Expert Nebraska Car Insurance Advice (Compare Costs & Companies)

While Nebraska drivers may opt to carry just minimum liability insurance, as it is an average of $35/mo in Nebraska, expert Nebraska car insurance advice is to carry more than the state-required minimum. Nebraska full coverage insurance is an average of $146/mo, but it offers the best protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Nebraska drivers must have liability insurance in the amount of 25/50/25

- Nebraska liability insurance is an average of $35 per month

- Nebraska full coverage insurance is an average of $146 per month

If you need expert Nebraska car insurance advice on how to find affordable car insurance that also offers great protection, we’ve created this comprehensive guide to help you find the best Nebraska car insurance for you and your family.

Here you’ll find a wealth of information specific to driving safely in Nebraska: coverage and rates, car insurance providers, state laws, and a lot more. At any time, you can use our free quote comparison tool to find affordable car insurance in Nebraska.

Nebraska Car Insurance Coverage & Rates

Whether you’re moving to Nebraska or are a long-time Nebraskan, we’ve created this guide to help you find the best auto insurance coverage and rates from the Mighty Mississippi River to the foothills of the Rocky Mountains.

Nebraska’s Car Culture

Nebraskans love their cars. As of 2019, there are 2,503,163 registered vehicles and 1,450,479 licensed drivers in Nebraska.

With just under 2 million residents, that means there are more cars than people in this gateway to the Great Plains.

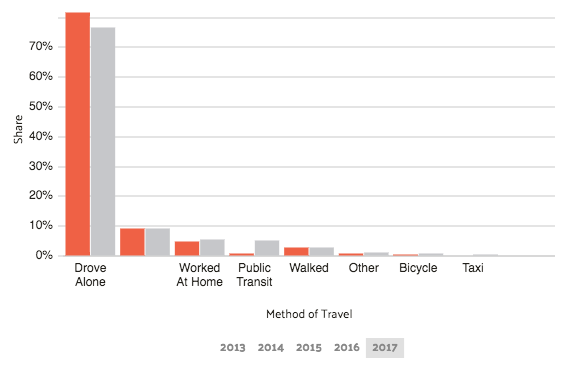

Given that the state is largely rural, you won’t find a ton of public transportation options in Nebraska outside its two biggest cities, Omaha and Lincoln, which also happen to be university towns.

Nebraska Minimum Coverage

Nebraska’s minimum insurance laws are fairly straightforward. The state requires liability insurance that covers:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle.

Although Nebraska does not require insurance beyond basic liability, comprehensive insurance is fairly affordable in most areas of the state. Below we’ll cover some great ways to make your insurance work better for you.

Forms of Financial Responsibility

Nebraska takes insurance very seriously. Their zero-tolerance law means your “license and/or operating privileges will be automatically suspended when you have been convicted/found guilty of a citation for No Proof of Insurance.” Yikes.

We want to help you avoid that.

The easiest way to prove you have car insurance is to carry your proof of insurance — or auto insurance ID card — with you at all times. But we all make mistakes, and the State of Nebraska gives you a few more options for proving financial responsibility:

- A completed and filed form SR-22

- A Bond of a Surety Company for at least $75,000

- A Cash Bond of $75,000 furnished by certified check, bank draft, or money order

Premiums as a Percentage of Income

Nebraskans’ median household income was $59,970 for 2017, just a few hundred dollars below the national average of $60,336. And that household income has been rising steadily for the last few years.

Disposable income is the amount of money a person has to spend or save after they have paid their taxes. You might call it “take-home pay.”

Cornhuskers spend a lower-than-average amount of their annual disposable income on car insurance. In 2014, the nationwide average was 2.29 percent, whereas Nebraska’s was only 1.81 percent.

Here’s the average of Nebraska’s car insurance premiums as a percentage of income between 2012 – 2014:

- 2012: 1.86 percent

- 2013: 1.88 percent

- 2014: 1.81 percent

Average Monthly Car Insurance Rates in NE (Liability, Collision, Comprehensive)

The State of Nebraska requires much less car insurance than more populous states. But remember, experts agree: the better insured you are, the better prepared you will be to deal with an accident, whether or not you are at fault.

Additional Liability

Though anything above liability insurance is optional in Nebraska, having stronger coverage may help you avoid financial hardship or even bankruptcy should medical or property damage bills stack up. (Though kudos to Nebraska for being one of the states with the lowest uninsured driver rates at 6.8 percent.)

An insurer’s loss ratio is how much the company spends on claims compared to how much money they receive in premiums.

For instance, if a company spends $750 in claims for every $1,000 they receive in premiums, they have a loss ratio of 75 percent. Accordingly, loss ratios above 100 percent mean an insurer is losing money — though note that abnormally low loss ratios mean a company isn’t paying out much in claims.

The National Association of Insurance Commissioners (NAIC) reports that in 2017, the national average for loss ratios was 73 percent. Our research shows insurance loss ratios between 60 and 70 percent are optimal.

Here are the loss ratios for Nebraska between 2012 – 2014:

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 78.34% | 81.17% | 80.34% |

| Uninsured/Underinsured Motorist | 65.48% | 66.40% | 74.06% |

With only 6.8 percent — compared to a national average of 13 percent — of uninsured motorists, Nebraskans are taking advantage of higher coverage levels, which is safer not only for each of us individually but also for our neighbors.

Not having enough car insurance can put you — and those around you — at risk.

Add-Ons, Endorsements, & Riders

Ample coverage at an affordable premium is likely your number-one goal in shopping for car insurance.

Luckily for you, there are a lot of cheap but powerful extras you can add to your policy to ensure you are better covered in case of an accident or other events. Here are some useful add-ons you might consider in Nebraska:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

Another option to consider: Personal Injury Protection (PIP). PIP, otherwise known as no-fault insurance, covers medical bills incurred from a wreck, regardless of who is at fault, who is driving, or who owns the vehicle.

Average Monthly Car Insurance Rates by Age & Gender in NE

More and more states are outlawing gender discrimination in insurance premiums. Though Nebraska hasn’t enacted legislation quite yet, rates for male and female drivers are comparable.

Our research shows that age and marital status are much more determinate of one’s car insurance premiums. In the table below, we show average rates by age, gender, and carrier.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allied | $1,812.89 | $1,872.18 | $1,622.89 | $1,738.25 | $4,171.27 | $5,204.70 | $2,086.90 | $2,259.18 |

| Allstate | $2,181.35 | $2,077.34 | $1,938.05 | $1,954.86 | $6,080.95 | $6,397.53 | $2,455.30 | $2,507.30 |

| American Family | $1,770.79 | $1,770.79 | $1,612.52 | $1,612.52 | $2,966.53 | $4,367.34 | $1,732.11 | $1,874.67 |

| Geico | $2,948.59 | $2,893.21 | $2,888.54 | $2,779.55 | $6,078.75 | $7,963.78 | $2,659.17 | $2,575.93 |

| Mid-Century | $2,294.53 | $2,283.40 | $2,057.06 | $2,167.27 | $8,770.83 | $9,042.05 | $2,594.48 | $2,713.90 |

| Progressive Northern | $2,108.34 | $2,038.13 | $1,730.90 | $1,797.14 | $8,039.05 | $9,069.45 | $2,524.47 | $2,700.63 |

| Safeco | $3,285.67 | $3,565.82 | $2,594.19 | $3,158.12 | $14,111.65 | $15,859.09 | $3,448.52 | $3,821.47 |

| State Farm | $1,595.00 | $1,595.00 | $1,395.53 | $1,395.53 | $4,288.72 | $5,477.80 | $1,760.67 | $1,993.40 |

| USAA | $1,386.59 | $1,384.24 | $1,260.17 | $1,299.75 | $4,333.52 | $5,190.05 | $1,795.93 | $2,005.79 |

Cheapest Rates by Zip Code

The most expensive car insurance in a Nebraska zip code is for those living in 68111, a neighborhood just north of the core of downtown Omaha, by far the state’s biggest city. The chart below lists the highest and lowest rates according to Nebraska’s zip codes.

How Much Car Insurance Rates in Nebraska

Discover how car insurance rates vary across different cities in Nebraska. Select your city from the list below to learn about insurance costs in your area.

| Find Affordable Car Insurance Rates in Nebraska |

|---|

| Lincoln, NE |

| Mccook, NE |

| Neligh, NE |

| Omaha, NE |

| Oshkosh, NE |

Best Nebraska Car Insurance Companies

So who is the best car insurer in the Cornhusker State? That depends on what you value, your demographic information, your driving history, and where you live.

Some companies are best for some types of drivers, but it all depends on your circumstances and insurance needs. The Nebraska Department of Insurance is also a great resource, and they exist to protect the state’s insurance consumers.

In the following sections, we offer a lot of information to consider as you shop for Nebraska auto insurance.

The Largest Companies’ Financial Rating

AM Best provides insurance companies’ financial ratings. A good score means a company is highly likely to stay solvent and have the ability to pay customer claims. A bad score can signal a warning sign for potential customers.

Companies with Best Ratings

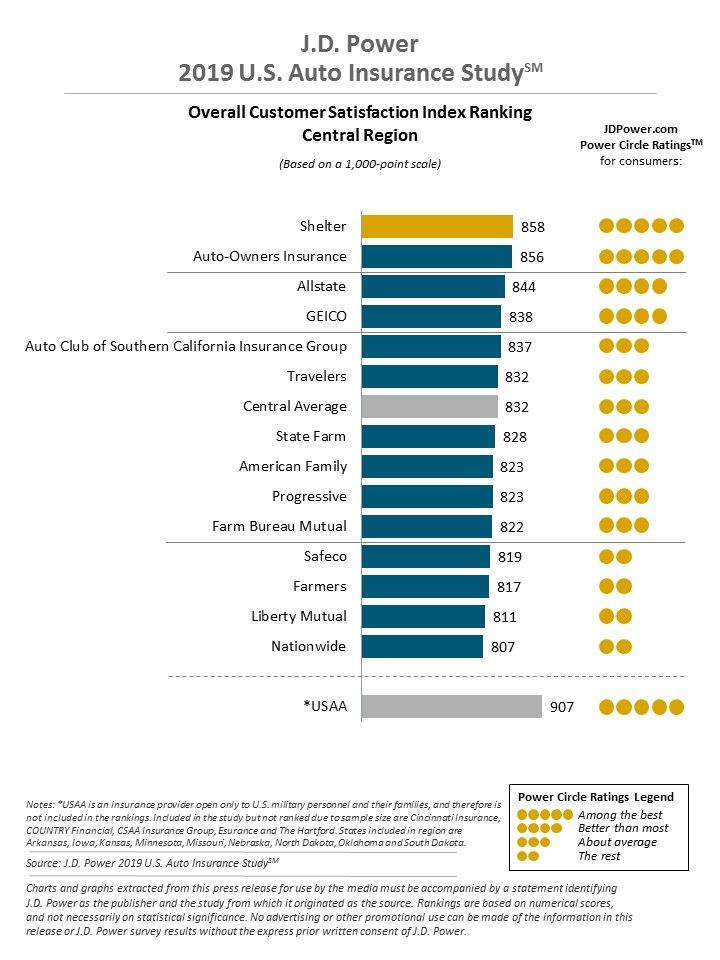

Nebraska is part of J.D. Power’s Central Region. For 2018, they rated these companies best for car insurance:

But knowing a company’s financial and J.D. Power ratings is just the beginning. It’s also important to ask: what does an insurance company’s current, or past, customers say about their service?

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Commute Rates by Companies

Nebraskans have the fifth-shortest average commute in the nation, only 18 minutes each way compared to an American average of 26.1 minutes.

And though our research shows that commute time isn’t a huge factor in determining car insurance premiums for Nebraskans, here’s some information for the state’s top carriers based on commute milage:

But more importantly, do you know how much car insurance you need or want?

Coverage Level Rates by Companies

Not surprisingly, the amount of coverage you need highly affects your car insurance premium. For instance, if you need a lot of coverage above just liability, American Family Insurance will likely be the cheapest car insurance provider for you in Nebraska.

The table below provides averages rates for low, medium, and high coverage levels for the top 10 insurance providers in Nebraska.

| Company | Low Level Coverage | Medium Level Coverage | High Level Coverage |

|---|---|---|---|

| Allstate | $3,121.13 | $3,193.28 | $3,282.84 |

| American Family | $2,196.25 | $2,279.32 | $2,164.66 |

| Farmers | $3,823.80 | $3,933.99 | $4,213.54 |

| Geico | $3,760.03 | $3,844.99 | $3,940.29 |

| Liberty Mutual | $6,057.90 | $6,197.21 | $6,436.58 |

| Nationwide | $2,637.85 | $2,585.77 | $2,564.48 |

| Progressive | $3,580.81 | $3,741.58 | $3,930.65 |

| State Farm | $2,342.89 | $2,433.89 | $2,536.33 |

| USAA | $2,256.68 | $2,328.68 | $2,410.66 |

Always remember the more insurance you have, the better prepared you are in the case of an accident or other issue involving your driving.

Credit History Rates by Companies

Did you know your credit history can affect your auto insurance rates? It’s one of the many factors insurance companies take into account when determining your premium.

With an average Vantage credit score of 695, Nebraskans have one of the top 10 best average credit scores across the United States. But even if you have a poor credit history, your car insurance need not be cost-prohibitive. In Nebraska, both State Farm and Progressive provide reasonable premiums for folks with poor credit.

Whether you have good, fair, or poor credit, here’s some information you should know about different companies in the Cornhusker State:

| Company | Good Credit History | Fair Credit History | Poor Credit History |

|---|---|---|---|

| Allstate | $2,607.28 | $3,020.24 | $8,995.67 |

| American Family | $1,648.32 | $2,026.00 | $4,572.61 |

| Farmers | $3,608.23 | $3,790.48 | $4,400.38 |

| Geico | $3,326.47 | $3,818.47 | $4,307.21 |

| Liberty Mutual | $4,266.87 | $5,429.16 | $3,969.74 |

| Nationwide | $2,183.71 | $2,483.58 | $3,541.78 |

| Progressive | $3,333.16 | $3,612.67 | $3,120.82 |

| State Farm | $1,648.11 | $2,123.22 | $3,108.18 |

| USAA | $1,784.78 | $2,103.06 | $2,965.91 |

What’s affects your car insurance premium more than your credit history? Your driving record.

Driving Record Rates by Companies

We all make mistakes, and that’s often reflected in our driving records.

Whether you’ve had an accident, a speeding ticket, or a DUI, your insurance is affected by your past on the open roads of Nebraska. If you’re a Nebraskan with a DUI, for instance, American Family Insurance will likely be the cheapest car insurance provider for you. Have a speeding ticket on your record? Nationwide will probably be your best option.

The table below illustrates how Nebraska’s top insurers consider a speeding ticket, an accident, or a DUI in determining your car insurance premium.

| Company | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $2,778.41 | $3,105.70 | $3,132.72 | $3,779.52 |

| American Family | $2,167.41 | $2,167.41 | $2,351.41 | $2,167.41 |

| Farmers | $3,378.04 | $4,034.21 | $4,328.05 | $4,221.46 |

| Geico | $2,468.24 | $4,021.98 | $3,549.90 | $5,353.65 |

| Liberty Mutual | $5,344.48 | $6,456.53 | $6,294.37 | $6,826.89 |

| Nationwide | $1,841.14 | $2,087.26 | $2,660.35 | $3,795.39 |

| Progressive | $3,189.50 | $3,572.84 | $4,674.90 | $3,566.80 |

| State Farm | $2,267.34 | $2,437.70 | $2,608.08 | $2,437.70 |

| USAA | $1,769.47 | $2,004.52 | $2,227.91 | $3,326.12 |

Largest Car Insurance Companies in Nebraska

Bigger can sometimes mean better and cheaper. The table below gives the top 10 auto insurers in Nebraska by their market share, direct premiums written, and loss ratio.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate | $6.0 million | 63.38% | 4.86% |

| American Family | $10.1 million | 77.13% | 8.08% |

| Farmers | $4.3 million | 57.72% | 3.44% |

| Farmers Mutual | $10.7 million | 65.57% | 8.56% |

| Geico | $7.0 million | 86.22% | 5.67% |

| Iowa Farm Bureau | $8.5 million | 65.32% | 6.81% |

| Nationwide | $6.7 million | 60.94% | 5.41% |

| Progressive | $15.6 million | 66.71% | 12.48% |

| State Farm | $28.9 million | 70.76% | 23.13% |

| USAA | $5.3 million | 91.23% | 4.31% |

| **State Total** | $125.2 million | 70.17% | 100.00% |

Number of Foreign vs. Domestic Insurers in Nebraska

Foreign vs. Domestic might sound misleading when it comes to talking about car insurers. When it comes to car insurance, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Nebraska has 34 domestic car insurance companies and 867 foreign car insurance providers.

Nebraska Laws

It’s always important to know the laws where you’re driving, but we know navigating each state’s particular laws can be confusing. The National Motorists Association offers a top-notch overview of Nebraska’s driving laws, many of which we’ll talk about below.

And remember: legal violations are a key factor in determining your car insurance premiums. So, obey the law to stay safe and save money.

Car Insurance Laws

As we talked about above, Nebraska requires provable liability car insurance with the following minimums:

- Minimum bodily injury liability $25,000/$50,000

- Minimum property damage liability $25,000

- Uninsured/underinsured motorist bodily injury $25,000/$50,000

And remember, these are minimums. Depending on your driving record, your credit history, and your typical commute, more comprehensive coverage might serve you and your family best.

How State Laws for Insurance are Determined

How exactly do insurance laws get made? It differs from state to state, like in Nebraska, home of the nation’s only unicameral (one body) state legislature.

The National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia, and five U.S. territories. They offer this great guide to understanding how the sausage gets made.

Windshield Coverage

Nebraska law doesn’t require windshield coverage for its minimum liability rules. However, individual insurance companies may offer coverage and/or a zero-dollar deductible.

Depending on your insurance needs, it’s certainly worth investigating whether windshield coverage is a smart add-on to your auto insurance policy. After all, glass damage is one of the most-filed claims when it comes to car insurance anywhere.

High-Risk Insurance

Like many states, Nebraska uses a points system. The more points — or infractions on your driving record — the higher your car insurance premium.

But even if you’ve made a mistake or two, all hope is not lost for low-cost, quality auto insurance. Nebraska offers a driver improvement course that can be completed once every five years. Completion of the course results in two points removed from your record, which will likely result in lower car insurance rates.

Automobile Insurance Fraud in Nebraska

Like most places, automobile insurance fraud is a criminal offense in Nebraska.

Nebraska defines insurance fraud as “any deliberate deception committed against, or by, an insurance company, insurance agent, or consumer for unjustified financial gain.” Your first violation will cost you at least $5,000, and the penalties only go up from there.

Statute of Limitations

A statute of limitations is the amount of time you have to bring a lawsuit to court.

In most cases, these statutes vary state-to-state. Under Nebraska Revised Statute 25-207, you have four years to file either personal injury or property damage lawsuits following a car accident.

It’s important to know what rights you have and what to do following a car accident. In Nebraska, for instance, you have four years to file a lawsuit. However, accidents involving death, personal injury, or property damage exceeding $500 must be reported within 10 days to the Department of Transportation in Lincoln.

State-Specific Laws

Every state has its quirks when it comes to driving and insurance laws. For instance, in Nebraska, those charged with a DUI or DWI have the right to a trial by a jury of their peers. Also, no texting on Nebraska roads, no matter your age.

Check out The National Motorists Association’s summary of Nebraska-specific driving laws.

Vehicle Licensing Laws

Like almost everywhere, Nebraska requires a valid driver’s license to operate a vehicle. And who doesn’t love getting their picture taken at the DMV?

According to the Nebraska Department of Motor Vehicles, the following people must have a valid Nebraska license:

- Any Nebraska resident who operates a motor vehicle on the streets and highways of Nebraska must have a license.

- Any new resident with a valid license from another state must obtain a Nebraska license within 30 days.

And remember, Nebraska has a zero-tolerance policy for driving without proof of insurance.

REAL ID

The U.S. Department of Homeland Security explains that Nebraska IDs are compliant with the federal REAL ID system. So get a Nebraska license and you’re good to enter a federal facility, like the Fort Calhoun Nuclear Power Plant, just north of Omaha in Blair.

REAL ID laws can affect your travel, especially if you’re traveling by air. So it’s good to know before you go.

Teen Driver Laws

Given the rural communities that make up a majority of Nebraska’s landscape, the state has some unique teen permitting and driving laws. The table below explains some of those unique exceptions for Nebraska’s teens.

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 15 in metropolitan areas, and 14 and 2 mos. in rural areas | no more than 1 passenger younger than 19 secondary enforcement (family members excepted) | midnight-6 a.m. secondary enforcement |

| Provisional License | 16 with holding period of 6 months and 50 hours, 10 of which must be at night (none with driver education) | no more than 1 passenger younger than 19 secondary enforcement (family members excepted) | midnight-6 a.m. secondary enforcement |

| Full License | 16 | Passenger restrictions lifted: 6 months or age 18, whichever occurs first (min. age: 16, 6 mos.) | Time restrictions lifted: 12 months or at age 18, whichever occurs first (min. age: 17) |

In counties designated rural, teens who are at least 14 years and two months of age may be issued a learner’s permit (called an “LPE permit”) and a limited license (called a “school permit”). Both require adult supervision when in use.

It’s important to note, however: the same point system is in effect for teens and those under 21 years of age, except it’s harsher.

If a driver under the age of 21 accumulates six or more points within 12 months, the only way to prevent suspension is to complete a Defensive Driving Course within three months of notification by the DMV.

Older Driver License Renewal Procedures

Nebraska’s older drivers don’t differ greatly in their renewal procedures from younger citizens.

When it comes to the method of renewal and proof of vision, however, there are a couple of key differences. The table below makes those differences clear as the sky over Western Nebraska.

| Renewal Procedures | General Population | Older Population |

|---|---|---|

| License renewal cycle | 5 years | 5 years |

| Mail or online renewal permitted | online, every other renewal | not permitted 72 and older |

| Proof of adequate vision required at renewal | when renewing in person | 72 and older, every renewal |

New Residents 732-609-0959

Getting a new license in Nebraska is relatively easily. The Nebraska Department of Motor Vehicles explains you need to fill out an application with them and provide:

- Proof of U.S. Citizenship or Lawful Status, containing name, date of birth, and identity

- Two documents showing proof of address

- Disclosure of valid social security number verified by the Social Security Administration or proof of exemption.

And don’t forget: you need to get your Nebraska license within 30 days of moving to the Cornhusker State.

Rules of the Road

Knowing the rules of Nebraska’s roads will not only keep you safe but will also keep your insurance more affordable. In the sections below, we’ll cover some key features of Nebraska’s transportation laws.

Fault vs. No-Fault

Nebraska is a traditional fault state, meaning the driver found responsible for the car accident is also responsible for all ensuing costs, including injuries, lost income, vehicle damage, and so on.

The more comprehensive your insurance, the better prepared you are to face accidents and other auto incidents head-on, whether or not you are at fault.

Seat Belt & Car Seat Laws

According to the Nebraska Department of Transportation, “The driver, each front-seat occupant in the vehicle and all children six years of age and less than 18 years of age must wear occupant protection systems and all occupant protection systems worn [must be] properly adjusted and fastened.”

Effective January 1, 2019, the Nebraska Child Safety Restraint Law requires that:

- All children up to age eight must ride correctly secured in a federally approved child safety seat.

- Children ride rear-facing until up to age two or until they reach the upper weight or height limit allowed by the car seat’s manufacturer.

- Children under age eight must ride in the back seat, as long as there is a back seat equipped with a seatbelt and is not already occupied by other children under eight years of age.

- Children ages eight to 18 must ride secured in a safety belt or child safety seat (booster seat).

- Childcare providers must transport all children securely in an appropriate, federally approved child safety seat or safety belt.

- Children up to age 18 are prohibited from riding in cargo areas.

A violation carries a $25 fine plus court costs and one point is assessed against the operator’s driving record. It’s important to not let those points add up, lest your insurance premium increase substantially.

Keep Right & Move Over Laws

As expected, you should stay in the right lane when driving slower than the average speed of traffic in Nebraska and use the left lane only for passing. However, Nebraska Revised Statute 60-6,134 lays out three exceptions to this rule, explaining you can pass to the right when:

- The vehicle to be overtaken is making or about to make a left turn;

- Upon a two-way street or highway with an unobstructed roadway, not occupied by parked vehicles, of sufficient width for two or more lanes of moving vehicles going in the same direction when the passing vehicle is traveling in one of such lanes; or

- Upon a one-way street, or upon any roadway on which traffic is restricted to one direction of movement when the roadway is free from obstructions and of sufficient width for two or more lanes of moving vehicles.

It’s more than just common courtesy to pull over for emergency vehicles. Unless you want a fine of $100 and up to seven days in jail, move over for emergency vehicles parked on any multi-lane road.

Speed Limits

Nebraska speed limits are absolute. That means you violate the law by driving even just one mph over the posted speed limit. In Nebraska, the maximum posted speed limits for both cars and trucks are:

- 75 mph on rural interstates

- 70 mph on urban interstates

- 70 mph on limited-access roads

- 65 mph on all other roads

And remember: speeding is one of the easiest ways to increase your car insurance premium according to our research. So slow down to keep you and your family safe and your car insurance affordable.

Ridesharing

People often find insurance liability in rideshare options like Uber and Lyft to be murky waters. But such companies’ driver requirements are pretty clear: rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance policies that align or exceed the minimum coverages dictated by state law.

Automation on the Road

Nebraska allows two types of autonomous vehicles: automated-driving-system-equipped vehicles and driverless-capable vehicles. The law mandates these vehicles must be able to achieve “a minimal risk condition” in the event of a failure.

According to the Insurance Institute for Highway Safety (IIHS), automation is the use of a machine or technology to perform a task or function that was previously carried out by a human.

In driving, automation involves using radar, camera, and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving tasks on a sustained basis.

Perhaps the future isn’t as far away for Nebraska drivers as you may expect.

Safety Laws

Driving safely is important wherever you are. The National Safety Council Nebraska helpfully reminds us that “most car crashes are the result of human error. The best way to reduce the risk of being involved in a collision is to know, and practice, safe driving techniques.”

Now that you know the proper way to insure and register your Nebraska vehicle, here’s some important information about keeping you, your family, and your vehicles safe in The Cornhusker State.

DUI Laws

DUIs are no laughing matter. Don’t ever drive drunk or buzzed. If you find yourself ticketed with drunk driving in Nebraska, and you can expect some hefty bills to pay:

| DUI Offenses | DUI Details |

|---|---|

| BAC Limit | 0.08 |

| HIGH BAC Limit | 0.15 |

| Criminal Status by Offense | 1st-3rd w/in 15 years class W misdemeanors, 4th w/in 15 years class IIIA felony, 5th+ w/in 15 years class III felonies, Injury related DUI class IIIA felony. If driver with prior felony conviction with BAC >0.15 caught driving with BAC >0.02, class IIIA misdemeanor in addition to any other penalties. |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 15 years |

| 1st Offense-ALS or Revocation | 2 month minimum; may be served with IID upon court order. If given probation or suspended sentence: 60 day DL revocation |

| 1st Offense Imprisonment | 7-60 days probation/suspended sentence: 10 days in jail or 240 hours community service |

| 1st Offense-Fine | no minimum, but up to $500 |

| 1st Offense-Other | SR-22 for three years |

| 2nd Offense-DL Revocation | 18 months; 45 days before eligible for IID |

| 2nd Offense-Imprisonment | 30-180 days; probation/suspended sentence: 10 days in jail or 240 hours community service |

| 2nd Offense-Fine | no minimum, but up to $1000 |

| 3rd Offense-DL Revocation | 15 years; probation/suspended sentence: 2-15 years, 45 days before eligible for IID |

| 3rd Offense-Imprisonment | 90 days - 1 year; probation/suspended sentence: 30 days |

| 3rd Offense-Fine | no minimum, but up to $1,000 |

| 4th Offense-DL Revocation | 15 years; probation/suspended sentence: 45 days before elegible for IID |

| 4th Offense-Imprisonment | 180 days-3 years; probation/suspended sentence: 90 days in jail |

| 4th Offense-Fine | up to $10,000; probation/suspended sentence: $2000 |

| 4th Offense-Other | 90 days CAM |

| 5th Offense | 15 years DL revocation; 2-20 years; up to $25000; probation/suspended sentence: 180 days in jail; $2000, 45 days before elegible for IID, 180 days CAM |

| Mandatory Interlock | all offenders |

Unlike most states, those charged with a DUI in Nebraska have the right to a trial by a jury of their peers.

Marijuana-Impaired Driving Laws

Nebraska has yet to enact a marijuana-impaired driving law. But with marijuana decriminalization and legalization on the uptrend, it’s probably only a matter of time.

Distracted Driving Laws

Nebraska is fairly lenient when it comes to distracted driving from handheld devices, where there is no handheld band.

Though a state-wide texting band for everyone and a cellphone ban for anyone 18 or under is in effect, these laws are secondarily enforced, meaning you must be pulled over first for something else — such as speeding or failure to yield — to receive a distracted driving citation.

Though Nebraska’s distracted driving laws are secondarily enforced, the state’s Department of Health and Human Services explains they carry hefty fines and points to your driving record: “A driver who violates the texting law can be fined $200 for first offense, $300 second offense, or $500 for subsequent offenses in addition to three points against the driver’s license.”

That would certainly raise the cost of your car insurance. Not texting while you drive is not only safe, but smart.

Driving Safely in Nebraska

Now that we know some of the basic rules of the road in Nebraska, let’s look at some driver safety statistics.

Vehicle Theft in Nebraska

The FBI reported just over 4,000 vehicle thefts in Nebraska in 2016 — and 3,125 of these were in the city of Omaha alone.

Pickups in this largely rural state are more susceptible to theft, especially Chevrolets. The table below shows the top 10 models stolen in the Cornhusker State.

| Make/Model | Number of Thefts |

|---|---|

| Chevrolet Pickup (Full Size) | 196 |

| Ford Pickup (Full Size) | 168 |

| Honda Civic | 165 |

| Honda Accord | 157 |

| Dodge Pickup (Full Size) | 102 |

| Jeep Cherokee/Grand Cherokee | 70 |

| Chevrolet Impala | 68 |

| GMC Pickup (Full Size) | 61 |

| Toyota Camry | 49 |

| Chevrolet Pickup (Small Size) | 43 |

Be sure to check what your car insurance covers when it comes to vehicle theft.

Road Fatalities in Nebraska

Road fatalities are relatively low in Nebraska, a state of wide rural stretches and mostly insured drivers. Despite this, it’s important to know the types of road fatalities Nebraskans face.

The table below shows the type of road fatalities across the Cornhusker State in 2017.

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 228 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 168 |

| Motorcyclist Fatalities | 27 |

| Drivers Involved in Fatal Crashes | 316 |

| Pedestrian Fatalities | 20 |

| Bicyclist and other Cyclist Fatalities | 3 |

Most Fatal Highway in Nebraska

Not surprisingly, the more traffic, the more fatalities. The long stretch of Interstate 80 that traverses the state is Nebraska’s most deadly highway.

Fatalities (All Crashes) by County

Road fatalities in most Nebraska counties are holding relatively steady over the last five years. The table below shows the five-year trend in traffic fatalities for Nebraska’s biggest counties.

| County | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Douglas County | 34 | 34 | 53 | 36 | 43 |

| Lancaster County | 15 | 23 | 21 | 15 | 18 |

| Hall County | 6 | 6 | 5 | 5 | 11 |

| Sarpy County | 8 | 3 | 9 | 7 | 11 |

| Dawson County | 5 | 7 | 8 | 9 | 7 |

| Dodge County | 8 | 7 | 7 | 3 | 7 |

| Buffalo County | 6 | 6 | 5 | 9 | 6 |

| Cherry County | 2 | 2 | 2 | 3 | 6 |

| Keith County | 3 | 2 | 2 | 6 | 6 |

| Lincoln County | 4 | 8 | 3 | 13 | 6 |

| Top Ten Counties | 104 | 116 | 132 | 120 | 121 |

| All Other Counties | 107 | 109 | 114 | 98 | 107 |

| All Counties | 211 | 225 | 246 | 218 | 228 |

Traffic Fatalities

In 2018, 230 people died in Nebraska traffic fatalities, a slight increase of 2 percent compared to the previous five-year trends. Compared to national averages, however, Nebraskans tend to be relatively safe on the road.

Perhaps surprisingly, more Nebraskans die in rural versus urban traffic fatalities. According to the National Highway Traffic Safety Administration (NHTSA), of the 228 traffic deaths in Nebraska in 2017, 159 were rural and 69 were urban.

Fatalities by Person Type

The table below breaks down 2017 Nebraska vehicle fatalities by person type, whether an occupant of an enclosed vehicle, a motorcyclist or a nonoccupant.

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 32 |

| Motorcyclists | 12 |

| Nonoccupants | 10 |

Fatalities by Crash Type

The table below breaks down 2017 Nebraska vehicle fatalities by crash type.

| Crash Type | Number |

|---|---|

| Single Vehicle | 130 |

| Involving a Large Truck | 38 |

| Involving Speeding | 37 |

| Involving a Rollover | 78 |

| Involving a Roadway Departure | 126 |

| Involving an Intersection (or Intersection Related) | 61 |

Fatalities Involving Speeding & Alcohol-Impaired Driving

Douglas (home of Omaha) and Lancaster (home of Lincoln) lead the state in speeding fatalities. But overall, Nebraska’s speeding fatality rate is fairly low. According to the Department of Transportation, only 17 deaths in 2017 were the result of speeding.

More deaths result from drunk driving than speeding in Nebraska. The table below shows the breakdown of fatalities in crashes involving an alcohol-impaired driver or speeding for Nebraska’s three biggest counties in 2013 and 2017.

| County Name | Speeding Fatalities 2013 | Speeding Fatalities 2017 | Alcohol-Impaired Driving Fatalities 2013 | Alcohol-Impaired Driving Fatalities 2017 |

|---|---|---|---|---|

| Douglas | 10 | 9 | 11 | 18 |

| Lancaster | 1 | 1 | 4 | 4 |

| Sarpy | 4 | 4 | 5 | 0 |

Teen Drinking & Driving

A scratch in Nebraska’s typically-stellar driving statistics: the state ranks second for teen drunk driving arrests. The table below illustrates the startling truth about teens and drunk driving in Nebraska.

| Teens and Drunk Driving | Laws |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 1.3 |

| Higher/Lower Than National Average (1.2) | slightly higher |

| DUI Arrest (Under 18 years old) | 109 (ranked 2nd in the nation) |

| DUI Arrests (Under 18 years old) Total Per Million People | 230.29 |

Thankfully, agencies across the state are coming together in a concentrated effort to reduce the number of Nebraska’s teens drinking and driving.

EMS Response Time

As with almost anywhere, the EMS response time in Nebraska is largely dependent on the crash happening in a rural or urban area.

The table below breaks down the average EMS response time for urban and rural areas of the Cornhusker State, from time of the crash to EMS notification to time of the crash to hospital arrival.

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 4.57 | 10.76 | 28.63 | 64.1 |

| Urban Fatal Crashes | 2.61 | 4.66 | 20.84 | 40.4 |

Transportation in Nebraska

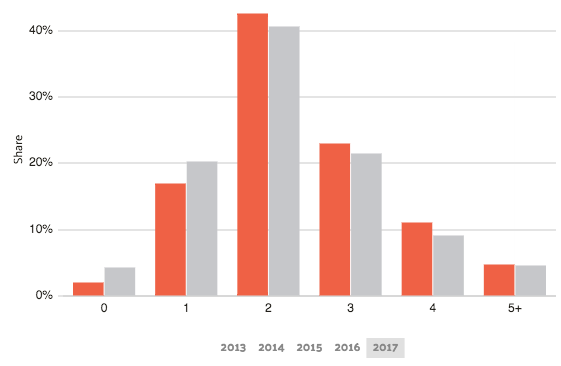

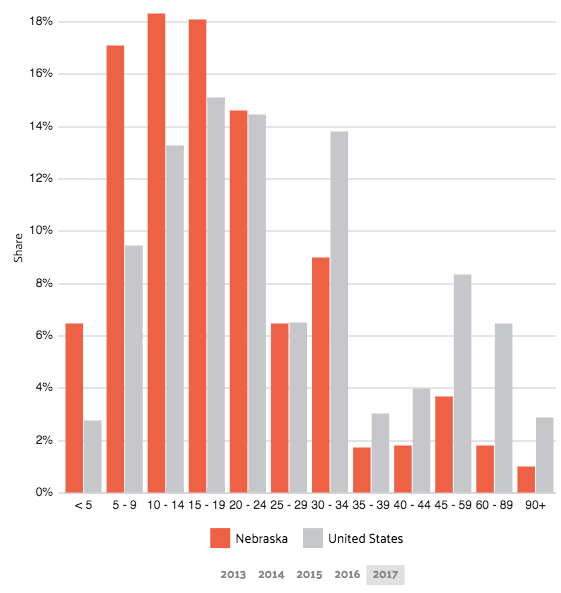

If you live in Nebraska, chances are you live in a household with one to three cars, drive alone to work, and spend anywhere from five to 24 minutes of your day commuting, well below the national average.

Car Ownership

There are more cars than drivers in the Great State of Nebraska! There are 2,503,163 registered vehicles in the state, and only 1,450,479 licensed drivers.

Commute Time

As we’ve already seen, Nebraskans have relatively short commutes: only 18 minutes each way compared to an American average of 26.1 minutes.

Commuter Transportation

Given the rural nature of most of Nebraska, commuter transportation is not much of an option outside of Omaha and Lincoln.

Traffic Congestion

Though traffic congestion in Nebraska’s two largest cities — Omaha and Lincoln — is a worsening problem, the state faces few congestion issues as a whole.

From the Mighty Missouri River in the east to the foothills of the Rocky Mountains in the west, you’ll find lots of wide-open highway in the great state of Nebraska.

So, what part of this guide to Nebraska car insurance did you find most helpful?

Are you ready to find the best quotes for your next insurance decision?

Just enter your zip code below to get started.

Frequently Asked Questions

How much car insurance coverage should I get in Nebraska?

The minimum car insurance requirements in Nebraska are liability insurance with at least $25,000 per person and $50,000 per accident for bodily injury, and $25,000 per accident for property damage. However, it’s recommended to have higher liability limits and additional coverage, such as collision and comprehensive insurance, to protect yourself in case of accidents or theft.

How can I compare car insurance costs and companies in Nebraska?

You can compare car insurance costs and companies in Nebraska by using online comparison tools or by contacting insurance agents or brokers. It’s important to compare quotes from multiple insurers and consider factors such as coverage options, deductibles, discounts, and customer reviews.

What factors affect my car insurance rates in Nebraska?

Several factors affect your car insurance rates in Nebraska, including your age, gender, marital status, driving history, credit score, vehicle make and model, annual mileage, and coverage options. Additionally, some insurers may also consider factors such as your occupation, education level, and location.

How can I lower my car insurance rates in Nebraska?

You can lower your car insurance rates in Nebraska by maintaining a good driving record, improving your credit score, choosing a higher deductible, bundling your insurance policies, and taking advantage of discounts offered by insurers, such as safe driver, good student, and multi-car discounts.

What should I do if I’m involved in a car accident in Nebraska?

If you’re involved in a car accident in Nebraska, you should call the police and seek medical attention if necessary. You should also exchange contact and insurance information with the other driver(s), take photos of the accident scene and damage, and contact your insurance company to report the accident and file a claim. It’s important to cooperate with the authorities and your insurer and avoid admitting fault or making statements that could be used against you later.

What is the average cost of car insurance in Nebraska?

The average cost of Nebraska auto insurance is $35 per month for liability insurance and $146 per month for full coverage insurance.

Does insurance follow the car or driver in Nebraska?

Nebraska car insurance coverage will usually follow the car.

Who has the best car insurance rates in Nebraska?

Companies that usually offer cheap Nebraska car insurance rates are Geico, State Farm, and USAA.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.