Expert Georgia Car Insurance Advice (Compare Costs & Companies)

Georgia car insurance laws require all drivers to carry minimum coverage of 25/50/25 for bodily injury and property damage liability. Georgia car insurance rates average $87 per month, while the cheapest car insurance companies in Georgia are Coast National Insurance Company and American National Property and Casualty Company.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Georgia minimum car insurance requirements are 25/50/25 for bodily injury and property damage liability

- Georgia car insurance rates average $87 per month

- Car insurance quotes in Georgia are influenced by personal factors such as age, gender, marital status

| Georgia Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 127,492 Annual Miles Driven: 111,535 million |

| Vehicles | Registered in State: 7,955,532 Total Stolen: 26,854 |

| State Population | 10,519,475 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 13% State Rank: 25th |

| Driving Fatalities | 2017 Total: 1,540 Speeding: 248 Drunk Driving: 366 |

| Average Annual Premiums | Liability: $557.38 Collision: $331.83 Comprehensive: $159.18 Full Coverage: $1048.40 |

| Cheapest Provider | Coast National Insurance Company |

Georgia is one of our nation’s fastest-growing and most-diverse states, brimming with sprawling Atlanta, several unique mid-size metros, and mile after mile of rolling country hills. We’ve created this comprehensive Georgia car insurance guide to help you find the best car insurance for you and your family.

So whether you’re about to catch that midnight train to Georgia or a longtime Georgia peach, read on to find out more about car insurance coverage and vehicular safety in the great state of Georgia.

Want to start comparing quotes right now? We’ve got you covered just enter your zip code in our FREE quotes comparison box above.

Georgia Car Insurance Coverage & Rates

From the Spanish moss of Savannah to the palm trees of Valdosta, Georgia is a peach to call home.

You’ll need the best car insurance to make sure you’re covered from Augusta to Alpharetta, and we’ve built this guide to take the guesswork out of Georgia car insurance coverage.

Georgia’s Car Culture

Folks love to drive in Georgia.

Over 7 million licensed Georgians are on the road, and those roads can be crowded or under constant construction. (There’s an old joke that goes, “Atlanta’s traffic is the friendliest around. The commuters spend hours mingling with each other every day!”)

- Georgia

- Affordable Car Insurance Rates in Atlanta, GA

- Affordable Car Insurance Rates in Athens, GA

- Affordable Car Insurance Rates in Augusta, GA

- Affordable Car Insurance Rates in Columbus, GA

- Affordable Car Insurance Rates in Sandy Springs, GA

- Affordable Car Insurance Rates in Savannah, GA

- Cheap Car Insurance in Georgia

- Affordable Car Insurance Rates in Williamson, GA (2026)

- Affordable Car Insurance Rates in Rome, GA (2026)

- Affordable Car Insurance Rates in Pooler, GA (2026)

- Affordable Car Insurance Rates in Lumpkin, GA (2026)

- Affordable Car Insurance Rates in Lawrenceville, GA (2026)

- Affordable Car Insurance Rates in Garfield, GA (2026)

- Affordable Car Insurance Rates in Eastman, GA (2026)

- Affordable Car Insurance Rates in Dalton, GA (2026)

- Affordable Car Insurance Rates in Covington, GA (2026)

- Affordable Car Insurance Rates in Cartersville, GA (2026)

- Affordable Car Insurance Rates in Cairo, GA (2026)

- Affordable Car Insurance Rates in Blakely, GA (2026)

That trend is only going to continue. According to TRIP, the National Transportation Research Nonprofit, “Vehicle travel on Georgia’s highways increased by 19 percent from 2000 to 2017.” And though “Georgia has made substantial progress in addressing a backlog of road construction and maintenance in recent years,” the Atlanta Journal-Constitution reports that the state still “needs to spend hundreds of millions of dollars more to improve its aging infrastructure.”

Congestion and construction are leading factors in car accidents, and it’s important that you get the best coverage to be a safe Georgia driver.

Do you know what the minimum coverage laws are for the Peach State?

Georgia Minimum Coverage

| Minimum Car Insurance Requirements in Georgia | Stats |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person and $50,000 per accident |

| Uninsured Motorist Property Damage | $25,000 with a $250, $500, or $1000 deductible |

Minimum auto insurance coverage and rates vary from state to state. Compare state to state below:

Accidents can be extremely pricey. Minimum liability coverage is required in every state to ensure that if you are ever in an accident, you have the insurance to cover the myriad of costs involved. Otherwise, you could end up going bankrupt.

What exactly can you expect from Georgia’s minimum liability coverage?

Liability insurance in Georgia covers at least:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

And that’s the minimum amount of insurance you’ll need. To avoid paying out-of-pocket if you’re in an accident that costs more than this, you’ll want to understand what your insurance covers.

But before we get there, you’ll need to know what counts as legal forms of financial responsibility in the Peach State.

Forms of Financial Responsibility

You need to be able to prove you have at least the minimum insurance Georgia requires. You do this through a legally-recognized form of financial responsibility.

There are various ways to show this proof of insurance, usually by carrying a valid insurance ID card or a copy of your insurance policy.

Georgia also allows your insurance company to electronically file your proof in the state’s DRIVES e-Services database, which can come in handy if you find yourself without physical proof of your valid insurance.

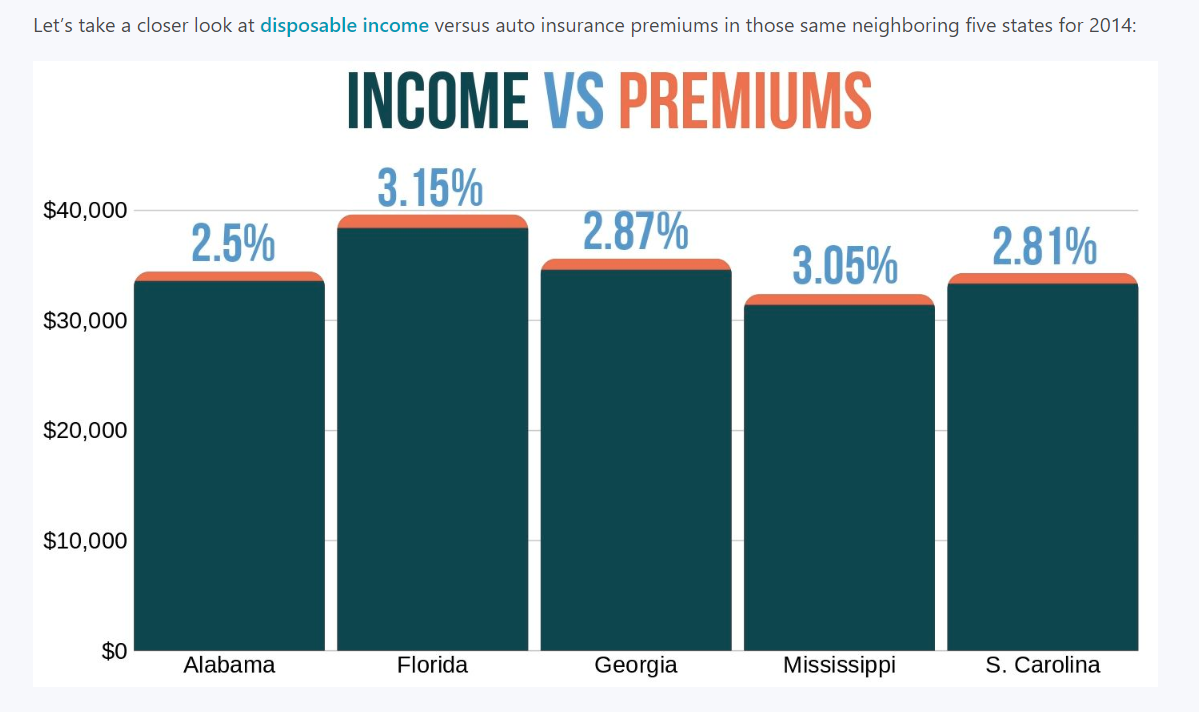

Premiums as a Percentage of Income

The median household income for Georgia was $56,183 in 2017, $4,153 lower than the national average of $60,336. But as Georgia quickly grows, incomes are also quickly growing in the state: 9.91 percent from 2014 – 2017 alone.

Georgians spend just under 3 percent of their average disposable household income on car insurance, slightly above the national average of 2.3 percent. But don’t worry, Georgians aren’t necessarily overpaying in comparison to their neighbors in the southeastern United States.

Georgians are paying slightly more of their income each year for car insurance, but the trend is noticeably minimal. Here’s the average of Georgia’s car insurance premiums as a percentage of income between 2012 – 2014:

- 2012: 2.78 percent

- 2013: 2.87 percent

- 2014: 2.87 percent

Use the handy tool below to calculate what percentage of income your insurance premium might be.

CalculatorPro

Average Monthly Car Insurance Rates in GA (Liability, Collision, Comprehensive)

As Georgia grows, so grows the cost of car insurance in the state.

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive coverage. Review rates for car insurance coverage below:

But remember, experts agree: the better insured you are, the better prepared you will be to deal with an accident, whether or not you are at fault.

Additional Liability

It’s true: Georgia, like many states, only requires liability insurance. Though anything above liability insurance is optional, stronger coverage can help you avoid financial hardship should medical or property damage bills stack up like traffic during Atlanta’s rush hour.

Knowing a company’s loss ratio is important in determining if they can provide you the car insurance you need.

A company’s loss ratio is how much the insurer spends on claims compared to how much money they receive in premiums.

That can be confusing, right? So here’s an example: if a company spends $750 in claims for every $1,000 they receive in premiums, they have a loss ratio of 75 percent. This means that loss ratios over 100 percent point to an insurer that is losing money. Conversely, abnormally low loss ratios mean a company isn’t paying out much in claims.

The National Association of Insurance Commissioners (NAIC) reports that in 2017, the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is between 60 and 70 percent.

The most recent loss ratios in Georgia are:

- 80.33 percent for medical payments (a bit high)

- 22 percent for uninsured motorists (a bit low)

Rember: both Medical Pay and Uninsured/Underinsured Motorist coverage are optional in Georgia. But, they might still be important for you to add to your insurance policy. Why? In 2015, 13 percent of motorists in the US and 12 percent of motorists in Georgia were uninsured.

Add-Ons, Endorsements, & Riders

Complete coverage at an affordable premium is likely your top priority in shopping for car insurance for you and your family.

Luckily, there are a lot of cheap but powerful extras you can add to your policy. These extras ensure you are better-covered in case of an accident or other events involving you or your vehicle.

Some useful add-ons you might consider in the Peach State are:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

You might also want to consider personal injury protection (PIP). PIP, sometimes called “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

Average Monthly Car Insurance Rates by Age & Gender in GA

Bucking national trends, female drivers pay significantly more than male drivers for insurance in Georgia.

According to the Insurance Journal, “Several studies in 2018 and 2017 revealed that women over 25, particularly those between 40 and 60, often pay more than men — not less — for auto insurance, all other rating criteria being equal.” Several states have moved to outlaw such gender-based discrimination, but Georgia has yet to act.

The table below offers a comparison of average premiums for 25- and 55-year-old males and females.

| Male vs. Female | Geico | Progressive |

|---|---|---|

| 25-Year-Old Male | $98.27 | $99.51 |

| 25-Year-Old Female | $134.49 | $103.34 |

| 55-Year-Old Male | $135.75 | $79.20 |

| 55-Year-Old Female | $178.27 | $82.60 |

Cheapest Rates by Zip Code

The most expensive average car insurance premiums by Georgia Zip Code can be found in 30002, a community called Avondale Estates. A tony community east of Atlanta near Decatur, Avondale Estates was founded by millionaire George Francis Willis in 1924. Named after Shakespeare’s birthplace — Stratford-upon-Avon — many of the planned community’s buildings are in the Tudor style to honor this English namesake.

It’s easy to find the cheapest car insurance rates for you. Just enter your zip code to get started.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Cheapest Rates by City/County

Georgia’s cities are some of the most diverse in the country.

From the fast-paced metropolis of Atlanta to some of the prettiest small towns in the United States, your car insurance rates are highly determinative of where you call home.

The table below provides the cheapest and most expensive rates by Georgia city or county.

| Lowest Average Rates | Rates | Highest Average Rates | Rates |

|---|---|---|---|

| Ware County | $2,902.91 | Atlanta | $4,263.90 |

| Whitfield County | $2,957.79 | Stone Mountain | $4,251.77 |

| Albany | $3,152.58 | College Park | $4,243.45 |

| Augusta | $3,205.43 | Marietta | $3,602.31 |

| Columbus | $3,313.84 | Macon | $3,518.81 |

Best Georgia Car Insurance Companies

The best car insurance company for you depends on many factors.

From company financial ratings to rates for drivers of various histories, you’ll want to consider the pros and cons of each insurer. You’ll also want to know what companies are most likely to protect you and your family. Georgia’s Office of Insurance and Safety Fire Commissioner is also a great resource, and they exist to protect the state’s insurance consumers.

For our compilation of the best car insurance companies in Georgia, check out the sections below.

The Largest Companies’ Financial Rating

A company’s ability to financially cover its customers is important, and that’s where financial ratings come into play.

AM Best ranks America’s insurance companies by financial solvency. What does it mean for a company to receive a high grade? That company is highly likely to stay solvent and have the ability to pay customer claims. A bad grade might be a warning sign for potential customers.

The table below gives the financial ratings for Georgia’s 10 largest car insurance providers.

| Providers (Listed by Size, Largest at the Top): | A.M. Best Rating: |

|---|---|

| State Farm | A++ |

| Berkshire Hathaway | A++ |

| Progressive | A+ |

| Allstate | A+ |

| United Service Automobile Association | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Travelers | A++ |

| Georgia Farm Bureau | B+ |

| Auto Owners | A++ |

Companies with Best Ratings

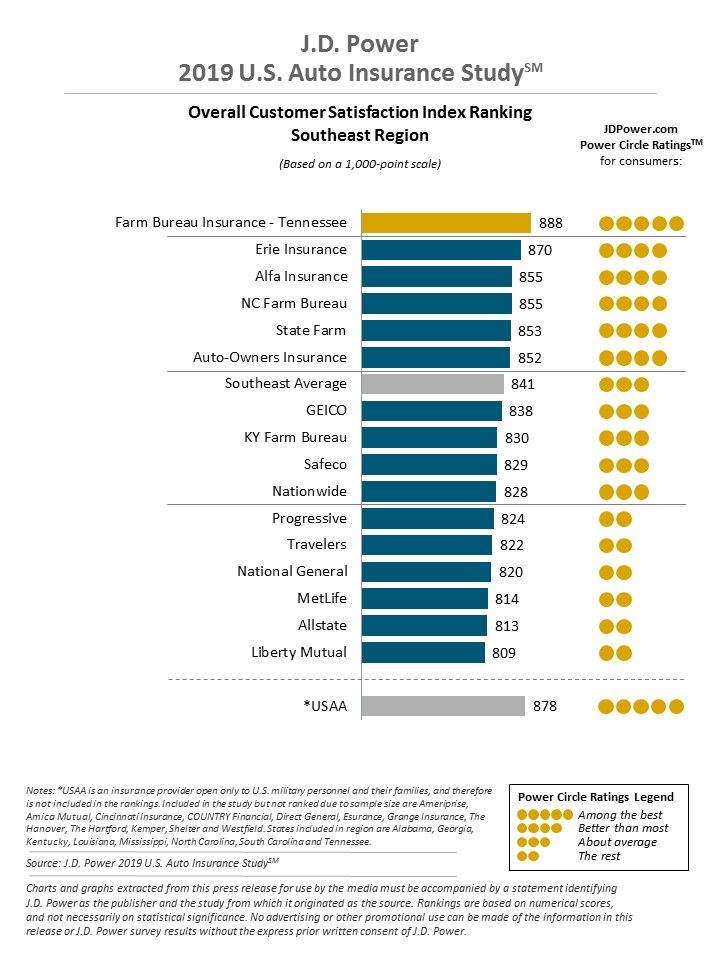

You might expect a large national company with zippy commercials to get the best ratings for car insurance, but J.D. Power and Associates recently ranked Farm Bureau Insurance – Tennessee the best auto insurer in Georgia.

Here are their 2018 rankings for the Southeast region:

Companies with the Most Complaints in Georgia

Part of knowing who is best is knowing who gets the most complaints. Georgia’s Office of Insurance and Safety Fire Commissioner makes it extremely easy to file and track a complaint, and that’s helpful if you’re having trouble with our car insurer.

State Farm has an abnormally high number of complaints in The Peach State. The table below provides Georgia’s top auto insurers by market share’s number of complaints filed from 2015 to 2018.

| Top Providers by Market Share in GA | Complaints 2018 | Complaints 2017 | Complaints 2016 | Complaints 2015 |

|---|---|---|---|---|

| State Farm | 1266 | 1550 | 9274 | 6559 |

| Geico | 247 | 354 | 283 | 243 |

| Progressive | 0 | 2 | 4 | 3 |

| Allstate | 9 | 16 | 18 | 17 |

| USAA | 273 | 351 | 340 | 282 |

| Liberty Mutual | 19 | 13 | 8 | 1 |

| Nationwide | 0 | 3 | 6 | 3 |

| Travelers | 4 | 2 | 5 | 1 |

| Georgia Farm Bureau | 16 | 16 | 23 | 19 |

| Auto-Owners | 81 | 101 | 100 | 123 |

Cheapest & Most Expensive Companies in Georgia

Cost might be your bottom dollar when it comes to choosing a car insurance company, and we understand. Just remember that the cheapest isn’t always best (though most expensive might not be either).

The table below provides the five cheapest and five most expensive car insurance companies in Georgia.

| Top 5 Cheapest Providers (Average) | Rates | Top 5 Most Expensive Providers (Average) | Rates |

|---|---|---|---|

| Coast National Insurance Company | $1,141.14 | Everest Security Insurance Company | $7,306.51 |

| American National Property and Casualty Company | $1,260.92 | Main Street America Assurance Company | $7,299.73 |

| 21st Century Centennial Insurance Company | $1,297.98 | Amica Mutual Insurance Company | $7,084.16 |

| AIG Property Casualty Company | $1,475.30 | Victoria Fire And Casualty Company | $6,487.43 |

| Twin City Fire Insurance Company | $1,617.20 | Insuremax Insurance Company | $6,448.09 |

Commute Rates by Companies

Georgia workers are above-average commuters, with a 27.1 minute median commute time.

Over 3 percent of Georgians are even super-commuters, with commute times over 90 minutes.

Your commute time will be a factor your auto insurer considers in determining your premium, especially in The Peach State. The table below shows average rates for some of Georgia’s top car insurers by average commute distance.

Largest Auto Insurance Companies in Georgia

Bigger can sometimes mean better and cheaper, but not always. The table below gives the top 10 auto insurers in Georgia by market share, direct premiums written, and loss ratio.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $1,937,806 | 68.72% | 22.49% |

| Geico | $1,051,005 | 81.23% | 12.20% |

| Progressive Group | $1,001,828 | 63.09% | 11.63% |

| Allstate Insurance Group | $820,479 | 51.96% | 9.52% |

| USAA Group | $706,276 | 91.01% | 8.20% |

| Liberty Mutual Group | $335,540 | 66.84% | 3.89% |

| Nationwide Corp Group | $267,971 | 77.10% | 3.11% |

| Travelers Group | $266,864 | 71.60% | 3.10% |

| Georgia Farm Bureau Group | $261,432 | 64.70% | 3.03% |

| Auto-Owners Group | $224,705 | 70.36% | 2.61% |

Credit History Rates by Companies

Are you surprised to find out your credit history can affect your car insurance premium? It certainly can, especially with Liberty Mutual in Georgia.

With an average Vantage credit score of 654, Georgians have one of the lowest average credit scores across the United States. Who are the best car insurers in Georgia for those with a poor credit rating? Geico or State Farm will likely be the most affordable car insurance option.

The table below shows average rates for those with a good, fair, or poor credit rating for Georgia’s top car insurance providers.

| Company | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $5,456.39 |

| Allstate | Fair | $3,792.84 |

| Allstate | Good | $3,382.87 |

| Geico | Poor | $3,780.93 |

| Geico | Fair | $2,607.81 |

| Geico | Good | $2,542.83 |

| Liberty Mutual | Poor | $14,403.23 |

| Liberty Mutual | Fair | $8,834.05 |

| Liberty Mutual | Good | $6,923.06 |

| Nationwide | Poor | $7,719.34 |

| Nationwide | Fair | $6,258.58 |

| Nationwide | Good | $5,476.79 |

| Progressive | Poor | $5,074.80 |

| Progressive | Fair | $4,376.95 |

| Progressive | Good | $4,045.92 |

| State Farm | Poor | $4,798.23 |

| State Farm | Fair | $2,988.35 |

| State Farm | Good | $2,368.08 |

| USAA | Poor | $4,110.85 |

| USAA | Fair | $2,892.23 |

| USAA | Good | $2,469.31 |

Driving Record Rates by Companies

Do you have a spotless driving record or one with a few marks? We all make mistakes, but be prepared for your car insurance premium to be affected by your driving history, perhaps more than anything else.

If you’re a Georgian with a DUI, for instance, State Farm will likely be the cheapest car insurance provider for you. Have an accident in your past? Geico will probably be your most affordable option.

We’ve built the table below to illustrate how Georgia’s top insurers consider a DUI, accident, or speeding ticket in determining your car insurance premium.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 accident | $5,365.97 |

| Allstate | With 1 DUI | $4,363.29 |

| Allstate | With 1 speeding violation | $3,647.83 |

| Allstate | Clean record | $3,465.70 |

| Geico | With 1 accident | $2,493.90 |

| Geico | With 1 DUI | $5,179.25 |

| Geico | With 1 speeding violation | $2,244.40 |

| Geico | Clean record | $1,991.22 |

| Liberty Mutual | With 1 accident | $10,428.16 |

| Liberty Mutual | With 1 DUI | $11,988.03 |

| Liberty Mutual | With 1 speeding violation | $10,164.83 |

| Liberty Mutual | Clean record | $7,632.75 |

| Nationwide | With 1 accident | $5,859.64 |

| Nationwide | With 1 DUI | $9,033.42 |

| Nationwide | With 1 speeding violation | $6,053.51 |

| Nationwide | Clean record | $4,993.04 |

| Progressive | With 1 accident | $6,212.74 |

| Progressive | With 1 DUI | $4,157.29 |

| Progressive | With 1 speeding violation | $4,102.75 |

| Progressive | Clean record | $3,524.11 |

| State Farm | With 1 accident | $3,684.98 |

| State Farm | With 1 DUI | $3,384.88 |

| State Farm | With 1 speeding violation | $3,384.88 |

| State Farm | Clean record | $3,084.80 |

| USAA | With 1 accident | $3,058.95 |

| USAA | With 1 DUI | $4,461.07 |

| USAA | With 1 speeding violation | $2,693.63 |

| USAA | Clean record | $2,416.20 |

Number of Foreign vs. Domestic Insurers in Georgia

What do you think a foreign or domestic car insurance company is? When it comes to auto insurers, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Georgia has 23 domestic car insurance companies and 988 foreign car insurance providers.

Georgia Laws

Even if you’re just passing through, it’s important to know the laws where you’re driving. Obeying driving laws not only keeps you safe, but it also helps keep your insurance premiums at a minimum.

The National Motorists Association offers a top-notch summary of Georgia’s driving laws, some of which we’ll talk about below.

Car Insurance Laws

Remember, Georgia requires liability insurance with the following minimums:

- Injury to one person: $25,000

- All injuries: $50,000

- Property damage: $25,000

Also remember, these are minimums. What is best for you and your family might be coverage above liability.

How State Laws for Insurance are Determined

Insurance laws can seem like a mystery.

The National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from all 50 states, the District of Columbia and five U.S. territories. They offer this great white paper to help you understand how insurance laws get made.

Windshield Coverage

Broken windshields are common. According to the Insurance Journal, “Windshields are the number one insurance claim in the United States.”

Georgia law allows car insurers to use aftermarket parts if the parts and the guarantee are listed on the estimate. You can choose to have original parts — and get the windshield repaired by a shop of your choice — but check with your insurance company’s estimators first because you’ll be left paying the difference in cost out-of-pocket.

And remember, glass coverage is an optional add-on to many car insurance policies.

High-Risk Insurance

You might have had some bad luck on the road, leading to a less-than-stellar driving history.

If Georgia deems you a high-risk driver, you have to get what’s called SR-22 insurance, which is often more expensive. Some common reasons for the SR-22 requirement:

- You are convicted of a DUI/DWI

- You are found to be driving while uninsured

- You are involved in a serious injury-causing accident

- You have a large number of points on your driving record

Statute of Limitations

Let’s say you get in an accident. How long do you have to settle any disputes over liability?

That’s where Georgia’s statute of limitation laws come into play.

A statute of limitations is the amount of time you have to file a lawsuit in court after an automobile incident. The table below provides Georgia’s statute of limitations for both personal injury and property damage.

| Georgia Statutes of Limitations | Years |

|---|---|

| Personal Injury | 2 Years |

| Property Damage | 4 Years |

State-Specific Laws

Check out The National Motorists Association’s summary of Georgia-specific driving laws. Below is some interesting (and important) information for driving in Georgia we’ve found:

- Georgia requires that you have your headlights on whenever you are using your windshield wipers.

- A license to carry a concealed firearm issued to a nonresident by another state shall be honored if such state provides a reciprocal privilege.

Georgia also has a unique Speed Trap Law that applies to all police agencies except the State Highway Patrol. This law means that police:

- cannot issue tickets for less than 10 mph over the posted speed limit,

- cannot use Speed Measuring Devices (SMDs) on downhill roads with more than a 7 percent downgrade,

- cannot use SMD closer than 500 feet inside a changed speed limit zone,

- vehicles using SMD must be seen by all approaching vehicles at least 500 feet or more, and

- municipalities using SMD must have warning signs on a major road at city or county limits stating so.

Vehicle Licensing Laws

Like almost everywhere, Georgia requires a valid driver’s license to operate a vehicle.

And who doesn’t love getting their picture taken at the DMV?

According to the Georgia Department of Driver Services, “Once you have become a resident of the State of Georgia, you have 30 days to apply for a Georgia driver’s license.” They also explain that a person is a resident if any of the following apply:

- A person who has a permanent home or abode in Georgia.

- A person who accepts employment or who enrolls his/her children in public or private school within 10 days of becoming employed in Georgia.

- Any person that has been present in the state for 30 days or more

Driving without a license will get you a suspended registration with a $25 lapse fee and a $60 reinstatement fee.

REAL ID

Having a REAL ID can save you the hassle of bringing other forms of identification with you to conduct official state or federal government business.

Georgia began complying with REAL ID laws in 2012, and the state’s Department of Driver Services can provide information on how to get that star on your license.

Penalties for Driving Without Insurance

The Georgia Department of Revenue is required, by law, to suspend or revoke vehicle registrations on any vehicles found to be driving without continuous liability coverage. You will also incur a $25 fine for a lapse in coverage. That fine jumps to an additional $160 if the lapse in coverage is not paid in 30 days.

Teen Driver Laws

Teen driver laws vary by state, so if you’re new to Georgia, it’s best to read up before your teen gets on the road.

For instance, Georgia has a graduated license system that restricts the times of day or night and the number of passengers a teen driver can have.

We’ve compiled the table below to illustrate the key aspects of Georgia’s graduated licensing system for teens.

| Young Driver Licensing System | First Requirement | Second Requirement | Third Requirement |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15 | – | – |

| Before getting a license or restricted license you must: | Have a mandatory holding period of 12 months | Have a minimum supervised driving time of 40 hours, 6 of which must be at night | Have a minimum age of 16 |

| Restrictions during intermediate or restricted license stage: | Nighttime restrictions – midnight-5 a.m. secondary enforcement | Passenger restrictions (family members excepted unless otherwise noted) – first 6 months—no passengers; second 6 months—no more than 1 passenger younger than 21; thereafter, no more than 3 passengers secondary enforcement | – |

| Minimum age at which restrictions may be lifted: | Nighttime restrictions – until age 18 (min. age: 18) | Passenger restrictions – until age 18 (min. age: 18) | – |

Older Driver License Renewal Procedures

Regardless of age, Georgia requires drivers to renew their licenses every eight years and to prove adequate vision at the time of renewal. The only real difference, however: once you turn 64, you can no longer renew online or by mail.

New Residents

Georgia’s population is growing at nearly twice the national average.

That’s a lot of new licenses to issue and new auto insurance policies to buy. Here’s some important info to keep in mind if you’re new to the Peach State:

- Georgia doesn’t have a traditional DMV, but rather two agencies that handle motor vehicles: the Department of Driver Services (DDS) and the Department of Revenue (DOR). DDS handles things like licensing, permits, and ID cards, and DOR handles registration, taxes, and plates.

- Georgia has a move-over law that requires you to move over to emergency vehicles on the side of the road. Violation of this law is the same as a moving violation and can incur you a ticket of up to $500.

- Unless you want a $150 fine, texting while driving is prohibited. In cases of emergency it can be allowed, but keep those phones away and on silent when driving in Georgia.

And remember: you have to obtain your Georgia license within 30 days of moving to The Peach State.

License Renewal Procedures

We all look forward to a trip to the license office. Well, not really, but come prepared and you’ll have a much smoother experience.

Georgia requires drivers to renew their licenses every eight years and to prove adequate vision at the time of renewal. Most drivers can renew online, in person, or by mail. Visit the Georgia Department of Drivers Services to find out the easiest way for you to renew.

Rules of the Road

Whether you’re a Georgian through-and-through or just a passing midnight train through The Peach State, you’ll need to know rules for driving in Georgia.

Below we’ve compiled some helpful advice to make sure you’re in the know.

Fault vs. No-Fault

Georgia is an at-fault state, meaning you’ll be held financially and legally liable if you are found at-fault in an auto accident.

The more comprehensive your insurance, the better prepared you are to face accidents and other auto incidents head-on, whether or not you are at fault. Make sure you have the best insurance you can to protect you and your family.

Seat Belt & Car Seat Laws

With few exceptions, Georgia requires seat belts for:

- All passengers in the driver and front seats, regardless of age.

- All passengers aged 8 to seventeen.

- All children under the age of 8 must use a car seat “appropriate for such child’s height and weight and approved by the United States Department of Transportation.”

Keep Right & Move Over Laws

Georgia passed an official Slowpoke Law in 2014, which makes impeding traffic in the left lane of a highway a ticketable offense. Like in most states, you should use the left lane for passing and the right lane for maintaining speed.

Georgia’s Move Over Law requires you to move over to the side of the road for emergency vehicles. Violation of this law is the same as a moving violation, which means a ticket up to $500.

Speed Limits

Exceptions occur, but absolute speed limits — the posted limit by which you break the law in exceeding — across The Peach State are just that: absolute.

These absolute speed limits include:

- 20 miles per hour in school zones

- 30 miles per hour in urban and residential districts

- 35 miles per hour on unpaved country roads

- 65 miles per hour on sections of physically divided highways without full access control on the state highway system

- 70 miles per hour on interstate highways

- 55 miles per hour on other roadways

Don’t forget: our research shows that speeding is one of the easiest ways to increase your car insurance premium. Slowing down helps keep you and your family safe and your car insurance affordable.

Ridesharing

In 2017, The Georgia Supreme court voted to block an Atlanta taxi driver group’s appeal for exclusive rights, meaning ridesharing groups like Lyft or Uber can operate fairly freely in the state.

Does this make you worry about your liability by stepping into a rideshare, however? Don’t. A 2015 Georgia law requires ridesharing companies to carry a minimum of $1 million in coverage for “personal injury accident claims, property damage, and death.”

So feel free to hail that Uber at Hartsfield-Jackson, the busiest airport in the world and one of the main economic drivers of Georgia.

Automation on the Road

As automobile technology continues to advance, you’ll likely see more and more automation on the road. The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task or function that was previously carried out by a human.

When it comes to automation, think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

The 2017 Georgia law SB 219 allows for autonomous vehicles on the state’s roadways. The law states the vehicle must be properly insured and registered but interestingly, does not require the “driver” to hold a valid license.

So what’s it like to ride in a “driverless” car?

Safety Laws

Most car crashes are the result of human error. Driving safely is important wherever you are. And a big part of driving safely is knowing a state’s safety laws and regulations.

Since we’ve shown you know the proper way to insure and register your vehicle Georgia, let’s now cover some important information about keeping you, your family, and your vehicles safe in The Peach State.

DUI Laws

It’s never a good idea to drink and drive. Georgia has some especially strict laws for driving under the influence of alcohol. The table below explains those laws and possible penalties.

| Georgia's DUI Laws | Laws |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status by Offense | 1st-2nd misdemeanors, 3rd high and aggravated misdemeanor, 4th+ felony |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look back Period/Washout Period | 10 years |

| 1st Offense - ALS or Revocation | 120 days minimum up to 1 year |

| 1st Offense - Imprisonment | 10 days - 12 months, can all be suspended at judge's discretion unless HBAC, then all but 24 hours can be suspended |

| 1st Offense - Fine | $300-$1000 |

| 1st Offense - Other | 20-40 hours community service |

| 2nd Offense - DL Revocation | 3 years |

| 2nd Offense - Imprisonment | 90 days - 12 months; mandatory 72 hours for 2nd in 10 years, otherwise can be probated |

| 2nd Offense - Fine | $600-$1000 |

| 2nd Offense - Other | 30 days community service min, IID 6 months min, evaluation and treatment program mandatory, mandatory DUI school, photo of offender must be published in local newspaper |

| 3rd Offense - DL Revocation | 5 years |

| 3rd Offense - Imprisonment | 120 days - 12 months; sentence can be probated unless 3rd in 10 years, then 15 days mandatory incarceration |

| 3rd Offense - Fine | $1000-$5000 |

| 3rd Offense - Other | min 30 days community service, 6 months IID, DUI school required, photo of offender must be published in local newspaper |

| 4th Offense - Imprisonment | 1-5 years, sentence can be probated to 90 days mandatory minimum |

| 4th Offense - Fine | $1000-$5000 |

| 4th Offense - Other | 60 days community service, can be suspended if 3 years jail term served, 6 months IID min |

| Mandatory Interlock | repeat offenders |

Marijuana-Impaired Driving Laws

Marijuana is still not legal in any form in Georgia, and driving while high will get you a DUI.

According to NORML, “A person is guilty of a DUI if that person drives any moving vehicle while under the influence of any drug to the extent that it is less safe for the person to drive.”

So, don’t drink or smoke and drive.

Distracted Driving Laws

On July 1, 2018, the “Hands-Free Georgia Act” went into effect. This means Georgia drivers cannot:

- Hold a phone in their hand or have it touching any part of their body while talking on their phone while driving

- Write, read or send text messages, emails, social media content, and other internet data while on the road — though voice-to-text is allowed

- Watch videos when they are on the road, except for GPS and navigational video

- Record video when they are on the road

Take this law seriously.

Not only is it a safety issue, but it will also cost you.

The fine for a first conviction is $50 and one point against your license. The fine is $100 and two points for a second conviction, and $150 and three points for three or more convictions.

Driving Safely in Georgia

Driving safely is important wherever you are, but read on for some important information about keeping you, your family, and your vehicles safe in Georgia.

Vehicle Theft in Georgia

From the city of Abbeville to Zebulon, the FBI tracks the number of motor vehicle thefts in Georgia. In 2016, over 26,000 cars were stolen in the state. It’s important to check your insurance policy for coverage in the case of vehicle theft.

What vehicles are stolen the most in the Peach State? The table below shows the top-10 most-stolen cars in Georgia for 2018 by make, model, and model year.

| Make/Model | Year | # of Thefts |

|---|---|---|

| Honda Accord | 1997 | 1,052 |

| Ford Pickup (Full Size) | 2006 | 954 |

| Chevrolet Pickup (Full Size) | 1999 | 948 |

| Honda Civic | 2000 | 653 |

| Toyota Camry | 2014 | 568 |

| Chevrolet Impala | 2008 | 512 |

| Nissan Altima | 2014 | 484 |

| Dodge Pickup (Full Size) | 2003 | 452 |

| Jeep Cherokee/Grand Cherokee | 2001 | 449 |

| Dodge Caravan | 2002 | 425 |

And did you know: the likelihood of your particular car type being stolen can affect your car insurance premium?

How Much Auto Insurance Costs in Georgia

Find affordable car insurance rates tailored to your location in key Georgia cities such as Atlanta, Savannah, and more. Discover the perfect insurance plan for your budget, whether you’re in Athens, Columbus, or Sandy Springs. Join us as we navigate the intricacies of auto insurance costs in Augusta, Dalton, and beyond. Drive confidently with the right coverage at the right price in Georgia!

Road Fatalities in Georgia

Georgia’s highways, interstates, and roads are busy given the state’s growth. The table below shows the 2017 statistics on traffic fatalities in Georgia.

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 1,540 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 1,057 |

| Motorcyclist Fatalities | 139 |

| Drivers Involved in Fatal Crashes | 2,283 |

| Pedestrian Fatalities | 253 |

| Bicyclist and Other Cyclist Fatalities | 15 |

Most Fatal Highway in Georgia

The most fatal highway in Georgia is I-20 in Atlanta. This interactive study provides some interesting information on Georgia’s deadliest roadways.

Fatal Crashes by Weather Condition & Light Condition

Not surprisingly, crashes are highly determinate by weather and light conditions. A rare ice storm in late January of 2014, for instance, turned Atlanta’s network of roadways, highways, and interstates into a deadly parking lot.

The table below provides a breakdown of fatal crashes by weather and light conditions across Georgia in 2017.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 690 | 140 | 448 | 44 | 1 | 1,323 |

| Rain | 44 | 7 | 39 | 2 | 0 | 92 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 3 | 1 | 14 | 1 | 0 | 19 |

| Unknown | 1 | 0 | 1 | 0 | 0 | 2 |

| TOTAL | 741 | 148 | 503 | 47 | 1 | 1,440 |

Fatalities (All Crashes) by County

Given the concentration of drivers in certain areas of Georgia, it’s not surprising some counties are more dangerous for drivers than others. The table below provides the top-10 counties in Georgia for auto fatalities in 2017.

| Georgia Counties by 2017 Ranking | Counties | Fatalities 2013 | Fatalities 2014 | Fatalities 2015 | Fatalities 2016 | Fatalities 2017 | % Change From Previous Year 2014 | % Change From Previous Year 2015 | % Change From Previous Year 2016 | % Change From Previous Year 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Fulton County | 85 | 77 | 104 | 130 | 115 | -9 | 35 | 25 | -12 |

| 2 | Dekalb County | 70 | 55 | 83 | 80 | 95 | -21 | 51 | -4 | 19 |

| 3 | Gwinnett County | 45 | 55 | 67 | 61 | 66 | 22 | 22 | -9 | 8 |

| 4 | Cobb County | 59 | 49 | 49 | 59 | 53 | -17 | 0 | 20 | -10 |

| 5 | Bibb County | 31 | 23 | 21 | 28 | 34 | -26 | -9 | 33 | 21 |

| 6 | Cherokee County | 16 | 12 | 12 | 7 | 32 | -25 | 0 | -42 | 357 |

| 7 | Clayton County | 26 | 21 | 26 | 48 | 32 | -19 | 24 | 85 | -33 |

| 8 | Richmond County | 23 | 27 | 27 | 17 | 32 | 17 | 0 | -37 | 88 |

| 9 | Hall County | 17 | 21 | 33 | 31 | 31 | 24 | 57 | -6 | 0 |

| 10 | Chatham County | 44 | 26 | 54 | 44 | 29 | -41 | 108 | -19 | -34 |

Fatalities by Person Type

Not only motorists die on Georgia roads. Pedestrians, cyclists, and others are part of the state’s transportation system, too. The table below shows 2017 fatalities by person type, specifically occupants of enclosed vehicles, motorcyclists, and nonoccupants.

| Person Type | Number |

|---|---|

| Occupants (Enclosed vehicles) | 1,127 |

| Motorcyclists | 139 |

| Nonoccupants | 274 |

Fatalities by Crash Type

Crashes are caused by a variety of reasons, from speeding to drunk driving. The following table shows Georgia fatalities by crash type in 2017.

| Crash Type | Number |

|---|---|

| Single Vehicle | 823 |

| Involving a Large Truck | 214 |

| Involving Speeding | 248 |

| Involving a Rollover | 361 |

| Involving a Roadway Departure | 769 |

| Involving an Intersection (or Intersection Related) | 401 |

Five-Year Trend For the Top 10 Counties

Georgia is growing, and growing fast. The table below provides the five-year road fatality trends for the state’s 10 biggest counties.

| Georgia Counties by 2017 Ranking | County | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|---|

| 1 | Fulton County | 85 | 77 | 104 | 130 | 115 |

| 2 | Dekalb County | 70 | 55 | 83 | 80 | 95 |

| 3 | Gwinnett County | 45 | 55 | 67 | 61 | 66 |

| 4 | Cobb County | 59 | 49 | 49 | 59 | 53 |

| 5 | Bibb County | 31 | 23 | 21 | 28 | 34 |

| 6 | Cherokee County | 16 | 12 | 12 | 7 | 32 |

| 7 | Clayton County | 26 | 21 | 26 | 48 | 32 |

| 8 | Richmond County | 23 | 27 | 27 | 17 | 32 |

| 9 | Hall County | 17 | 21 | 33 | 31 | 31 |

| 10 | Chatham County | 44 | 26 | 54 | 44 | 29 |

Fatalities Involving Speeding by County

Speeding can be deadly. The following table illustrates the 2017 statistics on fatalities caused by speeding in Georgia by county.

| Rank | County | Fatalities 2016 | Deaths Per 100K Population 2016 | Rank | County | Fatalities 2016 | Deaths Per 100K Population 2016 |

|---|---|---|---|---|---|---|---|

| 1 | Glascock County | 2 | 66.84 | 25 | Appling County | 1 | 5.41 |

| 2 | Baker County | 2 | 62.34 | 26 | Long County | 1 | 5.38 |

| 3 | Miller County | 3 | 51.01 | 27 | Pierce County | 1 | 5.2 |

| 4 | Stewart County | 1 | 17.02 | 28 | Clayton County | 14 | 5 |

| 5 | Crawford County | 2 | 16.27 | 29 | Washington County | 1 | 4.92 |

| 6 | Clinch County | 1 | 14.73 | 30 | Liberty County | 3 | 4.89 |

| 7 | Screven County | 2 | 14.25 | 31 | Dodge County | 1 | 4.8 |

| 8 | Meriwether County | 3 | 14.24 | 32 | Columbia County | 7 | 4.75 |

| 9 | Brooks County | 2 | 12.74 | 33 | Mcduffie County | 1 | 4.66 |

| 10 | Seminole County | 1 | 11.84 | 34 | Putnam County | 1 | 4.64 |

| 11 | Marion County | 1 | 11.75 | 35 | Jackson County | 3 | 4.62 |

| 12 | Cook County | 2 | 11.64 | 36 | Bibb County | 7 | 4.57 |

| 13 | Bryan County | 4 | 11.16 | 37 | Habersham County | 2 | 4.53 |

| 14 | Morgan County | 2 | 11.04 | 38 | Franklin County | 1 | 4.48 |

| 15 | Early County | 1 | 9.71 | 39 | Richmond County | 9 | 4.46 |

| 16 | Harris County | 3 | 8.92 | 40 | Thomas County | 2 | 4.44 |

| 17 | Chattooga County | 2 | 8.05 | 41 | Troup County | 3 | 4.3 |

| 18 | Decatur County | 2 | 7.49 | 42 | Dawson County | 1 | 4.23 |

| 19 | Dooly County | 1 | 7.2 | 43 | Douglas County | 6 | 4.22 |

| 20 | White County | 2 | 6.94 | 44 | Floyd County | 4 | 4.14 |

| 21 | Baldwin County | 3 | 6.64 | 45 | Grady County | 1 | 4.02 |

| 22 | Jefferson County | 1 | 6.33 | 46 | Hart County | 1 | 3.91 |

| 23 | Telfair County | 1 | 6.24 | 47 | Bartow County | 4 | 3.87 |

| 24 | Pike County | 1 | 5.58 | 48 | Monroe County | 1 | 3.72 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Drunk driving is one of the most notorious causes of road fatalities, and for good reason. This table offers the 2017 statistics on crash fatalities involving an alcohol-impaired driver in Georgia by county.

| County Name | Fatalities Per 100,000 Population | County Name | Fatalities Per 100,000 Population |

|---|---|---|---|

| Baker County | 62.5 | Morgan County | 10.86 |

| Talbot County | 48.01 | Appling County | 10.8 |

| Taylor County | 36.85 | Brantley County | 10.68 |

| Chattahoochee County | 29.01 | Long County | 10.52 |

| Echols County | 25.41 | Pierce County | 10.36 |

| Burke County | 22.2 | Early County | 9.71 |

| Jasper County | 21.48 | Mcduffie County | 9.3 |

| Stewart County | 16.71 | Evans County | 9.28 |

| Washington County | 14.77 | Mitchell County | 8.97 |

| Screven County | 14.33 | Pulaski County | 8.93 |

| Mcintosh County | 14.18 | Colquitt County | 8.73 |

| Randolph County | 14.13 | Towns County | 8.69 |

| Putnam County | 13.81 | Chattooga County | 8.07 |

| Emanuel County | 13.32 | Grady County | 8.06 |

| Franklin County | 13.15 | Charlton County | 7.86 |

| Dawson County | 12.31 | Macon County | 7.51 |

| Marion County | 11.83 | Dooly County | 7.28 |

| Hart County | 11.63 | Coffee County | 6.97 |

| Stephens County | 11.59 | Madison County | 6.83 |

| Terrell County | 11.46 | Rockdale County | 6.64 |

| Camden County | 11.31 | Bulloch County | 6.57 |

| Decatur County | 11.23 | Newton County | 6.48 |

| Peach County | 11.07 | Pickens County | 6.33 |

| Monroe County | 11.06 | Telfair County | 6.25 |

| Dade County | 6.14 |

Teen Drinking & Driving

Teen drunk driving is a tragic statistic we must discuss. Thankfully, the Centers for Disease Control reports that fewer Georgia teens died in drunk driving incidents than the national average.

The table below provides 2017 statistics on teens and driving under the influence in Georgia.

| Teens and Drunk Driving | Limits |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 1.0 |

| Higher/Lower Than National Average (1.2) | Lower |

| DUI Arrest (Under 18 years old) | 89 |

| DUI Arrests (Under 18 years old) Total Per Million People | 35.44 |

EMS Response Time

Given the large urban-rural divide in Georgia, EMS response times can vary greatly by where you live and how populated your city or county is.

The table below breaks down the average EMS response time for urban and rural areas of the Peach State, from time of the crash to EMS notification, to time of the crash to hospital arrival.

| Type | Time of Crash to EMS to Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Urban | 4.56 | 8.34 | 33.44 | 43.25 |

| Rural | 5.85 | 11.75 | 43.72 | 58.80 |

Transportation in Georgia

As we’ve already seen, Georgia drivers are commuters. They spend more time commuting and own more cars per household than the national average.

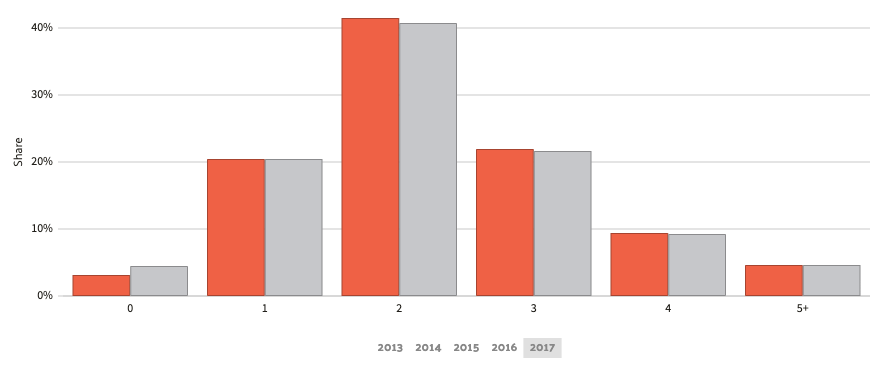

Car Ownership

Georgians love to own cars! In 2016, there were over 3.5 million cars registered with the state. The graph below provides some more recent data.

Commute Time

Georgians have an average commute time of 27.1 minutes, but your commute largely depends on where you live. The table below shows the Georgia cities where you’ll spend the most time in traffic

| City | Hours in Congestion | Commute in Traffic: Peak | Commute in Traffic: Daytime | Commute in Traffic: Overall |

|---|---|---|---|---|

| Atlanta, GA | 70 | 17% | 9% | 10% |

| Savannah, GA | 14 | 7% | 6% | 7% |

| Athens, GA | 12 | 7% | 6% | 6% |

| Gainesville, GA | 12 | 7% | 6% | 5% |

| Buford, GA | 8 | 5% | 6% | 5% |

| Columbus, GA | 8 | 4% | 3% | 4% |

| Augusta, GA | 7 | 4% | 3% | 3% |

| Macon, GA | 7 | 4% | 3% | 3% |

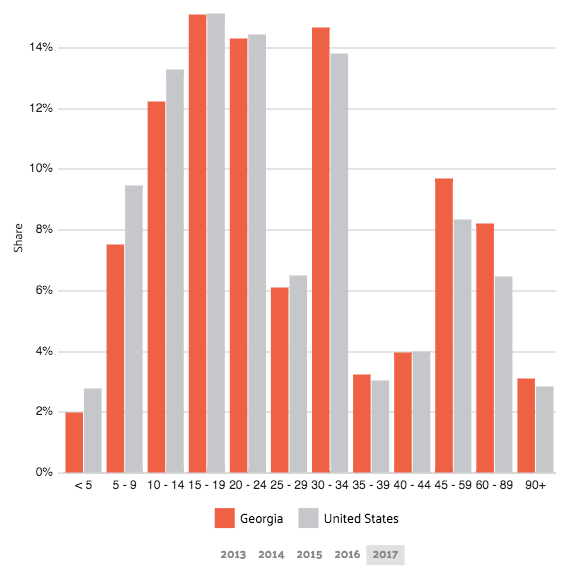

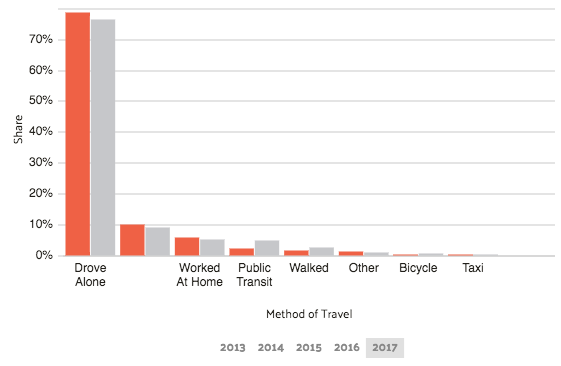

Commuter Transportation

Large-scale commuter transportation is only available in metro Atlanta, home of the Metropolitan Atlanta Rapid Transit Authority (MARTA).

Still, more Georgians commute alone in a car they own than the national average, as evidenced by the graph below.

Traffic Congestion

Traffic congestion is a huge concern in metro Atlanta. Traffic monitoring organization TomTom explains that the metropolis has an average congestion rate of 26% for 2018, while Numbeo offers that Atlanta’s traffic is the third-worst in the United States, just behind Detroit and Los Angeles.

Despite this, most parts of the Peach State have less congestion. But as Georgia continues to grow from its Atlantic beaches to its western mountains, so, too, will the statewide traffic congestion issues.

Has this guide helped you learn more about your liabilities as a driver in Georgia? What part was the most helpful?

Take the next step by getting the best auto insurance quotes for Georgia just by entering your zip code below.

Frequently Asked Questions

What is the minimum car insurance required by law in Georgia?

In Georgia, drivers are required to carry liability insurance that covers at least $25,000 per person and $50,000 per accident for bodily injury, as well as $25,000 per accident for property damage.

What other types of auto insurance are available in Georgia?

In addition to liability insurance, drivers in Georgia can choose to purchase collision insurance, which covers damages to their own vehicle in the event of an accident, and comprehensive insurance, which covers non-collision events such as theft, vandalism, and natural disasters.

Are there any additional coverage options available in Georgia?

Yes, there are several optional coverage options available in Georgia, including uninsured/underinsured motorist coverage, medical payments coverage, and rental car coverage.

How are car insurance rates determined in Georgia?

Car insurance rates in Georgia are determined by a variety of factors, including the driver’s age, gender, driving history, credit score, and the type of vehicle being insured. Insurance companies also consider local crime rates, weather patterns, and other factors that may affect the risk of accidents or theft.

Are there any discounts available for car insurance in Georgia?

Yes, there are several discounts available to Georgia drivers, including safe driver discounts, multi-vehicle discounts, and discounts for installing safety features such as anti-theft devices or airbags.

What happens if I’m in an accident with an uninsured driver in Georgia?

If you are in an accident with an uninsured driver in Georgia, you may be able to make a claim under your own uninsured motorist coverage, if you have it. Alternatively, you may need to pursue legal action against the other driver to recover damages.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.