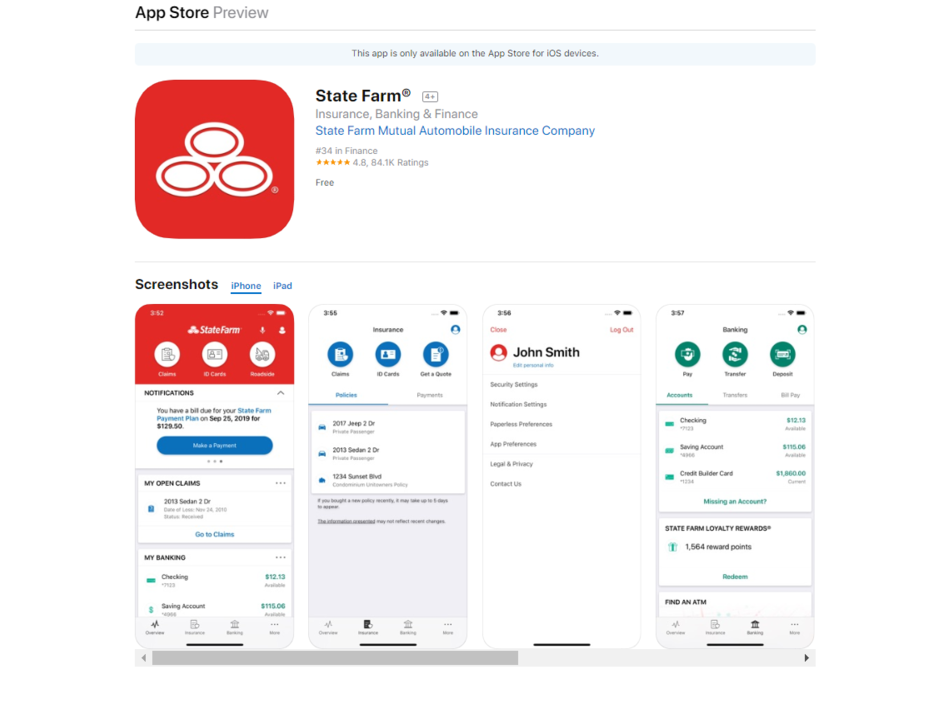

Apps are a great way to manage accounts from a smartphone. State Farm has two apps, a general account app, and a usage-based discount app.

Let’s start with State Farm’s general app.

State Farm’s general app has a 4.8-star rating (out of five stars) on Apple.

This great rating was calculated from over 84,00 reviews.

State Farm customers can do the following on the general app:

- Access State Farm insurance ID Cards

- Contact a State Farm agent

- File and manage claims

- Request roadside assistance

- Upload documents

- Upload pictures of damages after accidents

One of the most common customer complaints with the app’s functionality was incompatibility with new software updates. However, State Farm is constantly updating and improving its app, so bugs like this shouldn’t be too much of an issue.

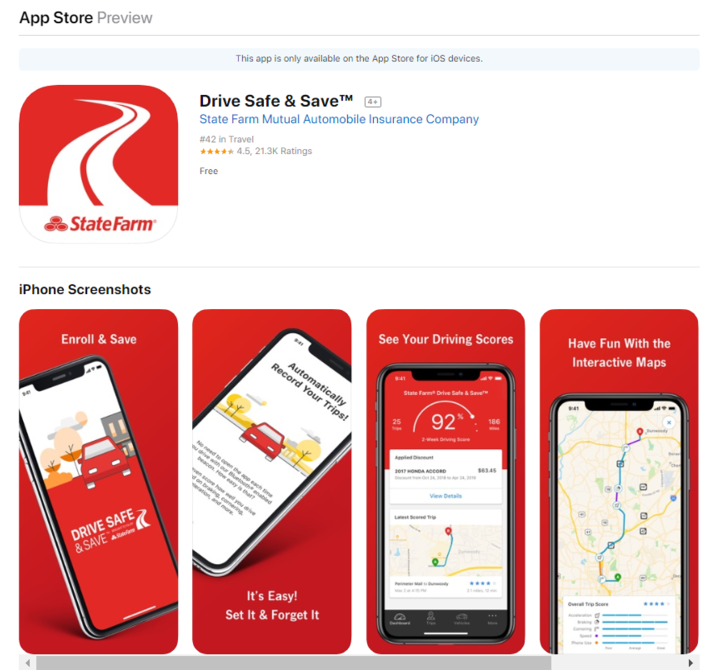

The other app we want to look at is State Farm’s Drive Safe & Save™ app.

The Drive Safe and Save™ has 4.5-stars out of five on Apple.

This great rating was calculated from over 21,000 reviews.

Most usage-based driving apps have poor reviews, so State Farm’s rating is fantastic. The app allows drivers to earn discounts for safe driving, as it monitors habits like hard braking.

Another app that gives discounts is State Farm’s Steer Clear® program for drivers under age 25.

Drivers who download the app can earn discounts for completing programs on their phones. Let’s take a look at how the app rated.

The Steer Clear® program has 3.6-stars out of five on Google Play.

This app didn’t do as well as State Farm’s other apps, but the rating is based on just under 600 reviews. As well, almost four stars is still a great rating.

Overall, State Farm has a great website and highly rated apps.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons

We’ve thrown a lot of information at you, so let’s take a moment to go over the main pros and cons of a State Farm policy.

| Pros | Cons |

|---|---|

| Has the third-lowest average premium among the top 10 providers | Rates can be high (depending on where you live) |

| Consistently strong financial standing and solid rankings | Could offer more discounts, like federal employees, green vehicles, and occupational discounts |

| Policies are available in all 50 states | Received an "about average" Power Circle Ranking in 5 out of 11 regions |

| Customers have a variety of online options and the apps are easy-to-use app | Limited add-ons are available |

There are a number of strong pros. State Farm is available in every state and generally has lower-than-average rates. It also has highly-rated apps.

However, your rates at State Farm could go up if you move to a new state, and there is a lower-than-average number of discounts.

And while State Farm has great financial ratings, JD Power only rated State Farm as average in most U.S. areas. Overall, though, the negatives don’t tend to outweigh the positives.

The Bottom Line

State Farm became one of the largest insurers for a reason. In the century since its foundation, it has flourished into a company with solid financial ratings and one of the largest shares in the market.

The company also has good customer reviews and well-designed apps. It’s lower than average rates help attract customers, and its coverages provide more than just the bare minimum.

The bottom line?

State Farm is going to be a major competitor for years to come. If you pick State Farm, there is no risk of the company going bankrupt and leaving you stranded without insurance.

Customers are also happy with State Farm’s service, which means you’ll get good customer service and lower rates.

Why is State Farm insurance so big?

State Farm is the biggest insurance company in the country, but it isn’t the oldest, although it is older than its most aggressive competitors Allstate, Geico and Progressive. State Farm was founded in 1922 as a mutual company servicing farmers. Although many other companies began in a similar fashion, State Farm is one of the only major insurance companies to continue operating under this model.

State Farm also employs more people than any other major insurer; it has nearly twice as many employees as Allstate and almost three times as many employees as Geico. State Farm requires this massive staff because it sells policies primarily through agencies.

While other companies rely on call center staff to handle claims and policies, State Farm offers more personalized service. All insurance affairs are handled by local agents, and many customers prefer this type of hands-on, personalized service.

State Farm’s size and staffing requirements mean that it makes substantially lower profits than its competitors. For example, in 2010, State Farm made $951 million. Allstate made $31.4 billion that year. State Farm’s low-revenue business model can only work because it is a mutual firm; publicly traded companies like Allstate must maintain higher profit margins in order to satisfy stockholders.

How do mutual firms work?

Most corporations are owned by their stockholders. Essentially, this means that the company is divided into stocks, which can then be bought and sold by investors. People with a high percentage of stocks have a controlling interest in the company, meaning that they have more votes in what happens to a company.

With stock companies, higher revenues equal higher stock values, which makes investments more attractive. Stockholders are less likely to hold stock in a company with low revenues because each individual stock will be worth less money.

This is why a publicly traded firm like Allstate needs to keep an eye on its profit margins; low revenue would lead to a decreased interest in stock, which would drive away investors. Allstate stockholders may or may not be insured in the company, and their interests will be purely financial.

Mutual companies are much simpler. Essentially, a mutual company is owned by its customers. The money paid by premiums is used to cover the operating costs of the company. All members shoulder risks and rewards equally. Because there are no stockholders to satisfy, profit shares can be narrower and companies can put more of their money back into growing the company.

In the case of insurance, a mutual firm can afford to offer greater discounts the larger its customer base becomes. This is why State Farm can offer lower premiums than many competitors despite the high overhead costs of its massive staff. These discounts and personalized customer service attract more customers, which in turn generate more money that can reward the members.

Is State Farm a good car insurance company for teens?

With its number of discounts on offer, State Farm may be the best choice for teen drivers. Whether you’re adding a teen to your policy or you’re a young person looking for your first insurance company, State Farm is worth investigating as an insurance option.

Traditionally, State Farm has always been viewed as a somewhat old-fashioned company. Its reliance on agency support rather than direct sales makes it stand out from competitors but also leads some consumers to assume that the company is not as progressive as other insurers. In order to evade this stigma and secure younger patronage, State Farm has begun actively targeting a younger demographic of drivers.

The newest advertisements for State Farm show that the company is targeting a younger, more technologically-savvy audience than ever before. Commercials often feature young, college-aged drivers and their hip, personable agents. Although State Farm continues to be brokered through insurance agents, it must compete against direct sales companies like Geico and Progressive that market directly to young people.

Advertisements aren’t the only way that State Farm has begun catering to younger drivers. The company has multiple discounts aimed directly at college-age drivers, and young people can take advantage of these discount programs to secure the lowest rates possible.

- The good student discount can save up to 25 percent off the cost of premiums

- State Farm’s exclusive “Steer Clear and Save” program is targeted at drivers under the age of 25

- 5 percent discount for drivers who complete an approved defensive driving course

Also, see our rates comparison above for teen male and female drivers

Have we answered all your questions about State Farm? Hopefully, you are now ready to make a decision.

If you want to compare rates today, you can enter your zip code in our free online tool below.

Frequently Asked Questions

Can I bundle my auto insurance policy with other insurance types at State Farm?

Yes, State Farm offers the option to bundle your auto insurance with other insurance policies they provide, such as home, health, life, and more. Bundling can often lead to cost savings.

What are the steps to cancel a State Farm insurance policy?

To cancel a State Farm insurance policy, you can contact your local State Farm agent by phone, visit an agent in person, or send a cancellation letter by mail to State Farm’s corporate headquarters. Make sure you have all the necessary information, such as your policy number and the name and policy number of your new insurer if applicable.

How does State Farm handle customer complaints?

State Farm’s complaint index has been lower than the national average in recent years, indicating that the majority of customers are satisfied with the company’s handling of complaints.

What is JD Power’s rating for State Farm?

JD Power rated State Farm among the best insurance companies, with a five JD Power circle rating.

How does State Farm’s auto insurance rates compare to other insurance providers?

State Farm generally offers competitive auto insurance rates, with rates that are often lower than the national average in many states. While there are some exceptions where State Farm’s rates are higher, it remains a cost-effective choice for many drivers.

What factors can affect my auto insurance rates with State Farm?

Several factors can influence your auto insurance rates with State Farm, including your driving record, credit history, coverage level, make and model of your vehicle, commute distance, and more. Maintaining a clean driving record, good credit, and selecting appropriate coverage levels can help lower your rates.

Does State Farm offer discounts to policyholders, and what types of discounts are available?

State Farm provides various discounts to policyholders, including multi-policy discounts, safe driver discounts, anti-theft device discounts, and more. While State Farm may not offer as many discounts as some other insurers, these discounts can still help reduce your overall insurance costs.

What programs and benefits does State Farm offer to its policyholders?

State Farm offers several beneficial programs to its policyholders, including accident forgiveness, car rental and travel expense coverage, emergency road coverage, and usage-based apps that can lead to discounts for safe driving habits. These programs aim to enhance customer satisfaction and provide valuable assistance in different situations.

How does State Farm handle accident forgiveness?

State Farm offers coverage for rideshare drivers as an additional option to their personal insurance policies. This coverage ensures you’re protected when you’re driving passengers for companies like Uber or Lyft.

What is State Farm’s stance on discounts for good driving records?

While State Farm may not offer as many discounts as some competitors, they do provide discounts for various factors, including safe driving records. These discounts can help policyholders reduce their premiums.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.